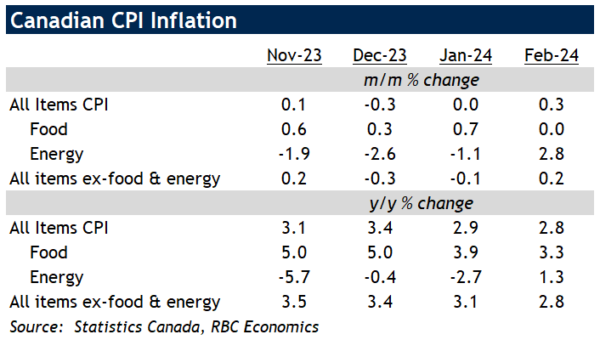

Canadian CPI growth was lower than expected in February, dropping to 2.8% year-over-year from 2.9% in January (expectations were for a 3.1% reading.) The downside surprise was broad-based as core CPI ex-food and energy inflation eased further to 2.8% from 3.1% in January.

Food and energy inflation were as expected – food CPI growth in February slowed further to 3.3% above last year, while energy inflation rose to 1.3% also year-over-year on higher gasoline prices.

Grocery inflation slowed to 2.4% in February with most food groups including meats, fruit and nuts seeing monthly (seasonally adjusted) price declines from January. Price growth for restaurant dining was little changed on a year-over-year basis from January, at 5.1%.

Shelter CPI growth continued to accelerate upon rising rent inflation that climbed to 7.9% in February. That was partially offset by slowing, but still-elevated price growth in mortgage interest costs (+26%) which should continue to trend lower as lending rates drop relative to a year ago.

Among other items, inflation for health care continued to trend lower to 2.7% in February, while prices for clothing and footwear (-4.2%), as well as air fares (-5.2%) both remained below where they were a year ago.

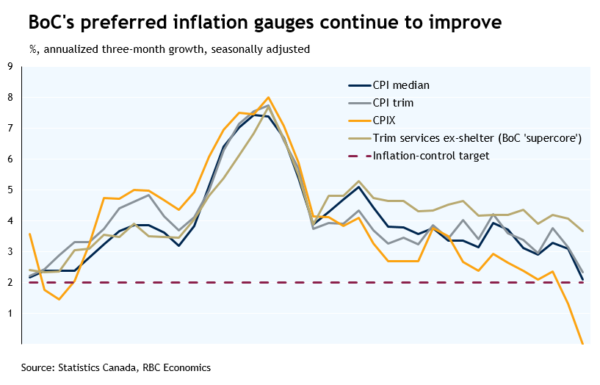

Slowing price pressures were more apparent in Bank of Canada’s aggregate core inflation measures – CPI trim (+3.2%) and CPI median (+3.1%) both eased further towards the top end of the inflation target range in Canada. The more recent three-month rolling average growth rates for those same measures averaged at 2.2% in February, or its lowest reading in three years.

Bottom Line: Building on the January CPI report that was already showing broad-based easing in price pressures in Canada, the February report today reaffirmed those trends. Different measures of core inflation all decelerated and the diffusion index that measures the scope of inflation pressures also improved. That measure however was still showing slightly broader price pressures than pre-pandemic “norms”, suggesting there’s still room for more improvement. Overall, we continue to expect a persistently soft economic backdrop to further slow inflation readings in Canada in the months ahead, allowing for the BoC to start lowering interest rates around mid-year.