- The RBNZ left the OCR at 5.5% at its May policy meeting, as was widely expected.

- The RBNZ discussed the possibility of tightening at this meeting but concluded that they retain sufficient confidence to leave the OCR unchanged. Cuts were not discussed.

- The revised projections lifted the OCR track. A first easing is forecast in the August 2025 Monetary Policy Statement, which is pushed out from the previous May 2025 view.

- The track suggests a significant risk of a tightening in the November Statement. This could occur if forecast declines in inflation later in 2024 don’t eventuate, but still seems unlikely.

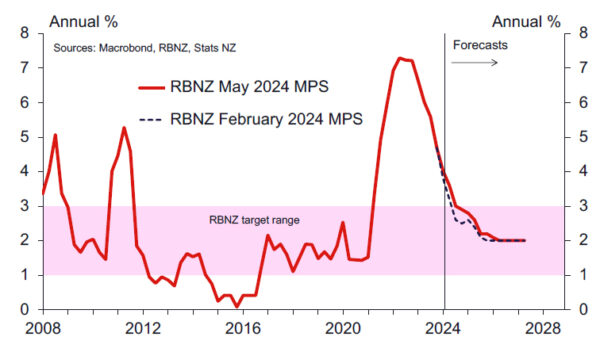

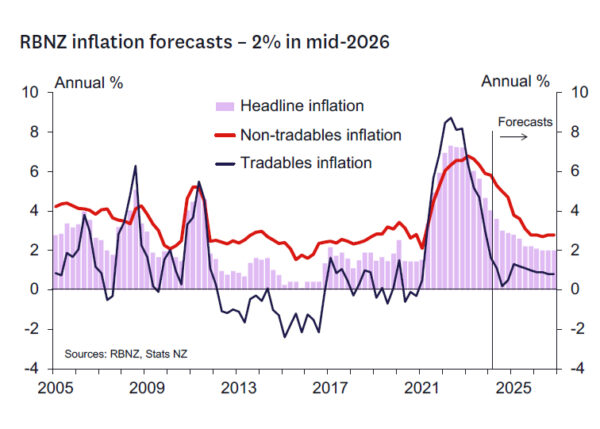

- Inflation is forecast to fall back inside the 1-3% band in Q4 this year, and to return to 2% in Q2 2026. This is another significant revision outward.

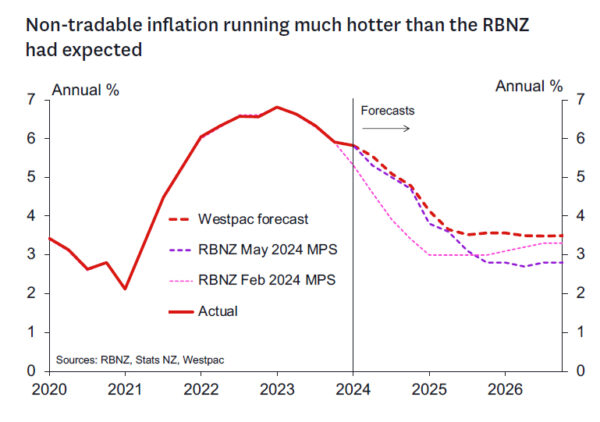

- The RBNZ assesses the risk profile for inflation as lying to the upside in the shorter term and is more balanced over the medium term. The risk profile is decidedly to the upside for nontradables inflation pressures.

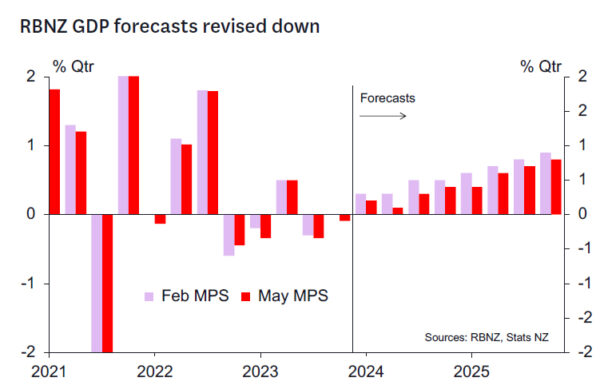

- The RBNZ’s forecasts for economic growth have been revised down significantly, which helps them retain confidence that inflation will ultimately fall.

- The neutral OCR has been revised up 25bps to 2.75% – this is a driver of longer-term OCR projections.

- Today’s RBNZ update leaves us comfortable for now with our forecast of a first policy easing in February next year, followed by only gradual policy easing thereafter. Future inflation data will be key in driving our OCR view with the risk that easing comes later than currently expected.

OCR remains on hold, tightening possible and rates higher for longer.

The RBNZ’s May 2024 policy decision and the messages in the accompanying Monetary Policy Statement were surprisingly hawkish.

As polls of analysts had indicated and markets had priced, the OCR was left at 5.5%.

The key area of hawkishness was with respect to the forward profile for the OCR. The RBNZ defied market expectations and revised up their interest rate forecasts. These now incorporate a material risk of a hike in the November Statement, as well as a delay in the timing of the first easing from the May 2025 timeframe assumed in the February Statement to around August 2025 in the current forecasts. The RBNZ continues to maintain that monetary policy will need to remain restrictive for a sustained period to return inflation back inside the target range.

Two key factors are driving the RBNZ to this “higher for longer” position despite a weak domestic economy. Most importantly, the inflation news has not been as supportive as hoped – especially with respect to nontradables inflation. This has led the RBNZ to revise up their inflation forecasts and project a slower decline going forward. Secondly, the RBNZ has revised up its neutral OCR estimate to 2.75%. This latter change has a more significant impact on the RBNZ’s longer-term OCR forecasts.

The RBNZ sees near-term upside risks to inflation that reflect the recent stickiness of non-tradable inflation. Further out, the weaker domestic economy and assumed favourable inflation expectations and wage dynamics help them retain confidence that given time inflation will fall to target. But that fall is taking longer than previously thought given the near-term upside surprises. The RBNZ have revised down their economic growth forecasts, but this is balanced by a downgrade in view of the economy’s productive potential.

These near-term risks are likely to be important for the policy outlook. The OCR profile peaks at 5.65% in Q4 of 2024. This suggests a material risk of a further tightening in the November Statement (perhaps a 60% or higher chance). We think this raises the stakes of the inflation outturns due between now and November. The RBNZ will need these to significantly moderate to keep the 5.5% OCR peak strategy in place and leave open the prospect of easing in H2 2025. Having said this, the Governor and his staff went to pains to emphasise that these interest rate forecasts could not be taken literally given forecast uncertainties.

CPI inflation taking longer to cool.

The policy outlook above is based on a revised forecast that shows annual CPI inflation falling back inside the 1-3% band in the December quarter of this year – but only just. The RBNZ now forecasts that inflation will end 2024 at a rate of 2.9%. That’s in line with our own forecasts but is considerably higher than their previous forecast of 2.5% inflation by the end of this year.

On top of that, the RBNZ now expects that it will take even longer to get inflation back to the 2% target mid-point. The May MPS forecasts don’t have inflation back at 2% until mid-2026 (compared to late 2025 in their previous forecasts). That’s even with the upward revision to their OCR forecasts.

The key issue for the RBNZ is the persistent strength in domestic inflation, which has surprised to the upside of the RBNZ’s assumptions for a year now. The minutes accompanying today’s decision noted that “persistence in non-tradable inflation remains a significant upside risk.”

Like the RBNZ, we expect that non-tradable inflation will drop back over the course of this year, but only gradually. While inflation in interest rate-sensitive areas of the economy (like the cost of property maintenance) are dropping back, other prices like rents, insurance charges and local council rates have held at firm levels. But although the RBNZ is now factoring in a more gradual easing in those costs, we still think the RBNZ could continue to be surprised to the upside on this front. That would be very important for the RBNZ’s stance over the coming quarters.

Balanced against that risk of persistent domestic inflation, imported inflation has fallen well short of the RBNZ’s forecasts. We expect that will continue to be the case over the coming year. That will be important for helping to keep inflation expectations anchored in the face of lingering domestic pressures.

Near-term GDP growth forecasts revised down.

The RBNZ have revised down their forecasts for GDP growth and now expect the economy to grow by 1% in 2024 and 2.4% in 2025 – both down by 0.6% on their previous forecasts.

While a downward revision to GDP growth might ordinarily lead to a more negative output gap, on this occasion the RBNZ have revised up their assessment of the positive output gap in recent years. Given the ongoing upward surprises seen in non-tradables inflation, to better explain the inflation that has been seen the RBNZ have revised down their assessment of trend productivity and so have revised up their assessment of the positive output gap seen in recent years. As a result, despite a weaker forecast for GDP growth, the output gap is less negative over the next year than forecast in the February MPS, before turning more negative from the second half of 2025.

RBNZ takes more hawkish stance regarding impact of fiscal policy.

It is worth noting that the RBNZ’s forecast for government expenditure in the projections is based on the Treasury’s Half Year Economic and Fiscal Update (HYEFU) 2023. And while that has not changed since the February MPS, the RBNZ notes that due to downward revisions to potential output growth, government expenditure is higher as a proportion of potential output than projected previously. In the RBNZ’s judgement, this makes the forecast decline in spending less disinflationary than was projected previously.

RBNZ policymakers also discussed the implications of the publicly announced aspects of Budget 2024. While the net impact on aggregate spending is expected to be broadly neutral over an extended horizon, the RBNZ raised the possibility that timing differences associated with reactions to changes in government spending and tax cuts might pose an upside risk to aggregate demand. That is, the RBNZ posed the possibility that reductions in government spending to date (albeit those mainly initiated by the previous government) may already be reflected in the soft high frequency indicators for GDP growth seen in recent months – which the RBNZ has taken onboard in downgrading its forecasts – whereas impending tax cuts may not yet be factored into spending decisions. This assessment seems debateable as it might also be reasonable to think that most of the new Government’s spending cuts are yet to take effect, while tax cuts have been equally well foreshadowed and so may also already be underpinning spending for those households that are not cash constrained. The data will ultimately tell the tale.

We will have more to say about our view regarding the impact of fiscal policy next week in our coverage of Budget 2024.

Westpac’s view: Doing the hard yards.

The overall messaging from the RBNZ today was very much consistent with that in our recently updated Economic Overview – that is, there are still “hard yards” to be done to bring annual CPI inflation down to the 2% target midpoint in a timely and sustainable manner, and thus monetary policy easing remains unlikely this year. Our baseline view remains that the first 25bp policy easing will occur in February next year, to be followed by a series of gradual (once a quarter) 25bp reductions that will eventually lower the OCR to around 3.75% in 2026.

The key surprise we took from this Statement is that it seems to take risks of an early rate cut off the table. Recent activity data has been weak (although not really much weaker than our forecasts) which has driven speculation that the RBNZ might be ready to adopt a dovish tilt. There is no sign of this here. Rather, any easing prospect has been pushed out further into the future.

We now find a large gap between our own OCR forecast of an easing in February 2025 and the RBNZ’s August 2025 view even though our inflation forecasts are fairly similar this year and somewhat more pessimistic on how fast inflation will fall over 2025. There is some risk that our February 2025 OCR cut may prove too optimistic. We will make an assessment on this on review of the Q2 CPI in July and the RBNZ’s updated view in the August Statement.

Upcoming key events.

Looking ahead, the following are the key domestic events and data releases that will help shape views ahead of the next two RBNZ policy reviews on 10 July and 14 August.

- Budget 2024, 30 May: The full details of Budget 2024 will be incorporated formally into the updated projections that the RBNZ will publish in the 14 August MPS. While Budget 2024 will provide details regarding spending levels and policy specifics (such as the size of the tax cuts), there will still be uncertainty about how the RBNZ will assess the economic impact (for example, the assumption the RBNZ makes about how much of any tax cut is saved).

- GDP (March quarter), 20 June: The GDP report will have an important bearing on the RBNZ’s assessment of the economy’s momentum and how the output gap is evolving.

- QSBO Business Survey (June quarter), 2 July: This survey contains a rich set of key capacity and inflation indicators and will be the final major data release ahead of the July review.

- CPI (June quarter), 17 July: The RBNZ will be looking for signs that inflation is on track to move back inside the target range this year and that the substantial upside surprise seen in non-tradables inflation in the March quarter has not continued.

- Labour market surveys (June quarter), 7 August: The RBNZ will looking for signs of a further easing of pressures in the labour market, including a further rise in the unemployment rate and confirmation that labour cost inflation is now on a clear downward trend.

- RBNZ Survey of Expectations (September quarter), 8 August: A further decline in inflation expectations would be welcomed as a sign that the RBNZ’s policy stance remains credible.

In addition to the indicators above, monthly spending, housing, migration and business sentiment/survey indicators will continue to warrant attention. And developments in global activity, inflation and commodity prices will also be monitored very closely by the RBNZ.