- ECB announces rate decision on Thursday at 13:15 GMT

- Policymakers to avoid rate cut signals as inflation risks linger in the background

- New economic projections might reflect potential changes in the ECB’s thinking

Don’t expect rate cut signals

Hawkish views by central bankers and positive economic data have led investors to reconsider their expectations of aggressive rate cuts. Although no actions are anticipated during the European Central Bank’s policy review this week, the board’s updated economic projections may shed light on the feasibility of a rate cut in June.

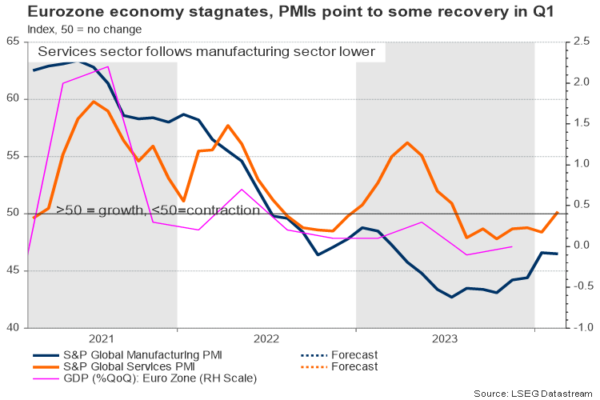

The recent euphoria in European stock markets is more of a reflection of the AI frenzy than a true picture of the region’s economy. Real GDP growth in the eurozone declined to 0.1% y/y in the second half of 2023. This is below the ECB’s sluggish forecast of 0.6% y/y expansion but is not considered a technical recession thanks to Spain’s and Portugal’s positive tourism performance which prevented the bloc from falling off the cliff despite Europe’s diminishing powerhouse Germany weighing on the output.

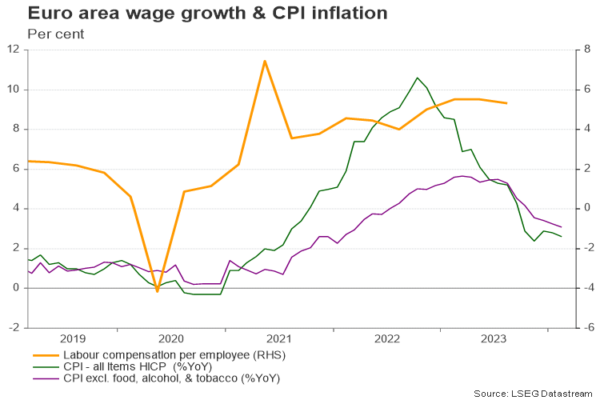

Despite the stagnant economy, policymakers are cautious about rate reductions to avoid fueling inflation amidst low unemployment and increasing wages. Moreover, the EU’s surrounding areas are experiencing instability, with no clear indication of when a ceasefire will occur in the Middle East and if Russia-NATO relations will improve in the near future. Therefore, another round of spikes in energy and food prices cannot be ruled out in the foreseeable future.

The ECB prefers to witness a stable decline in inflation towards its 2.0% goal before engaging in talks about rate cuts. Apparently, this is difficult to ensure this week. So, the central bank may not risk losing its credibility by disclosing its rate cut plans prematurely, especially when core CPI inflation is still above 3.0% and oil prices are rising again. There is another meeting in April and a couple of data releases, which might provide more clarity on the inflation path before June’s gathering, while May’s negotiated wage data for Q1 might be worth waiting too.

But new economic projections might move the euro

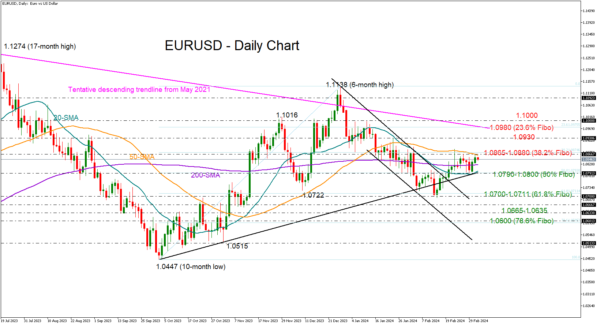

Hence, the central bank may not open up on Lagarde’s summer rate cut rhetoric, but its updated economic forecasts might give some indirect insight into its thinking. Previous projections showed headline inflation averaging around 2.1% y/y at the end of 2025. If policymakers bring the timing forward, investors might feel more confident that a June rate cut is on the way. In this case, EURUSD could reverse lower to test its 1.0790-1.0800 support zone, a break of which could prompt a sharper decline towards 1.0700.

Otherwise, if the central bank disappoints those who expect rate cut signals, sticking to its existing guidance and inflation forecasts, the euro could gear up. Specifically, the bulls will look for a close above the important 1.0880 bar and the 50-day simple moving average to lift the price aggressively into the 1.0930-1.0980 region. A negative surprise in the US nonfarm payrolls or unexpected dovish tweaks in Powell’s testimony later this week might have a similar impact on the pair.

That said, the eurozone economy may not have the comfort to wait for too long either. The elevated interest rates keep weighing on loans, with bank lending to households rising incrementally in February year-on-year and at the softest pace since June 2015. Mortgage lending faced a slight contraction for the first time in nine years, and corporate lending diminished too. Therefore, if not at this meeting, the next ECB gatherings might be more eventful for markets, potentially providing more details about when and how interest rates will drop.