- All eyes are on growth as PMI and IFO surveys are released this week

- The market could be looking for dovish hints at the ECB minutes

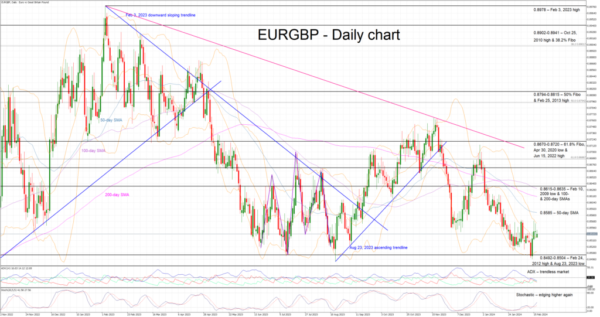

- Euro remains on the back foot against the pound

- Euro area PMI surveys will be published on Thursday 09:00 GMT

Strong US data releases help the ECB hawks

The upside surprises recorded by the recent US labour market statistics and the US inflation report have forced the market to reconsider its monetary policy expectations for 2024. Apart from the Fed now being expected to cut by around 90bps this year, with the first rate cut priced in by the June meeting, the market has also reevaluated its ECB expectations with 100bps of rate cuts currently on the cards.

This is somewhat surprising as the euro area economic outlook remains bleak. December’s ECB staff projections are already out of date as the German budget shenanigans have almost doomed this year’s growth prospects, especially as the Chinese economic situation remains fluid. Even the modestly optimistic EU commission revised its 2024 forecasts lower last Thursday with the respectable 1.2% growth rate for the euro area cut to just 0.8%. Germany is expected to barely grow, thus removing a possible headwind for the ECB doves.

In this context, the final GDP print for the fourth quarter for 2023 will be published on Friday and it will most likely confirm that Germany did not grow last year. More importantly, on the same day, the forward-looking Germany IFO survey for February will be released. The ECB hawks would love a sizeable upside surprise, but market expectations point to a marginal pickup.

Euro area PMIs could set the tone until the March ECB meeting

At the January ECB gathering president Lagarde stated that “the recent PMI numbers are actually a little indication that things are coming in place for recovery in 2024”. On Thursday morning the preliminary release of the February PMI surveys will be published, and the market will have the chance to gauge if president Lagarde’s statement has been accurate.

The euro area PMI surveys remain comfortably below the 50-threshold as both the German and French sub-indicators remain subdued. While the latter can be partially explained by the repeated workers’ strikes and the recent farmers protests reacting to the updated Common Agricultural Policy, the German figures are a cause for concern for the ECB hawks. The evident reason is the growth slowdown seen across the euro area but also the ongoing economic developments in China.

Efforts by the Chinese authorities to stimulate the economy have not yet produced fruit possibly because the measures up to now have been below par. The recent set of announcements aiming to prop up the Chinese stock markets are not really expected to impact the real economy but, at the moment, it appears cheaper for the Chinese administration to boost the financial markets’ morale than engineer some economic momentum.

ECB minutes to show how patient ECB members really are

Also on Thursday, the minutes from the January ECB meeting will be published. Despite certain investment houses expecting a dovish show, in January president Lagarde et al repeated the data dependent approach and highlighted the need for patience in order to examine more data, particularly on wages.

The minutes are probably not going to hold many surprises, but it will be interesting to see the discussion that took place during the two-day gathering. More specifically, the comments made by the dovish camp, which seems to be fighting tooth and nail to get going with the rate cuts. As the March 7 meeting approaches, the market is itching for further information that the ECB is ready to signal the start of rate cuts.

Euro is trying to recover lost ground against the pound

Since the start of 2024, the euro has been on the back foot against the pound with the pair recently recording a new five-month low. Last week’s mixed UK data allowed the euro bulls to recoup part of their recent losses, but they probably need growth-positive data to reverse the current bearish trend.

A positive set of figures this week could push the euro/pound pair higher with the busy 0.8615-0.8635 area likely being the initial target. On the flip side, another weak set of PMI surveys would reinvigorate the dovish ECB expectations, transform the March ECB meeting into a live one, and possibly help the euro bears retest the recent low of 0.8497.