- We expect the RBNZ will leave the OCR at 5.5% at its April policy review.

- We think the RBNZ will remain comfortable with the forward outlook communicated in the February Monetary Policy Statement.

- GDP growth was slightly weaker than expected – but the impact is very marginal compared to past quarterly forecast misses.

- The inflation outlook still looks challenging – the Q1 CPI seems likely to come in higher than the RBNZ expected back in February.

- Dairy prices are a bit weaker but the lower currency balances this.

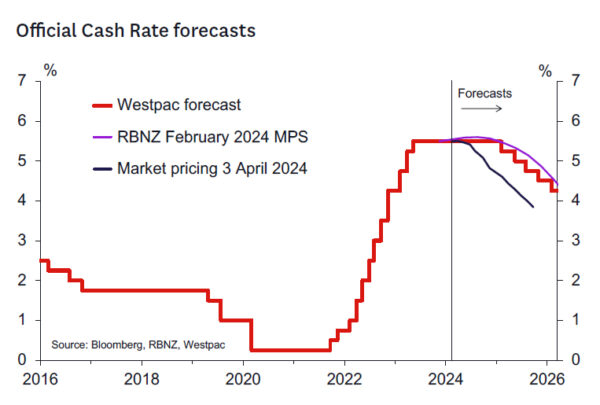

- Market views of OCR easing as early as August are unlikely to find support.

RBNZ decision and associated communication.

The information flow has been very light since the February Monetary Policy Statement – hence we don’t think the RBNZ’s monetary policy stance will have changed much since February. We expect no change in the OCR, with the decision to be accompanied by a relatively short statement that suggests little change in the OCR outlook from that communicated in the February Statement. We expect the RBNZ will:

- Indicate a high level of comfort with the current 5.5% OCR.

- Note that recent economic developments have proceeded broadly as expected.

- Note the increased signs that global interest rates may be moving lower soon.

- But remain concerned about the current high level of inflation and the pace at which it will return to the midpoint of the 1-3% target range.

A more definitive view of the outlook should come in the May Statement when the Monetary Policy Committee (MPC) will have more information on the Government’s fiscal stance and when new information from the Q1 CPI and labour market reports will be available. Both those reports will be of critical importance in determining if there is much need for the RBNZ to change its view that the OCR will remain unchanged until early/mid 2024. Markets have taken a more aggressive view on the timing and extent of OCR cuts in recent weeks. Our view is those expectations will be disappointed this time around.

Key developments since the February Monetary Policy Statement.

Relatively little data has come to light since the February Statement to disturb the RBNZ’s view on the inflation outlook. The general tone of the data that will have made the RBNZ perhaps slightly more comfortable with the inflation outlook and will have reduced, at the margin, concerns that a further interest rate rise may be required. However, it’s also the case that there is little to support the idea that interest ratees can be cut much earlier than the RBNZ previously assumed (early to mid-2025). Key developments have been:

- Slightly weaker Q4 2023 GDP and associated revisions. GDP growth in Q4 was slightly weaker than forecast (-0.1%q/q vs 0% forecast) and cumulative revisions mean that the economy was 0.2% smaller than forecast. This will likely reduce the RBNZ’s starting point output gap very modestly.

- Stronger CPI inflation components – the RBNZ forecast a low 0.4% quarterly outcome for the Q1 CPI in its February Statement. By contrast, Westpac’s forecast is for a 0.8% q/q outcome, with monthly indicators pointing to a larger lift in international airfares than the RBNZ likely assumed in its forecast. We also think that non-tradables prices will rise by more than the RBNZ has forecast.

- Higher Oil prices – Oil prices are around 7.5% higher than the level assumed for Q2 2024 in the February Statement (Dubai spot oil at USD 80.80) which will lift the RBNZ’s near-term CPI forecasts, all else equal.

- Weaker dairy prices – three of the last four GDT auctions have seen weaker dairy prices and the key whole milk powder price is down almost 6% from the high’s seen in February. The RBNZ will likely make some adjustment to their export price assumptions on these recent data.

- Weaker terms of trade in Q4 2023 – these data came in notably weaker than expectations, although in large part this reflect timing effects that will likely unwind in coming quarters.

- A lower NZD TWI – the TWI has fallen by around 2.5% since the February Statement and is now around 2% below the H124 level that had been assumed. The lower exchange rate probably broadly balances the impact of the weaker terms of trade and dairy prices on the economic and inflation outlook.

In addition to the softer than expected December quarter GDP, the RBNZ is also likely to acknowledge more recent signs that economic conditions are cooling, such as continued sluggish retail spending and the ongoing fall in consent issuance.

We don’t expect the RBNZ will have reached a conclusion on the likely impact of fiscal policy on the outlook. While the fiscal outlook has deteriorated – reflecting both cyclical and structural factors – we expect the RBNZ will await full information from the Budget to determine whether fiscal policy will still exert sufficient downward pressure on growth and inflation over coming years.