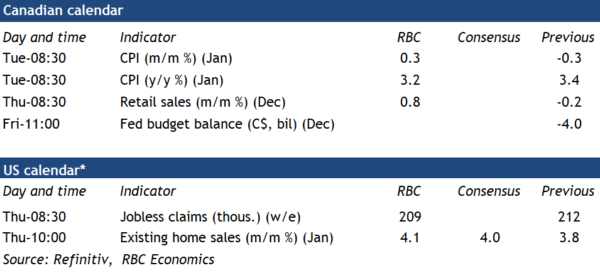

The first Canadian inflation reading of 2024 out next Tuesday should edge lower on falling energy prices and slower food price growth.

We expect the consumer price index to rise 3.2% year-over-year, lower than 3.4% in December. But the underlying details will be closely watched for signs on whether inflation pressures are continuing to trend— albeit gradually—towards the Bank of Canada’s 2% target. Most of the deceleration we expect in price growth comes from lower energy prices, which the central bank has little to no control over. Gasoline prices were little changed from December to January and residential natural gas prices fell in Alberta. Food price growth also looks likely to ease as a large month-over-month surge in January 2023 (+1.7%) falls outside of the year-over-year growth rate.

Stripping out volatile components like food and energy, we expect price growth to hold at 3.4% year-over-year with the recent months’ mixed underlying drivers continuing. More than a quarter of price growth overall is still coming from higher mortgage interest costs that are a direct result of earlier BoC interest rate increases. If we exclude that component, price growth would already be back within the BoC’s 1% to 3% inflation target range.

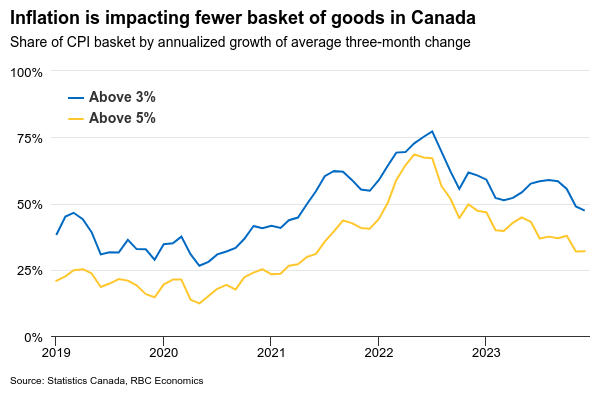

The share of the CPI basket seeing abnormally high inflation has also been declining. Roughly 51% of the consumer basket was growing at more than 3% over the last three months, down from a peak of 77% of the basket in July 2022. But we also look for year-over-year growth in the BoC’s preferred broader trim and median measures of underlying price growth to hold steady at 3.7% and 3.6%, respectively, in December.

Substantially stronger-than-expected January labour market data and a bounce back in home resales have raised fears that the Bank of Canada will need to leave interest rates higher for longer (again) to get inflation sustainably back to target. But, consumer demand has continued to soften on a per-capita basis.

We expect December retail sales data on Thursday to show an increase close to the 0.8% advance estimate from Statistics Canada a month ago, but that likely implies lower spending outside of a monthly jump in vehicle sales and higher gasoline prices. Our tracking of spending in January has been softer.