Summary

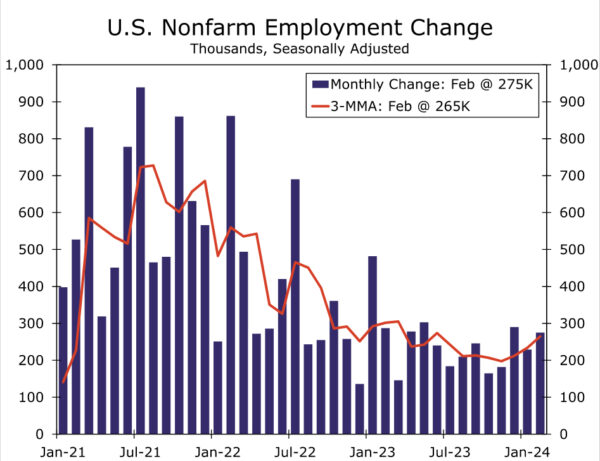

Another strong beat in payroll growth in February masked other signs of softening in the jobs market. Nonfarm payrolls surpassed consensus expectations for a 200K increase by rising 275K last month, with gains broadly-based across industries. Even with some meaningful downward revisions to the prior two months, the three-month average pace of job growth was little changed at a solid 265K. However, the unemployment rate rose to just over a two-year high of 3.9%. The increase was driven by a jump in unemployment and decline in the household measure of employment. While we put more weight on the payroll measure of employment, there were other cautionary signs about the labor markets’ strength going forward. Continued declines in temporary help workers, a rise in permanent job losers and a shift toward part-time work all point to deteriorating demand for workers and slower payroll gains ahead. A gradual cooling in the labor market offers additional evidence that inflation also will continue to slow in the months ahead and brings the long-awaited FOMC rate cuts into sharper focus.

Headline Beat on NFP, but Disappointing Details

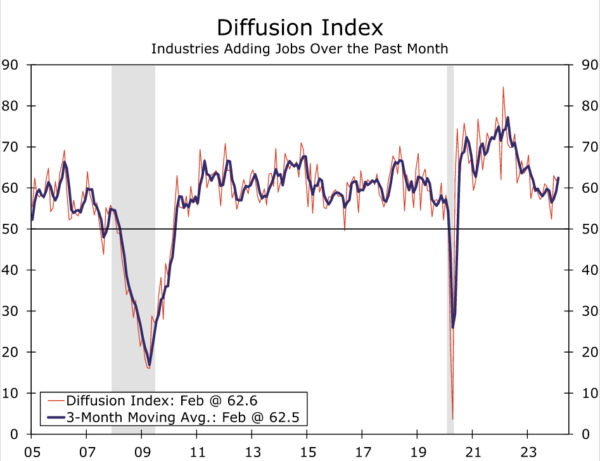

Nonfarm payroll growth beat expectations in February, growing by 275K compared to a consensus forecast for a 200K gain. However, downward revisions to job growth in the prior two months lowered past employment gains by 167K, more than offsetting the upside surprise in February. Encouragingly, the breadth of job growth across industries remained solid in the month. The employment diffusion index, a measure of job growth breadth, posted its second highest reading in the past 13 months. Payroll gains were lead by health care (+67K), government (+52K), leisure and hospitality (+58K) and construction (+23K). Average hourly earnings (AHE) posted a benign 0.1% increase in the month, a notable deceleration from the downwardly-revised 0.5% reading in January. That said, annualized AHE growth remains about one percentage point faster than the average pace that prevailed in 2018-2019.

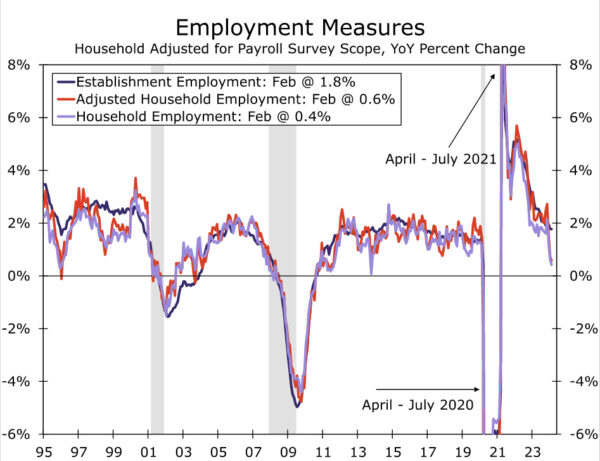

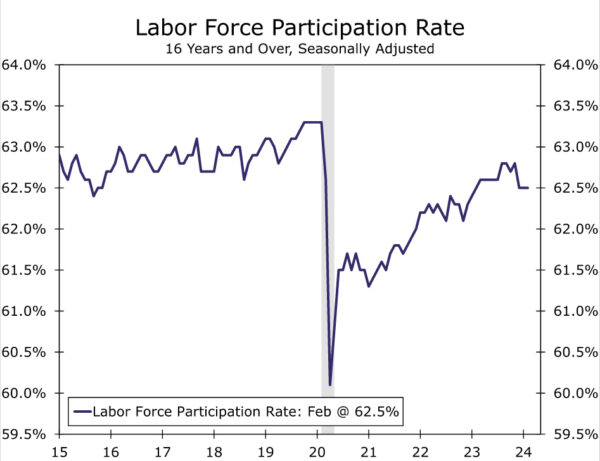

The separate household survey offered additional evidence that the headline beat on nonfarm payrolls masks underlying softening in the labor market. Household measures of employment are more volatile on a month-to-month basis than nonfarm payrolls, but the 184K decline in employment and 343K increase in unemployment helped push the unemployment rate up to 3.9%, the highest reading since January 2022. Solid labor supply growth in 2023 was instrumental in reducing upward pressure on wage growth without a material weakening in job growth. However, the upward trend in labor force participation through much of last year has showed signs of flattening out in recent months. In February, the labor force participation rate held steady at 62.5%, unchanged from both January 2024 and February 2023.

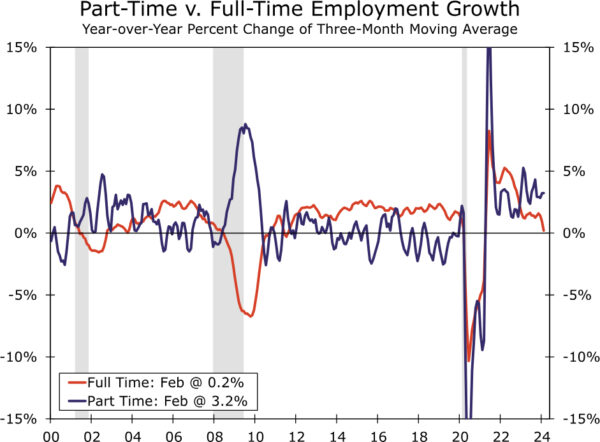

While hiring has remained robust to the start the year, we continue to see a moderation ahead. Underneath the still decent pace of payroll growth are cautionary signs. Demand for workers around the margin continues to weaken with temporary help services falling for a 23rd consecutive month. Average weekly hours rebounded after January’s odd plunge but remain below the 2019 average in a sign businesses are using workers less intensely. The drop in household employment was entirely accounted for by a drop in full time employment, continuing the trend of part-time employment comfortably outpacing full-time employment growth over the past year. Furthermore, the ranks of permanent job losers moved up again—a signal it is taking longer for laid off workers to find reemployment. These downbeat elements of today’s report come amid other signs of jobs market softening, such as small business hiring plans falling back to the lowest levels since 2016 and a rising number of layoff announcements according to the Challenger data. We expect to see payroll growth downshift in the months ahead as a result, which is likely to put further downward pressure on wages and weigh on household income and spending.

The upshot is that these signs point to a further moderation in inflation as 2024 progresses. The results may not be instantaneous as we noted in a recent report previewing next week’s CPI report, but there should be enough progress in the months ahead that the FOMC feels comfortable beginning the process of cutting the fed funds rate at some point in the May-July window. Next week’s inflation data will be key to how the FOMC views the outlook at its upcoming meeting on March 19-20, and we will be revising our economic and rates forecast post-CPI.