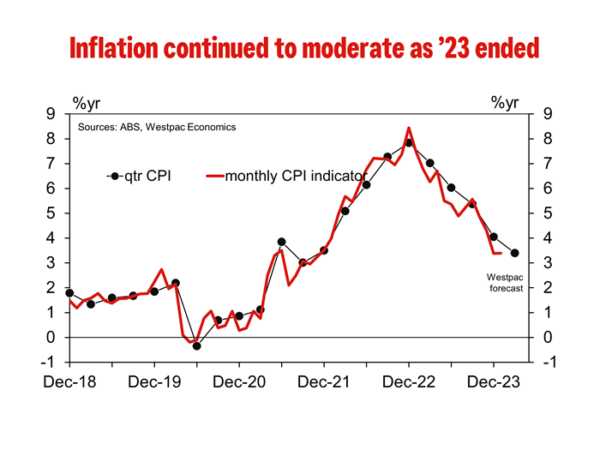

The Monthly CPI Indicator rose 3.4% in the year to January, in line with the outcome recorded in December. This remains the equal softest print for monthly inflation estimate since November 2021.

The January print was meaningfully less than Westpac’s forecast of 3.9%yr, and the market median forecast of 3.5%yr. Taken at face value the January Monthly CPI Indicator suggests that if there are any risks to our current March quarter CPI forecast of 0.7%qtr it is to the downside.

As noted in our preview, the first month of the quarter provides us with an update household durable goods but not a lot in the way of services outside of garments repairs & hire and maintenance/repairs to dwellings.

Diving into the details we find that while electricity and holiday travel was softer than we had expected, durable goods prices did not fall as much and as these prices are surveyed only in the first month of each quarter they will drive the quarterly forecast. The more robust durable goods prices offset weaker electricity and holiday travel prices, which are surveyed monthly so we will have two more months of data for these prices.

As such, we see the risks as balanced around our March quarter inflation forecasts; 0.7%qtr for the CPI and 0.8%qtr for the Trimmed Mean.

The Monthly Indicator Trimmed Mean printed 3.8%yr, down from 4.0%yr in December and well down from the recent peak of 7.2% in December 2022. The quarterly Trimmed Mean printed 4.2%yr in December and our current forecast for the March quarter is 3.8%yr.

The seasonally adjusted monthly indicator, which excludes volatile items (such as food and petrol) and holiday travel, increased 0.2% in January to be 4.0% higher in annual terms. This indicator has now been running at 0.2% in monthly terms for the past five months.