U.S. Highlights

- Minutes from the January 30th-31st FOMC underscored that policymakers are adopting a cautious approach on when to pivot to policy easing.

- A number of Fed Governors spoke this week, and all urged patience on rate cuts, particularly in light of the uptick in inflationary pressures in January.

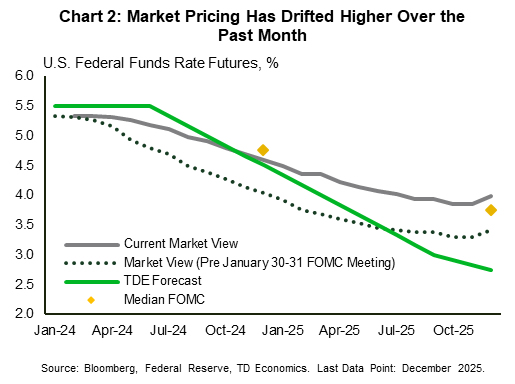

- Market pricing is now positioned for the first cut to come in June (previously May) with 100 bps of easing by year-end – closely aligning to TDE’s forecast.

Canadian Highlights

- Canadian inflation for the month of January surprised to the downside and is now back in the Bank of Canada’s (BoC) 1–3% target range. Core inflation metrics also moved lower, a welcome development for the BoC.

- The BoC might shift marginally to a more dovish tone at the March 6th policy meeting, but the overall narrative remains intact: inflation is still too high, and more evidence is needed that it is moving durably towards 2%.

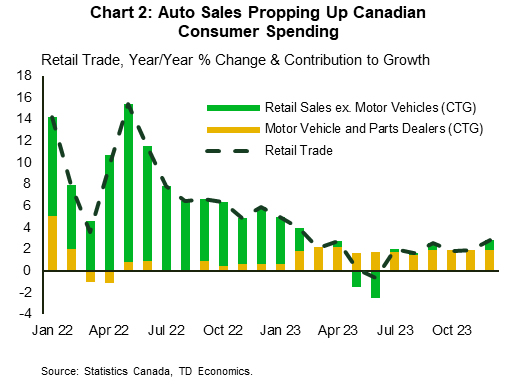

- Canadian retail sales capped off the year with a solid reading in December. Aside from still-robust spending on autos, other areas of consumer spending are weakening. This trend is expected to persist in the first half of this year.

U.S. – Slow Your Roll

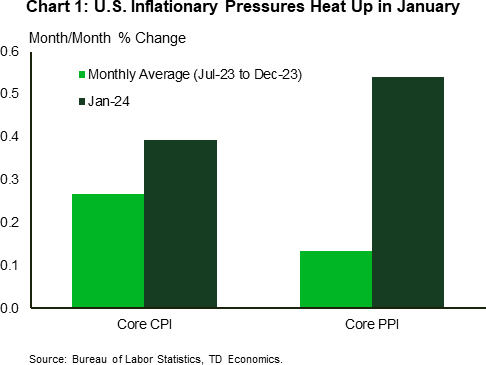

Slow your roll. That was the messaging communicated in the Federal Reserve’s meeting minutes released earlier this week. In hindsight, Fed officials had every reason to remain cautious in timing the pivot to policy easing. Since the January 30th-31st FOMC meeting, the economic data has done little to instill further confidence that inflationary pressures will continue to recede over the coming months. Not only did the January employment report come in more than double expectations, but a few inflation indicators (including CPI, PPI, and ISM price sub-indices) all came in much hotter-than-expected in January (Chart 1).

Market pricing has adjusted accordingly in recent weeks, with investors now positioned for a June rate cut and 100 basis points (bps) of policy easing by year-end – a trajectory that more closely aligns to both the FOMC’s and our own forecast (Chart 2).

While Fed officials acknowledged that inflation and employment risks are coming back into better balance, the minutes revealed that most participants remain concerned about the risk of “moving too quickly to ease the stance of policy”. Moreover, some officials cited the risk that stronger aggregate demand or a slow-down in the supply-side recovery could impede further progress on the inflation front. All of this argues for a more agile, data dependent approach to reducing the policy rate.

This is especially true given the recent growth dynamics. Economic growth remained incredibly resilient through the second half of last year – averaging an impressive 4% (annualized) or more than double its long-run potential. While first-quarter momentum looks to have lost a step, it’s still tracking a relatively robust 2-2.5%. As highlighted in our Quarterly Q&A publication released earlier this week, our current forecast assumes economic momentum will continue to soften as the year progresses. However, this is largely predicated on a further cooling in the labor market, resulting in slower income growth and weaker consumer spending. Should the labor market prove more resilient, then there’s an obvious upside risk to both spending and near-term inflation dynamics.

Next week we’ll get a pulse check on consumer spending and income trends for January. Accompanying the release will be the core PCE inflation data, which is likely to show an increase of 0.4% month-on-month – the strongest monthly gain in a year. It remains to be seen if January’s acceleration is a one-off, perhaps influenced by businesses increasing prices at the start of the year in a way that may not be fully captured by seasonal adjustment factors, or whether it’s the beginning of something more insidious. Either way, the recent uptick in inflationary pressures serves as a reminder that the descent back to 2% will likely come with some turbulence.

This is exactly why Fed Governors have been preaching patience over the past few weeks. Perhaps no one said it better than Christopher Waller, who noted “the strength of economy and the recent data on inflation mean it is appropriate to be patient, careful, methodical, deliberate – pick your favorite synonym”. “Whatever word you pick, they all translate to one idea: What’s the rush?”.

Canada – Good News on the Inflation Front

If the new year’s resolution for Canadian inflation was to retreat back into the Bank of Canada’s (BoC) 1–3% target range, then January’s CPI update is a good start. Prices in January dipped to 2.9% year-on-year (y/y) and are now sporting a two-handle for the first time since June 2023. This is a welcome development for Canadian consumers waiting for interest rate relief, but like all new-year goals, success will be judged on how well inflation sticks to the script. Markets took the news as a sign the BoC might be inching closer to their first interest rate cut, adding slightly more probability to a move before the summer. The 2 and 10-year Canadian yields both slipped by around 8 bps on the week, while the Canadian dollar stayed roughly flat.

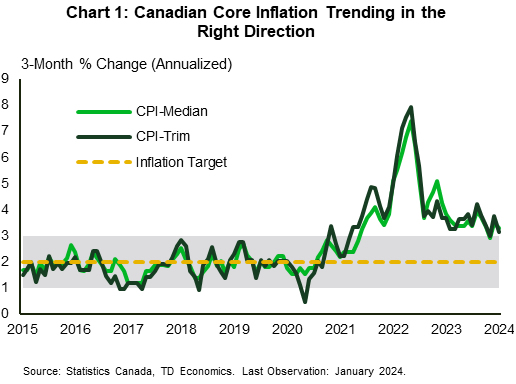

The details of January’s CPI report were encouraging. Gasoline prices were key in guiding inflation lower, while decelerating food, travel services, and clothing and footwear inflation also made meaningful contributions to the drop in the headline figure. More importantly, CPI-trim and CPI-median edged lower in January, and despite some head fakes in recent months, both measures are trending in the right direction (Chart 1). However, as has been a theme for many months, the shelter component of CPI, currently running above 6% y/y, continues to be the single biggest factor in preventing the BoC from achieving price stability.

It is still important to zoom out and avoid putting too much emphasis on one data point. Recall that just one month ago, an upside inflation surprise led to a volatile market reaction in the other direction. In the months leading up to the CPI release, markets and forecasters were flip-flopping between the first BoC interest rate cut occurring in either in April or June. As we near the BoC’s March 6th interest rate announcement, current inflation trends and the surprising strength in the Canadian economy to end the year have markets leaning towards the latter, in line with our view.

Will this report change the Bank of Canada’s tone? Probably slightly. They will likely acknowledge that progress is being made in returning inflation back to target. But the narrative remains intact, inflation remains too high to start cutting rates now, and the Bank will need more evidence that inflation is durably moving towards 2%.

A healthy gain in December retail sales was consistent with the better consumer spending momentum we had seen in the fourth quarter. While auto sales did lots of the heavy lifting in December retail trade, core sales also moved higher and were led by general merchandise stores, food and beverage stores and miscellaneous retailers. Over the past several months, auto sales have driven the majority of the y/y gains in retail trade, while spending across other major components has slowed (Chart 2). The advance reading for January sales also points to momentum fizzling in the new year, consistent with our own view.

Looking ahead to next week’s GDP release, we anticipate Canada’s economy will return to modest growth in the fourth quarter, after contracting in the third quarter, supported by a solid showing in consumer spending.