- Dollar shines after inflation surprise, awaits latest Fed minutes

- In Europe, business surveys will be crucial for euro and sterling

- Canadian and Australian data releases also on the agenda

Fired up dollar turns to FOMC minutes

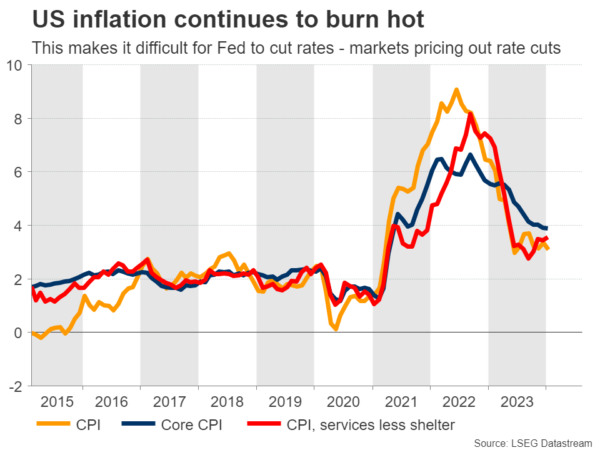

It was a beneficial week for the US dollar, which charged higher after data revealed US inflation is not cooling down as quickly as investors had hoped. Traders were forced to unwind bets of imminent Fed rate cuts in the aftermath, lending the dollar strength through the interest rate channel.

Solid economic growth, a tight labor market, and persistently high inflation are a cocktail that makes it very difficult for the Fed to cut interest rates. Markets have finally gotten the message. The timing of the first rate cut has been pushed out to June, while the market is now pricing in less than four cuts in total for 2024, down from six earlier.

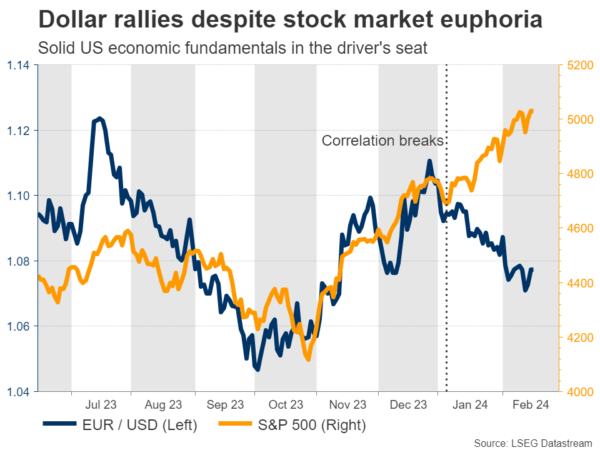

With rate cuts getting priced out, the dollar has started to shine once again, gaining 3% already this year against a basket of currencies. It’s crucial to note that this is happening even despite the euphoria in the stock market. Positive risk sentiment is generally bad news for the dollar, which is considered a safe haven asset.

This makes the dollar’s recent rally even more impressive. The reserve currency has started to realign itself with its robust economic fundamentals, and this process might have scope to continue since the market is still pricing in four rate cuts for this year, whereas the Fed has only signaled three.

Minutes of the latest Fed meeting will be released on Wednesday and will be the next piece in this puzzle. Investors will search for any clues on the potential timing of the first rate cut. We’ve heard from several Fed officials since this meeting, and most have preached patience on rates, warning against premature cuts given the strength of the US economy.

If the minutes echo a similar tone, the dollar could gain more momentum.

Eurozone and UK business surveys on tap

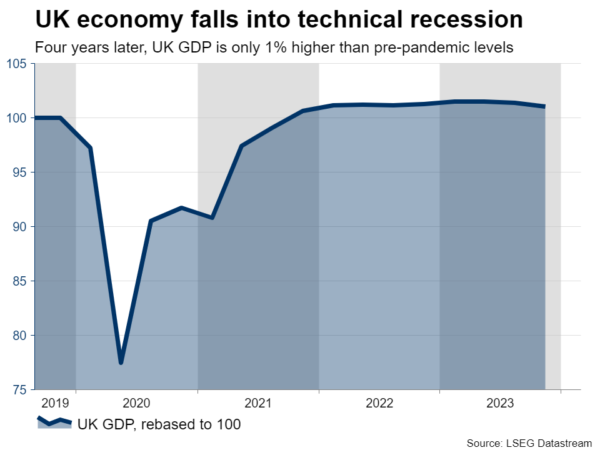

Crossing into Europe, the latest round of PMI business surveys will be released on Thursday in both the Eurozone and the United Kingdom. Both economies have been haunted by stagnant growth for some time now, with the UK even falling into a technical recession late last year.

Investors will dissect these business surveys for signals on whether the situation is improving or worsening in order to gain insights on how quickly these central banks might cut interest rates. Since UK inflation is still very hot, markets think the Bank of England will be among the last central banks to cut in this cycle.

This notion has helped support the British pound, which is currently the second-best performing major currency this year, behind the US dollar. The cheerful tone in global markets played a role too, as the pound is highly correlated with stock market performance, thanks to the UK’s twin deficits.

Of course, this is a dynamic that cuts both ways. If stock markets suffer a correction or if UK data continues to deteriorate, the pound would be left vulnerable to a selloff, especially with political uncertainty brewing ahead of a general election.

As for the Eurozone, even though it narrowly dodged a recession, the outlook is equally grim. New business orders have declined for seven months in a row, which is bad news for future growth. If the upcoming surveys show that this trend persists, the euro could receive another blow as traders become more confident the ECB will cut rates in April.

The minutes of the latest ECB meeting will also be published on Thursday, although this release usually does not have a significant market impact.

Canadian and Australian releases

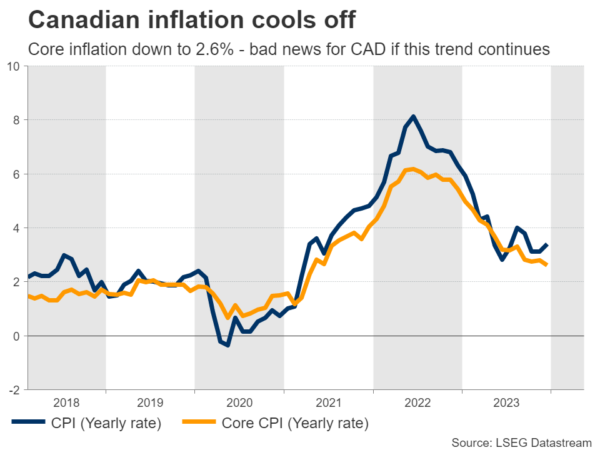

Turning to the commodity-linked currencies, the ball will get rolling on Tuesday with Canada’s inflation stats for January. Inflation has cooled dramatically in recent months, with the core CPI rate falling to just 2.6% in December, leading the Bank of Canada to abandon its tightening bias.

Another cooldown in inflation could raise the likelihood of a rate cut in the spring, keeping the Canadian dollar under pressure. The nation’s retail sales for December will also be released on Thursday.

Finally in Australia, minutes from the latest RBA meeting will see the light on Tuesday, ahead of wage growth data for Q4 on Wednesday.