Market picture

The cryptocurrency market is up 1.7% from 24 hours ago, with Bitcoin stuck between $51.5K and $52.5K. Buying interest has focused on the major altcoins such as BNB (+3.6%), XRP (+3.5%) and Cardano (+4%), which were lagging the day before, but they are just trying to keep up with Bitcoin’s rise. In our opinion, altcoins’ time will come when the first cryptocurrency has reached its historic highs and looks too expensive. But it could be another year before that happens.

Moreover, history suggests the market will pick new altcoins with each new growth cycle. The stars of the past era don’t always manage to rewrite their all-time highs, so there’s no rush to pick altcoins at this stage of the cycle.

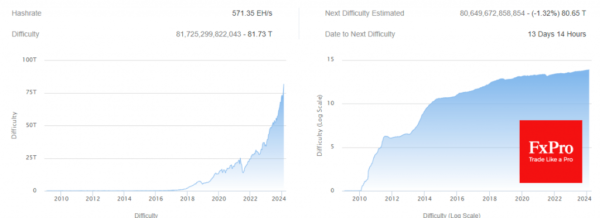

As a result of another recalculation, the difficulty of mining the first cryptocurrency increased by 8.24%. The indicator updated the historical maximum at 81.7 T. The average hashrate for the period since the previous change in value was 583.92 EH/s.

News background

According to data compiled by Bloomberg, outflows from gold ETFs since the beginning of 2024 have reached $2.39 billion, while inflows into spot bitcoin ETFs have reached $3.89 billion.

According to CoinGecko data, the US has captured 83% of the global spot bitcoin ETF market, worth over $41.7 billion, with Europe in second place with an 8.8% share. Canada, which approved spot bitcoin ETFs back in 2021, remains a major player in the segment with a 7.4% share.

In total, there are 33 such Bitcoin ETFs in the world. The first appeared in Europe in 2020. The largest by assets is the Grayscale Bitcoin Trust ETF (GBTC), which has been operating as a trust since 2014. The fund’s AUM is $22.8 billion (54.7% of the total).

Tron Foundation founder Justin Sun announced plans to develop a Tron-based L2 network to scale Bitcoin. The roadmap includes the integration of a cross-chain solution to link the tokens of the two ecosystems.

GameFi project WormFare partnered with Polygon Game Studio to improve game performance and security.

China will revise provisions of its outdated anti-money laundering law to prevent the use of crypto assets to launder criminal proceeds.