U.S. retail sales and consumer price index reports for January will be closely watched for whether strong consumer spending and slowing inflation continue to unexpectedly coexist. The U.S. Federal Reserve remains wary that strong demand could reignite price growth, but to date, inflation has continued to edge broadly lower. Strong consumer spending and resilient labour markets mean there is little pressure for the central bank to shift to interest rate cuts quickly. But, slower price growth is increasing confidence that the amount of economic pain feared when the Fed started aggressively hiking rates almost two years ago won’t necessarily materialize.

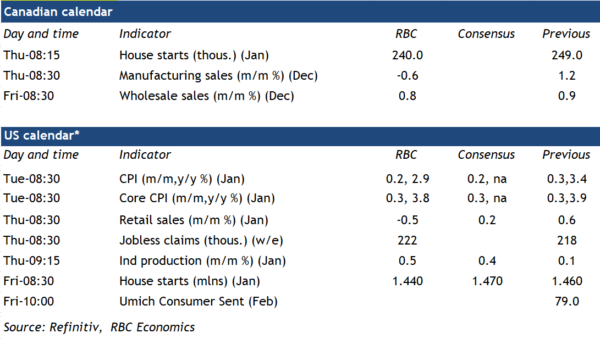

We expect January’s U.S. retail sales report to show a 0.5% decline from December led by a 7% drop in auto sales and a 2% fall in gasoline prices month-over-month. That marks the largest decline since March last year. Another surge in jobs in January (353,000) and acceleration in wage growth means household incomes are still strong but the household saving rate continues to run below pre-pandemic levels.

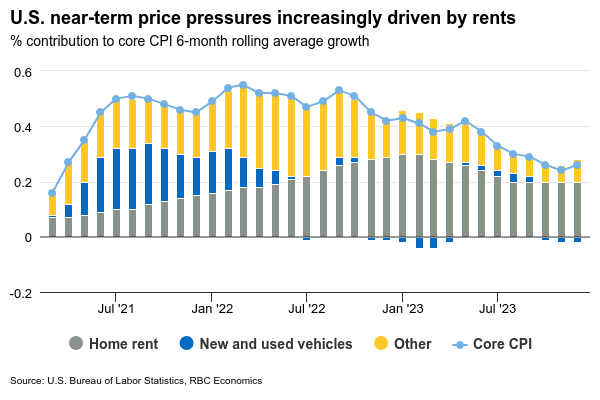

Consumer price growth is also expected to slow. We look for headline CPI growth (year-over-year) to fall below 3% for the first time in almost three years (since March 2021.) Most of that slowing is expected to come from a pullback in energy prices and another drop in food price growth. Core price growth, which excludes food and energy products, should ease less—we expect to 3.8% year-over-year in January from December’s 3.9%. But a disproportionate share of that increase still comes from higher home rents. The growth in shelter costs will continue to slow as lower market rents gradually feed through to leases. Price growth of goods has slowed back to around zero as the impact of acute global supply chain disruptions earlier ease.

Week ahead data watch

StatsCan’s advance results indicated manufacturing sales declined 0.6% in December. And we expect the volumes to be little changed given a similar decline in the industrial product price index for the manufacturing sector in the month.

The early indicator for ‘Core’ wholesale sales (ex. Petroleum, Petrol Prod & Other Hydrocarbons) pointed to a 0.8% growth in December, mainly driven by higher sales in motor vehicle and parts subsector.

U.S. industrial production likely grew by 0.5% in January, hours worked for manufacturing sector were little changed, but a rise in electricity output is flagging an increase in the utility sector.