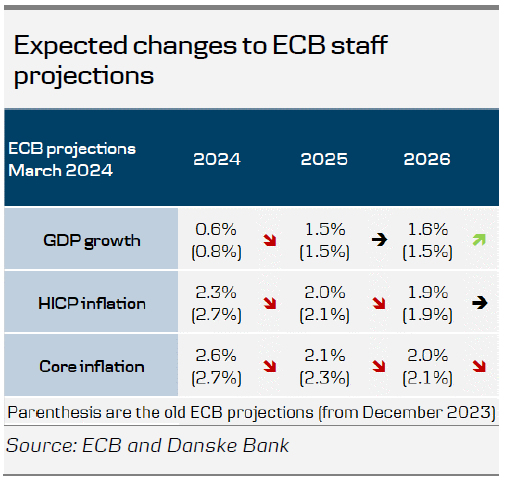

- Today, the ECB decided to keep policy rates unchanged, as unanimously expected by markets and analysts. The new staff projections saw a downward revision of the 2024 projection across growth, headline and core inflation. For 2025, the ECB revised down the projections for 2025 by 0.1pp and 0.2pp for headline and core respectively. Core inflation for 2026 was revised 0.1pp lower.

- Lagarde was quite clear with guidance for a June rate cut, and while April was not ruled out, she said they will know a little more in April, and a lot more in June. We doubt that the incoming data ahead of the 11 April meeting will be sufficiently weak to change that view.

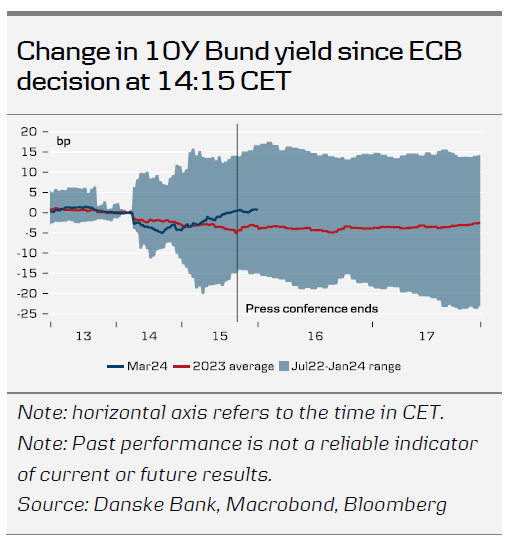

- Markets initially reacted with lower yields across the curve; however, they gradually drifted higher through the afternoon. The move was a parallel shift in the 2y+ area. For 2024, markets added 3bp to now have a 95bp cut priced in.

- Lagarde said she has a strong expectation that the operational framework will be completed at the 13 March (non-monetary policy) meeting.

Acknowledging the progress

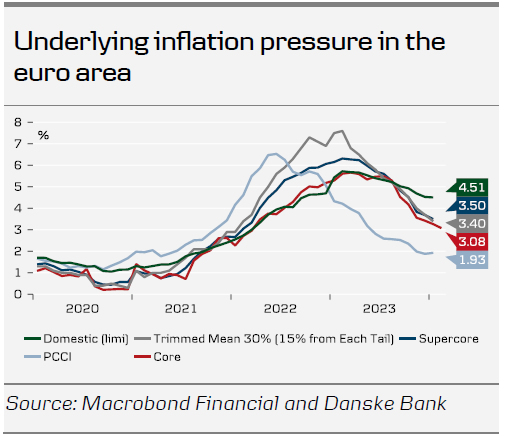

The ECB meeting today was a predictable one with no deviation from the prevailing ECB narrative on delivering a rate cut this summer. President Lagarde acknowledged that most measures of underlying inflation have eased further; however, it was nevertheless highlighted that domestic price pressure remains high, in part ‘owing to strong growth in wages’. On the other hand, Lagarde also highlighted that growth in wages has started to moderate, and firm profits will absorb part of the increased labour costs. The ECB focused on its internal wage growth tracker and the job portal Indeed for timely wage indications. Both measures have the advantage of being more timely than the usual favourite gauge, namely the compensation per employee, which will be released tomorrow covering Q4 23. The staff projections – which saw a revision of the core projection for 2025 – don’t rule out an April rate cut, but with the limited data by then (one PMI print, inflation, SPF and BLS) we do not think they will deliver a rate cut there.

The ECB didn’t discuss cutting rates at ‘this meeting’, but Lagarde said they have ‘just begun’ discussing dialling back the restrictiveness of monetary policy. This tallies very well with her comment on little more information by April and a lot more by June. Lagarde said they do not commit to a specific pace, rhythm or magnitude of future rate moves.

Staff projections see inflation at 2% target in 2025, but the ECB is not yet sufficiently confident to start lowering rates

Lagarde characterised the current state of the economy as weak, especially since consumers are holding back spending and foreign demand is low. However, surveys point to a gradual recovery in growth this year as real income rises and global growth increases.

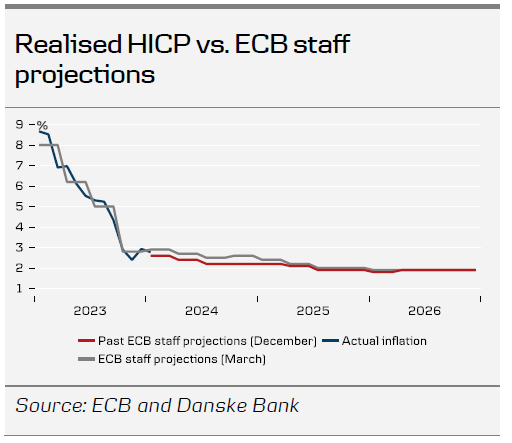

On the back of the economic assessment, new staff projections lowered the inflation projections for 2024 and 2025, while 2026 was unchanged. Headline inflation is now expected at 2.3% in 2024 (vs 2.7% in December), 2.0% in 2025 (vs 2.1 % in December) and 1.9% in 2026 (vs 1.9% in December). The downward revision for 2024 compared with the December projection mainly reflects a lower contribution from energy prices. Lagarde said the ECB is more confident in the expected decline in inflation, but not yet sufficiently confident to start lowering rates.

Lagarde stressed that wage growth is a key upside risk for inflation and that it is currently causing domestic inflation, which is mainly services, to remain high. This is also visible in the projections for core inflation. The ECB revised down projections for core inflation to 2.6% in 2024 (vs 2.7% in December), 2.1% in 2025 (vs 2.3% in December) and 2.0% in 2026 (vs 2.1% in December). Wage growth is expected at 4.5% in 2024, down from 4.6% in the December projections. The ECB expects wage growth at 3.6% and 3.0% in 2025 and 2026, respectively, down from 3.8% and 3.3% in December. Lagarde noted that they await more data, especially on wages, before they are sufficiently confident of inflation returning to the 2% target.

The near-term growth projections were revised down as financing conditions are restrictive and past interest rate increases continue to weigh on demand. The growth forecast for 2024 was revised down to 0.6% (from 0.8% in December), remained at 1.5% in 2025 and was revised up to 1.6% in 2026. Hence, growth is expected to remain subdued in the near term and then start to pick up, supported initially by consumption and later also by investments.

Limited FX market impact

As we expected, the FX market impact of the meeting was very limited. EUR/USD initially experienced a slight decline as the EUR weakened, broadly due to downward revisions in the ECB’s inflation outlook, which in turn caused front-end European yields to decline and added to rate cuts for ECB pricing this year. However, we saw a reversal of these moves during Lagarde’s press conference, as Lagarde guided that the first rate cut is more likely in June than April. We recently discussed the possibility of a short-term rise in EUR/USD due to USD weakness resulting from softer US data. This hypothesis has been supported by cooling signs in the US labour market, coupled with lower-than-expected ISM manufacturing and services. The biggest potential catalyst for the cross this week is the US February jobs report. If our expectation of a softer US labour market holds true, we could see EUR/USD rise further in the very near term.

However, over the course of the year, we still expect EUR/USD to trend lower. We believe the US economy is in a stronger position relative to the euro area, based on factors such as relative terms of trade, real rates, and relative unit labour costs. There are also signs that underlying inflation appears more persistent in the US compared with the euro area, which, all else being equal, should support the USD. A strong USD, coupled with tighter financial conditions, is a necessary condition for the Fed to sustainably achieve its inflation target of 2%. We forecast EUR/USD to reach 1.05/1.04 within a 6/12M horizon.