- RBA will meet on Tuesday, cash rate is expected to be kept unchanged

- Market wants a dovish show, but RBA could remain somewhat hawkish

- Aussie could benefit against the US dollar from a hawkish gathering

- Decision to be announced at 03.30 GMT, press conference one hour later

The Reserve Bank of Australia meets on Tuesday

The RBA kicks off next week’s busy central bank meetings’ schedule with its Tuesday gathering. Contrary to both the Fed and ECB being on the cusp of cutting interest rates, RBA members considered hiking rates in early February before agreeing to keep the official cash rate unchanged at 4.35%. Could this meeting bring a change in RBA’s rates outlook?

At the February 6 gathering, the main message was that progress has been made on the inflation front but the Bank needs to be confident that that this move will sustainably continue towards the target range. This gist of this message sounds familiar as it matches what we recently heard from both Fed Chairman Powell, at his double Congress testimony, and ECB President Lagarde, at the recent ECB press conference. Therefore, the key question is whether enough progress has been made since early February.

No real progress has been recorded in inflation

The monthly CPI for January came in at 3.4%, matching December’s increase, the TD-MI inflation gauge dropped to 4% in February, the lowest print since March 2022, but consumer inflation expectations over the 12 months remained at 4.5% for a third consecutive month. The wage price index for the fourth quarter of 2023 printed a tad lower but that was probably already factored in RBA’s calculations. As made evident, no major progress has been recorded on the inflation front.

In the meantime, there are conflicting messages about the growth outlook. The manufacturing sector remains under pressure, especially as China continues to experience significant growth issues despite the repeated support measures announced there, while the services sector continues to expand. This is positive from a growth perspective, but the elevated services sector inflation remains one of the main reasons why inflation is proving stickier than anticipated. The preliminary manufacturing and services PMI surveys for March will be published on Wednesday and could shed more light on the underlying economic momentum. If one adds the fact that fiscal policy is expected to loosen up during 2024, then the RBA has the option to sit back and monitor developments elsewhere.

The market accepts that the possibility of a rate move on Tuesday remains very low, with the first 25bps rate cut fully priced in by September 2024, while dismissing any chance of a rate hike. That doesn’t mean that the RBA cannot maintain a degree of hawkishness at Tuesday’s meeting but being overly hawkish is probably difficult considering the rates outlook by the Fed.

Aussie gains depend on Wednesday’s Fed meeting

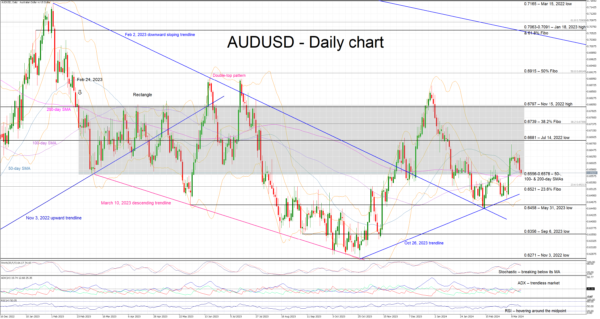

The aussie enjoyed a strong period against the US dollar with the pair returning inside the rectangle that has been in place since February 2023. There is a busy events’ calendar coming up with the convergence of the simple moving averages opening the door to an imminent strong move in this pair.

RBA’s meeting could boost the aussie/dollar pair higher with the July 14, 2022 low at 0.6681 possibly being the initial target, but any gains could prove short-lived as Wednesday’s Fed meeting will probably determine the short-term outlook for most dollar crosses. On the flip side, a dovish RBA gathering could open the door to a move towards the October 26, 2023 trendline, with this possible correction picking up speed if the Fed proves more hawkish than currently foreseen.