U.S. Highlights

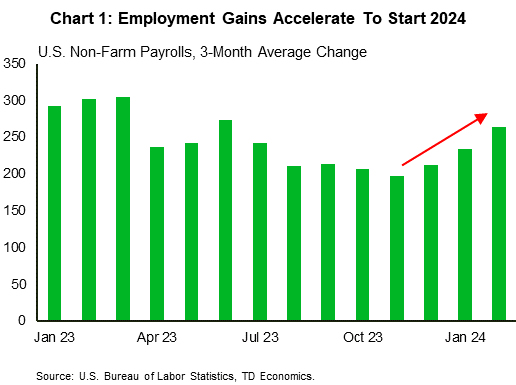

- The U.S. economy added 275k jobs in February, but job gains in the prior two months were revised down significantly and the unemployment rate ticked up to 3.9%.

- In his testimony before Congress this week, Federal Reserve Chair Powell noted that economic resilience gave the FOMC time to assess the sustainability of current disinflation trends.

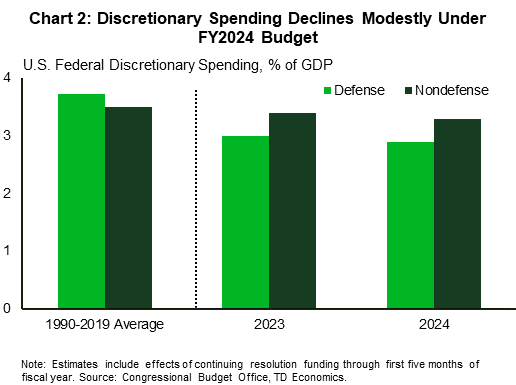

- Congress is set to pass half of the federal spending bills for the 2024 fiscal year this week, five months and four continuing resolutions after the fiscal year began in October.

Canadian Highlights

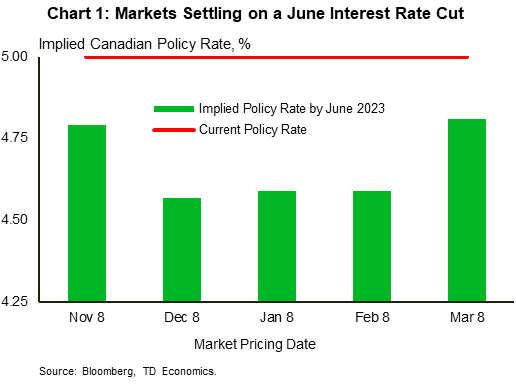

- The Bank of Canada (BoC) maintained the overnight rate at 5.00% and stated that it’s still too early to consider lowering the policy rate.

- Markets are leaning towards a first interest rate cut in June, in line with our view.

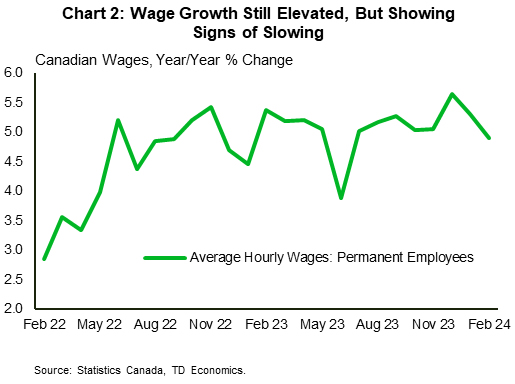

- Canada’s economy gained a solid 41k new jobs in February, but given continued strength in labour force growth, the unemployment rate ticked higher. Wage growth also moderated, suggesting labour markets are continuing to cool.

U.S. – A Busy Week in Washington

With the first quarter entering its final weeks, we received a host of important economic data this week that will help form expectations for the year ahead. This included a labor market pulse check in addition to Federal Reserve Chair Powell’s semi-annual testimony before Congress. Equity markets continued to notch record highs, with the S&P 500 rising 0.8% on the week, while Treasury yields fell by roughly 10 basis-points as of the time of writing.

The headline release for this week was Friday’s employment report, which showed that 275k jobs had been added in February. While job gains in the prior two months were revised down by a considerable 167k jobs, the economy still saw solid and accelerating job growth moving into 2024 (Chart 1). However, the unemployment rate ticked up by 0.2 percentage-points to 3.9%, in part due to a return of positive labor force growth. On aggregate, the labor market remains healthy but is continuing to moderate towards a more balanced state. This will be welcome news for the Federal Reserve as they target their dual mandate of maximum sustainable employment and price stability.

The shift towards a more balanced risk outlook was also noted in Chair Powell’s testimony to Congressional committees this week. In his remarks he stated that the resilience of the economy and the labor market gave the FOMC time to assess the sustainability of current disinflation trends. While Powell did note that it would likely be necessary to implement less restrictive policy this year, he cautioned against the risk of easing pre-maturely. Solid job growth and an economy that continues to exhibit above-trend growth support Chair Powell’s assessment and our expectation that the FOMC will hold off until July to begin lowering interest rates.

Also on Capitol Hill this week, Congress passed half of the federal spending bills for fiscal year 2024. With funding for six federal departments set to expire on Friday – legislated by the fourth continuing resolution of this cycle passed last week – the House passed a package of appropriation bills on Wednesday for the departments subject to the deadline. Senate approval and the President’s signature is expected ahead of the midnight deadline on Friday. The other six appropriations bills will need to be passed ahead of their March 22nd deadline, but aggregate spending levels are expected to be consistent with the limits previously agreed to by Congress (Chart 2). Removing the near-term risk of a government shutdown is undoubtedly positive, but ongoing structural deficits leave the sustainability of the national debt a long-term risk, which was also noted by Chair Powell in Congress this week.

In the near-term, markets will be closely watching the February CPI inflation data release next week, which is expected to show a deceleration from January’s unexpected uptick. Further progress on disinflation will be required before the Federal Reserve considers shifting its current policy stance.

Canada – Bank of Canada Holds the Line

To no one’s surprise, the Bank of Canada (BoC) maintained the overnight policy rate at 5.00% at this week’s meeting. When the Bank will start to cut interest rates is still top of mind for market watchers. However, Governor Macklem offered no clues to when this could occur, stating “it’s too early to consider lowering the policy rate”. January’s downside surprise in headline and core inflation was not enough to move the BoC off of their concern that upside risks to the inflation outlook are still present—though they continue to acknowledge progress. As it stands, the narrative remains the same: the BoC is afforded the time to wait to see more evidence that inflation is moving durably back to 2% before lowering interest rates.

In the wake of the decision, markets moved the probability of a June cut slightly lower, though June still stands as the most likely timing for a first rate cut (~80%). This pricing looks like where it was back in November, despite reactive pricing movements in the interim in the wake of incoming data (Chart 1). We sit in the June-cut camp, taking cues from the fact that economic growth continues to sputter, labour markets are balancing, and core inflation measures, while still a bit elevated, are being driven by shelter prices.

The focus now shifts to the April 10th policy meeting where the BoC will release a fresh set of forecasts in their Monetary Policy Report (MPR). These updates may start to lay the foundation for interest rate cuts. Notably, since the last MPR released in January, inflation for Q4-2023 came in a touch lower than projected (3.2% vs 3.3% y/y), while Q4-2023 growth came in a touch stronger.

February’s jobs data saw a healthy 40.7k net new jobs, driven by full-time employment, but details under the hood were weak. The unemployment rate nudged back up a tenth to 5.8% as labour market gains continue to outpace employment growth. Meanwhile, hours worked tallied a trend-like gain. The pace of wage growth has been a thorn in the side for the BoC, having been stuck above 5% y/y for seven consecutive months. Fortunately, wage growth dipped back into the high 4% y/y range in February, the softest reading since June 2023 (Chart 2). Still, more progress on this front is likely desired by the BoC.

Finally, international trade data for the month of January showed that both import and export activity are slowing. The sharp drop in import volumes reflects weakness in the Canadian consumer. This is consistent with Statistics Canada’s guidance for January’s retail sales and our own view of weaker spending over the first half of the year. Recall that last quarter, strong export activity contributed most to Canada’s GDP growth. Early tracking is showing trade may not be as much of a tailwind to Q1-2024 growth.

Now we sit and wait. One more inflation and labour market reading, as well as the release of the Bank of Canada’s Business Outlook Survey in early-April, are due before the BoC’s next meeting. These developments could set the tone for a potential communication shift from the BoC as rate cuts come closer to fruition.