Strong wage outcomes saw the Bank of Japan end its negative interest rate policy but further moves are still a world away.

At their March meeting, the Bank of Japan raised its policy rate to the range of 0% – 0.1% having “assessed the virtuous cycle between wages and prices” and judged “that the price stability target of 2 percent would be achieved in a sustainable and stable manner toward the end of the projection period”. The BoJ continues to view their stance as accommodative.

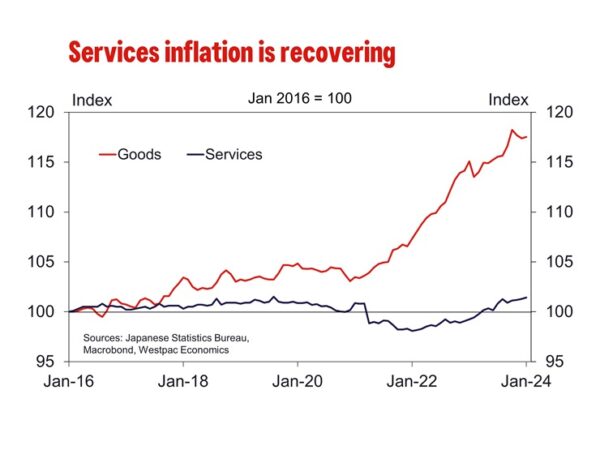

A strong RENGO wage outcome, emerging strength in services inflation and anecdotes of future wage increases allowed the BoJ to feel comfortable negative rates were no longer necessary. The BoJ also scrapped its YCC target and ceased purchases of ETFs and J-REITs; however, bond purchases will continue broadly at the same pace as before, and the BoJ made clear it will guard against a rapid rise in long-term interest rates.

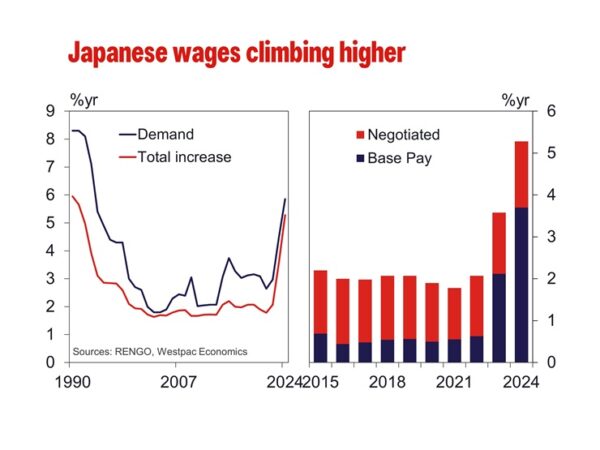

The 2024 RENGO wage outcome was certainly constructive. The result reflects solid profitability and support from the government for businesses seeking to raise wages. Total pay is poised to increase 5.28% versus a demand of 5.85%. RENGO has not been this successful with their demands since 2013, and headline wages have not grown this fast since 1991. The trade confederation chalked the result up to the higher costs of living, labour shortages and their ‘investment in people’ campaign.

According to the BoJ, a 3% base pay increase is necessary for consumer prices to sustainably grow at 2%. For the latter to eventuate however, consumers must feel confident these wage increases will persist and respond with stronger consumption, particularly services spending. Services contribution to annual inflation is rising and annual growth is stronger than it has been since the late 1990s, but this is at least in part due to strong growth in international tourist arrivals. For this momentum in services inflation to be maintained, domestic household spending must see sustained growth. This is not currently the case, with quarterly household consumption growth negative Q2 to Q4 2023 despite considerable support from 2023’s robust wage outcomes and a tight labour market.

The message from the data is clear – policy must remain extraordinarily accommodative to sustain wage growth and let it feed through to domestic consumption and inflation. Until the BoJ’s hope of achieving its target is fulfilled, there will be little justification for the policy rate to be moved materially above zero or an end to bond purchases. We believe many months of constructive data for consumption and inflation are necessary to build the case for such a move.