- US core PCE and Eurozone flash CPIs to keep inflation worries in the foreground

- Japanese and Australian inflation numbers also coming up

- RBNZ might strike a hawkish tone

- Manufacturing PMIs also in the spotlight

PCE inflation to headline busy US data week

The Fed is in no rush to ease policy and markets are finally starting to come round to the prospect of no rate cuts before the summer. Yet, stock markets have remained bullish, suggesting that the fact alone that interest rates will start to fall this year is enough to spur optimism.

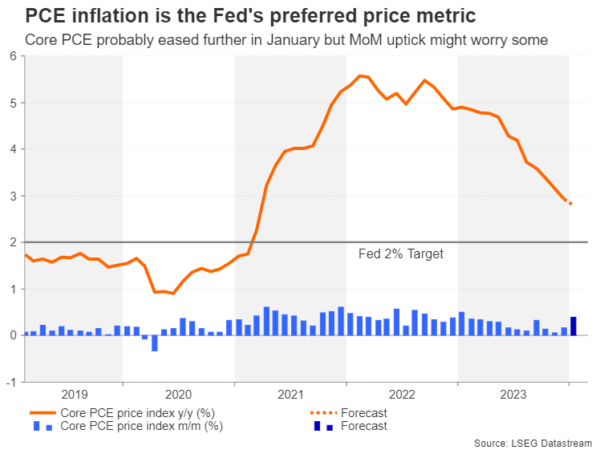

For the US dollar, however, any further delay could be crucial for its year-to-date uptrend, hence, next week’s releases will form one of the last pieces of the puzzle before the March FOMC meeting. Specifically, all eyes will be on the personal income and outlays report for January that includes the all-important core PCE price index, which is the Fed’s inflation indicator of choice.

After both the CPI and PPI figures surprised to the upside, another hot inflation print could cast doubt on even a June rate cut. It’s possible though that January’s PCE inflation readings due Thursday will not sway rate cut odds in either direction.

The core PCE price index is forecast to have cooled slightly on an annual basis from 2.9% to 2.8%, but an acceleration in the month-on-month rate to 0.4% would likely keep investors on their toes.

In the event of a mixed set of PCE price data, the market reaction could be determined by how strong the personal income and spending numbers are. Personal consumption unexpectedly jumped by 0.7% m/m in December. It’s projected to have moderated to 0.3% in January, potentially easing concerns about an overheating US economy.

Will data flurry provide a lift to the dollar?

Inflation and consumer spending will not be the only data in focus as there’s a slew of other releases on the US agenda next week. Building permits and new home sales for January are out on Monday. Durable goods orders and the consumer confidence index will follow on Tuesday, while on Wednesday, the Q4 GDP growth estimate is expected to be left unrevised in the second reading. The Chicago PMI and pending home sales are up next on Thursday.

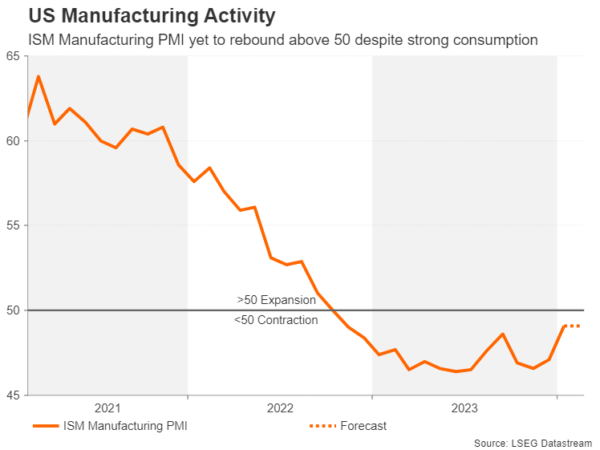

Rounding up the week on Friday is the ISM manufacturing PMI. The closely watched PMI gauge is forecast to have stayed unchanged at 49.1 in February, pointing to ongoing contraction in the sector.

If the data paint a broadly healthy picture, the US dollar might just be able to resume its ascent, though any gains would likely be limited without additional catalysts.

Last flash CPI report before March ECB meeting

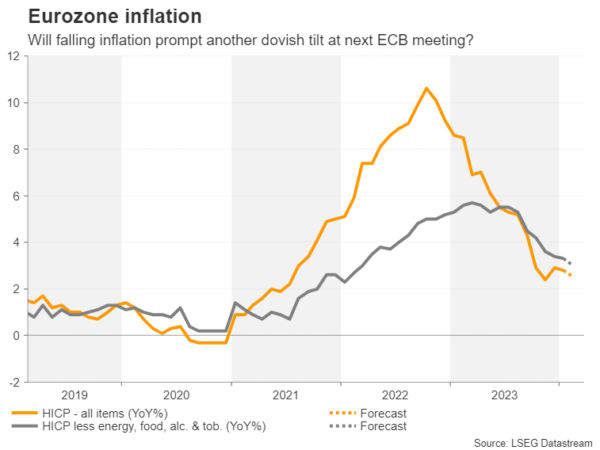

The European Central Bank’s next policy meeting is fast approaching on March 7 and there is intense speculation as to whether or not policymakers will flag a rate cut soon. Inflationary pressures in the euro area are somewhat more subdued than in America, thanks mainly to a much weaker economy. Headline inflation dipped to 2.8% year-on-year in January, confounding expectations of a return to the 3.0% handle.

The flash estimates for February are due on Friday and if there is a further decline, markets will probably perceive that as a green light for policymakers to formally pave the way for a rate cut in the summer.

However, it’s also likely that policymakers will not want to pre-commit to a rate cut before there’s been further progress in lowering underlying inflation. The core figure excluding food and energy stood at 3.6% in January, while the measure that also excludes tobacco and alcohol prices was slightly lower at 3.3% but nevertheless some distance away from the 2% target.

The euro has been enjoying a bit of a rally against the greenback lately despite Fed rate cut bets being pushed back. However, there’s a risk of those gains being reversed if the inflation numbers are on the soft side as that would increase the odds of the ECB cutting rates before the Fed.

Euro traders will also be keeping an eye on Wednesday’s economic sentiment indicator and the bloc’s jobless rate on Friday.

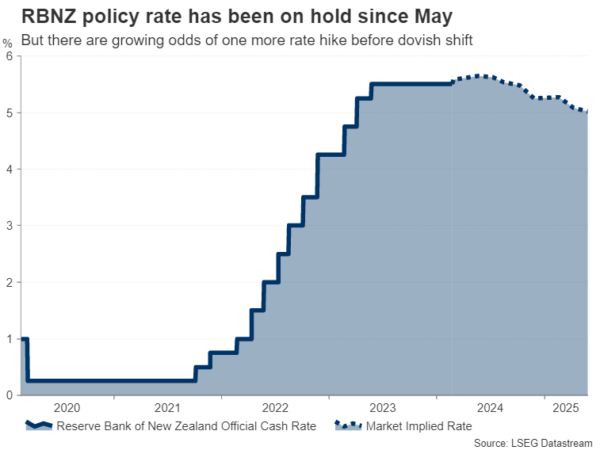

RBNZ might buck the rate cut trend

As most central bankers start to openly discuss shifting to an easing stance soon, the Reserve Bank of New Zealand has taken a hawkish turn. In recent comments, Governor Adrian Orr seemed to imply that there was a risk inflation would not return to the 1-3% target band without further tightening.

Although growth in New Zealand has been sluggish over the past few quarters and the labour market has cooled somewhat, business confidence is on the rise. The latest ANZ business outlook survey is out on Thursday. More importantly, CPI remains elevated at 4.7%, raising fears about persistent price pressures.

The odds of an additional rate hike have subsequently shot up, reaching almost 60% for the May meeting. For the February decision on Wednesday, markets have assigned a 30% probability. What is more certain, however, is that the RBNZ won’t be cutting rates anytime soon, if at all in 2024.

In its last quarterly projections, the RBNZ had forecast that rates would not start to fall before the first quarter of 2025. Should those forecasts be further pushed back in the quarterly Monetary Policy Report to be published on Wednesday, the New Zealand dollar could stretch its recent impressive gains.

Can the aussie extend its rebound?

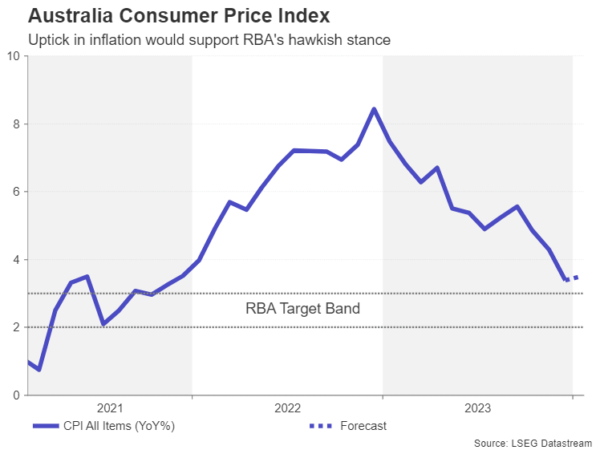

Another central bank that looks set to lag others in cutting rates is the Reserve Bank of Australia. However, inflation in Australia has now started to drop more quickly. The monthly headline rate had tumbled to 3.4% y/y in December. The January numbers are out on Wednesday and are forecast to show a slight uptick, giving the RBA more reason to remain hawkish.

Stalling disinflation would be positive for the Australian dollar, which recently broke above its bearish channel. But economic data, both domestically and from its largest trading partner – China – pose a downside risk. The fourth quarter estimate for capital expenditure is out on Thursday, while China’s official manufacturing and Caixin manufacturing PMIs are due on Friday.

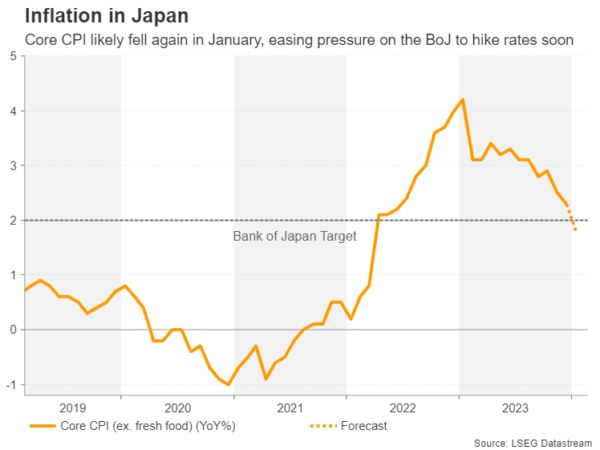

Japanese CPI unlikely to halt yen’s slide

Inflation will also be the highlight in Japan as the Bank of Japan ponders whether to exit from negative interest rates. The core consumer price index is expected to have risen by 1.8% y/y in January, in what would be a slowdown from the 2.3% rate in December, removing any urgency for policymakers to lift rates soon.

The yen could come under pressure from weaker-than-expected figures, although the BoJ’s primary focus right now is the spring wage negotiations, so any reaction would probably be modest.

Other releases will include preliminary industrial output and retail sales numbers for January on Thursday, followed by jobs stats on Friday.

Elsewhere, Canada reports fourth quarter GDP data on Thursday. The Canadian economy contracted in the third quarter, but a bounce back is likely in the final three months of 2023. A solid GDP reading could provide a much-needed boost to the Canadian dollar, which has failed to follow its peers in staging a rebound against its US counterpart over the past 10 days.