Canadian Q4 and December GDP growth numbers will be in focus for the Bank of Canada after a busy week where inflation numbers for January broadly surprised to the downside.

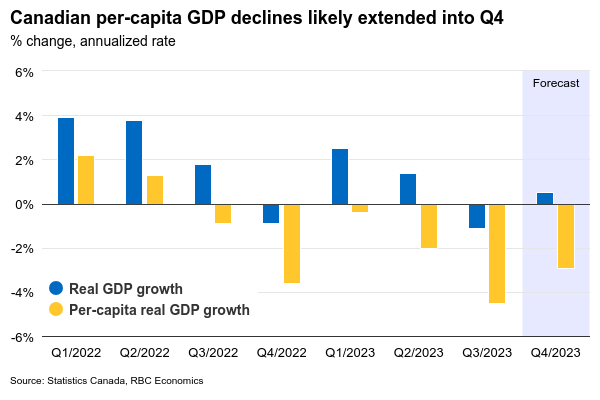

We expect Q4 GDP growth to remain in positive territory with a small annualized increase of 0.5%. That will prevent the economy from seeing two consecutive quarters of contraction, which is often used as the definition of a “technical” recession. But when measured against the country’s rapid population growth, it’s the sixth straight quarterly decline on a per-capita basis, alongside a rising unemployment rate.

Consumer spending bounced back in Q4—retail sale volumes jumped at an annualized rate of 5.3%. But business spending appears to have softened with lower imports of equipment and declining construction activity. While employment continued to rise in the quarter, actual hours worked declined outright for the first time since the initial pandemic lockdowns in Q2 2020.

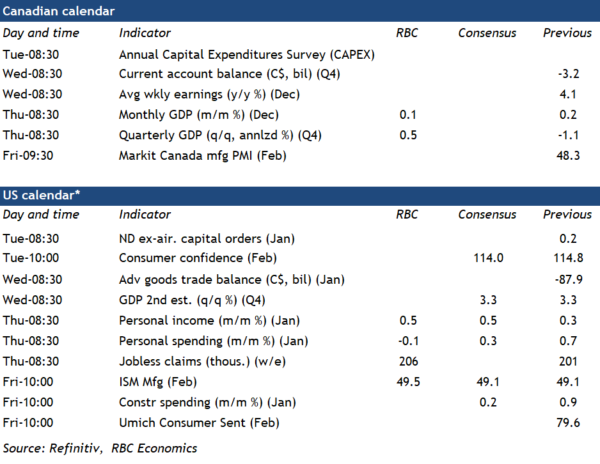

On a monthly basis, we expect GDP edged up 0.1% in December, building on the 0.2% increase in November but below the 0.3% preliminary estimate from Statistics Canada a month ago, which is highly prone to revision. Oil and gas extraction activity jumped higher in December, and retail sales volumes rose 0.8% from November. But manufacturing and wholesale sales volumes both declined and Quebec’s public sector strikes will weigh on output. Our tracking is pointing to softer consumer discretionary spending in January as households unwind from a robust holiday shopping period.

The bottom hasn’t fallen out of the economy in a way that would force the BoC to rush into easing interest rates, and inflation is slowing but still above the central bank’s 2% target. Our base case remains that the first interest rate cut from the BoC will come in June, contingent on inflation continuing to drift lower.

Week ahead data watch

Canada’s Annual Capital Expenditures Survey (CAPEX) on Tuesday will be closely watched for signs on whether cautious business spending will persist into 2024. Business spending on machinery and equipment has been weaker in recent months. The BoC’s Business Outlook Survey shows businesses are still planning to invest more in machinery and equipment in the year ahead but at a modest pace.

U.S. personal consumption expenditure likely ticked down 0.1% in January from December, driven by lower retail sales and gas prices. That would be the first month-over-month decline since March 2023. We expect personal income to edge up 0.5%, boosted by resilient labour markets and a large annual cost of living adjustment for social security benefits.

Job openings and wages will be closely watched in Canada’s SEPH labour market data. Job openings edged higher in October and November but are still running 25% below year-ago levels. Other data from Indeed.com suggest that job postings continued to decline through most of January.