- China’s Q1 GDP expected to fall below 5.0% on Tuesday at 02:00 GMT

- Expansion to remain solid but unlikely to quell stimulus calls

- AUDUSD tests lower boundary of the 2024 range

China to report weaker GDP after disappointing trade data

China remains a major trade partner for advanced economies such as the US and Europe, especially in the manufacturing sector, where its global dominance in terms of production and value added surpasses its peers by a large margin. Therefore, although the West has toughened its stance against Beijing’s trade practices in industrial areas, demand from China will remain vital for global markets.

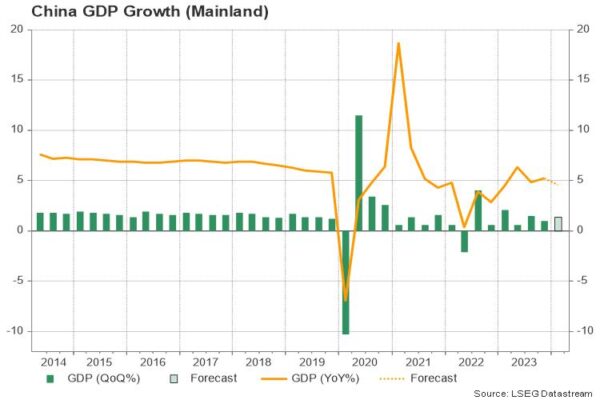

China’s GDP data scheduled for release on Tuesday will give an insight into how the economy performed in the first three months of the year. Forecasts point to a slowdown to 4.6% y/y in Q1 from 5.2% y/y previously – the lowest in a year – but the sharp decline might be an outcome of the annual comparison effects as China’s delayed reopening at the end of 2022 unleashed a surge in consumption and production in the same period last year.

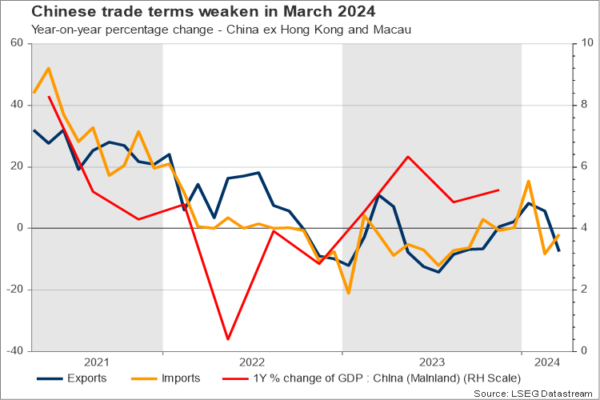

The unexpected steep 7.5% drop in the value of exports and the almost 2.0% decline in imports in March has already warned traders over an economic deceleration in Q1, but if the quarter-on-quarter GDP reading shows a stronger rebound of 1.4% in Q1 compared to 1.0% in Q4, investors may not sell aggressively the yuan and the aussie. Note that the manufacturing sector returned to expansion in March for the first time in a year, according to the PMI data.

Economic outlook remains blurry

Nevertheless, the economy might have a tough time in boosting investors’ sentiment. The problematic real estate sector, which remains vulnerable to delayed projects, excessive borrowing, and bankruptcy jitters, will keep weighing on the economic outlook. Recent headlines suggest that credit support from banks is well below the amount needed to secure the completion of pre-sold houses, while the previous stimulus measures are already losing power in the new homes market. Funds raising in the Mainland’s capital markets is not optimistic either, hitting multi-year lows recently in a sign of broken confidence.

As regards to consumption, the latest inflation figures underlined persisting challenges on the demand front. Consumer prices rose by a marginal rate of 0.1% y/y in March after a 0.7% surge on the back of the Lunar new year celebrations in February, remaining worlds apart as inflation in other major economies is showing some stickiness above central banks’ targets. Producer prices faced stronger headwinds, dipping for the 16th consecutive month by 2.5% y/y.

Hence, given the problematic old growth drivers, such as infrastructure, and the geopolitical and policy risks, which threaten China’s competitiveness in clean energy products, the government might be under pressure to release more stimulus if Tuesday’s GDP data miss expectations.

AUDUSD levels to watch

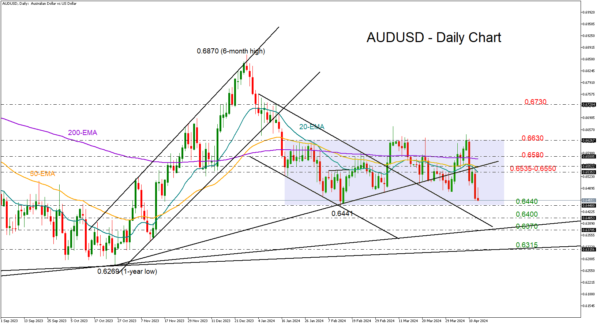

Looking at AUDUSD, the pair is currently trading at the lower boundary of the 2024 range of 0.6440-0.6630, and in the absence of any positive technical signals, there is little optimism for a rebound. Although the negative surprise in China’s trade data did not cause any serious reaction in the market last week, investors will look for a break below the 0.6440 floor and towards 0.6400 if China’s GDP misses forecasts by a large margin. Slightly lower, the 0.6315-0.6370 support trendline area could be another important pivot area.

Alternatively, for the price to reach the upper band of the range around 0.6630, the bulls will have to overcome the 0.6535-0.65680 zone, where the exponential moving averages (EMAs) are placed. If the pair breaks its horizontal move on the upside, resistance could next emerge near the 0.6730 territory.