Market picture

The cryptocurrency market has corrected by 2%, dropping below $2.3 trillion in market capitalisation. Now, this looks like a technical correction, with the biggest coins pulling back from Thursday night’s highs and holding their positions at the start of Friday’s trading. Bitcoin and Ether are drawing their seventh consecutive daily growth candle, albeit at a distance from the previous two days’ highs.

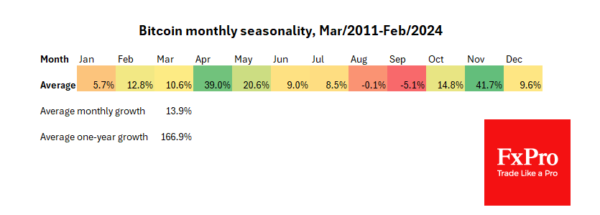

Bitcoin rose 44.7% in February, the strongest monthly gain since December 2020. This coming March is not considered favourable from a seasonal perspective.

Over the past 13 years, bitcoin has ended March with eight declines and only five gains. The average decline was 15%, while the average gain was 17.5%.

Altcoins such as Uniswap and Theta have gained around 90% in the last 30 days, including +50% in the last seven days. The same can be said for Dogecoin, which has added around 50% over the month and 42% over the last seven days.

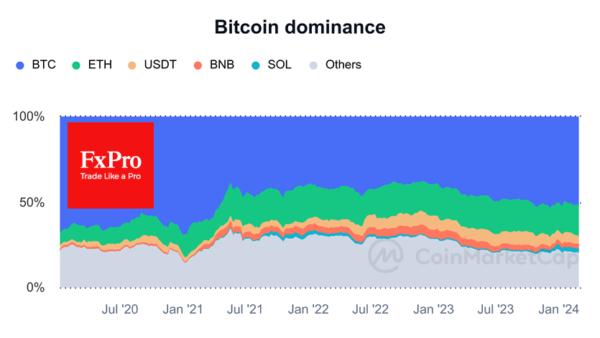

Is this the season for altcoins? We doubt it, given that the first cryptocurrency still accounts for over 50% of total market capitalisation and that this figure has been rising since the beginning of 2023.

News background

According to data from Bloomberg and BitMEX Research, net daily inflows into bitcoin ETFs reached a record $673 million, of which $612.1 million came from BlackRock’s IBITs. The previous high of $655.2 billion was set on the instrument’s first day of trading on 11 January.

ETF demand for bitcoin (2,800 BTC per day) is three times greater than its mining (900), according to CoinShares. The resulting demand shock contributed to a further decline in bitcoin balances on centralised exchanges.

The Coinbase exchange suffered a technical failure due to the frenzy of demand for cryptocurrencies. The problem occurred amid a “huge” influx of users.

The Gemini exchange will pay a $37m fine for “serious compliance violations” and refund $1.1bn to users of its Earn staking programme as part of a settlement with the New York State Department of Financial Services.

Two top Binance executives were arrested in Nigeria as the country cracks down on cryptocurrency exchanges.

El Salvador’s unrealised profit from bitcoin investments was 40%, or about $41.6 million, according to the country’s president, Nayib Bukele. The country’s leaders do not yet intend to sell the coins.