- All eyes on US CPI on Tuesday after run of strong data

- Retail sales on the agenda too for the US dollar

- Pound on standby for UK data flurry, including CPI and GDP

- Japanese GDP and Australian employment coming up too

Will US CPI remain sticky?

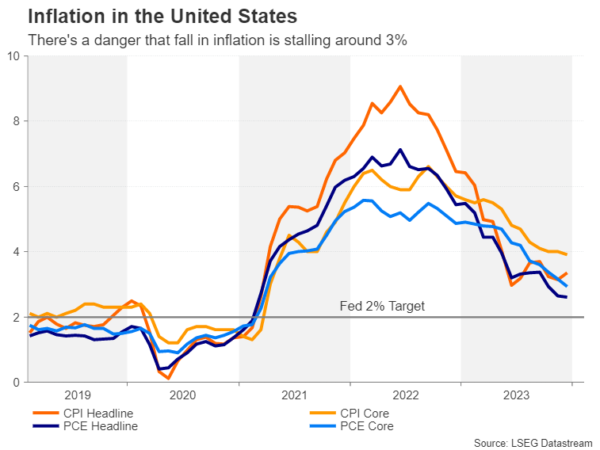

Inflation in the United States has generally been trending lower but the progress to get it all the way down to 2% has stalled in recent months, at least according to the CPI metric. Whilst Fed officials are optimistic that price measures will continue to head lower over the next few months, the resilience of the US economy is proving to be a thorn in the side of the Fed, as strong domestic demand increases the odds of inflationary pressures brewing again, particularly if there’s a significant re-acceleration in wage growth.

The consumer price index rose to 3.4% y/y in December, having been hovering above 3.0% since last July. There was somewhat better news for core CPI, which eased below 4.0% y/y for the first time since May 2021.

The picture for PCE inflation – the Fed’s preferred measure – is a little more encouraging, especially on an annualized basis. Headline PCE stood at 2.0% and core PCE at 1.9% on a six-month annualized basis in the last two months of 2023. This may have contributed to the markets’ exuberance in anticipating an imminent dovish pivot by the Fed.

However, Fed officials have overwhelmingly signalled that a rate cut may be some time away, giving the US dollar a leg up as investors priced out a March move.

Tuesday’s CPI print could be crucial in determining whether easing expectations will be pushed back further, as investors still see a strong likelihood of a rate cut in May. Forecasts suggest CPI stayed unchanged at 3.4% y/y in January.

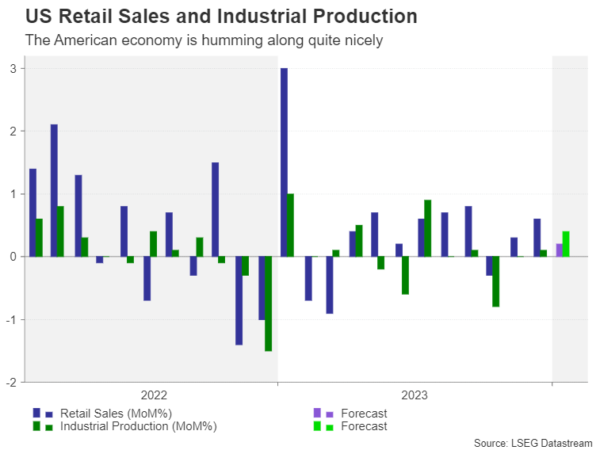

US economy might be running hot again

But the worry isn’t just inflation not coming down fast enough. The US economy appears to have enjoyed a pickup in activity in January so Thursday’s retail sales numbers will be vital too. The consensus estimate is for a 0.2% m/m increase, pointing to a cooldown from December.

In other data, the Philly Fed manufacturing index is also due on Thursday along with industrial production figures for January. Wrapping up the week on Friday are housing starts, building permits, producer prices and the University of Michigan’s preliminary consumer sentiment survey.

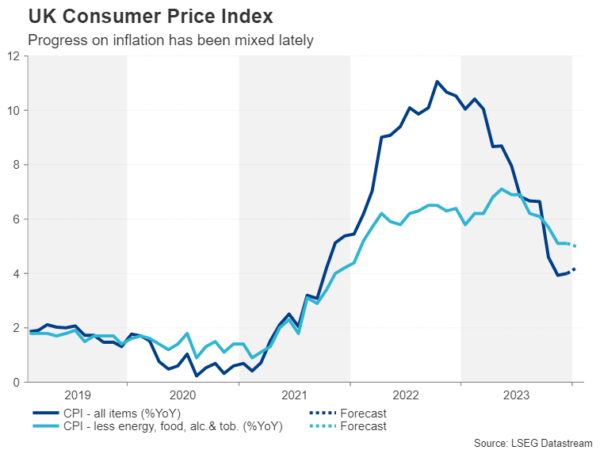

Pound to seek direction from UK CPI and GDP data

Inflation in the UK fell rapidly at the end of 2023 before edging up slightly. If both headline and core CPI resume their decline in January, this would come as a relief for the Bank of England but probably not for the pound. However, only the core measure is forecast to tick lower and headline CPI is expected to climb again to 4.2% y/y.

Although BoE policymakers have been pushing back on market expectations of an early rate cut, investors could ratchet up their bets if there’s a surprise drop in inflation.

But like in the US, it’s not just about the inflation picture as the economy has also been performing somewhat better than anticipated. UK GDP contracted by 0.1% in the three months to September, raising fears about a recession. But Q4 data due on Thursday is expected to show that the UK economy avoided a recession and recorded flat growth during the period.

Meanwhile, retail sales numbers will be watched on Friday for signs that consumer spending is recovering following an upbeat services PMI.

Not to forget about the labour market where wage growth has only just started to moderate. The employment report for December is out on Tuesday and any unexpected strength in the jobs market could dampen rate cut bets, lifting the pound.

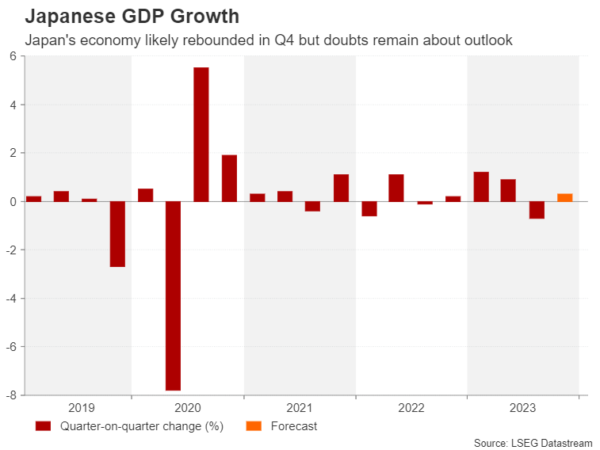

Japanese economy probably returned to growth in Q4

In Japan, the focus will be on the nation’s Q4 GDP readings on Thursday. After suffering a steeper-than-expected contraction in the third quarter of last year, economic growth is forecast to have rebounded by 0.3% q/q in the final three months of 2023.

If Thursday’s figures disappoint, doubts about the strength of the recovery are likely to persist as recent data has been rather mixed amid subdued consumption, although higher exports probably boosted GDP in Q4.

The Bank of Japan is hoping that this year’s ‘Shunto’ wage negotiations will spur pay growth and generate more sustainable inflation. But this could be a hard target to achieve even if the BoJ is confident enough to project it, so a sound economic backdrop is essential in adding credibility to its forecasts.

The yen could come under pressure on the back of a softer-than-expected bounce back, but an upside surprise cannot be ruled out either as most businesses have been positive in the BoJ’s most recent Tankan surveys.

Aussie and kiwi on a slippery slope

The Australian dollar hasn’t had a very good start to 2024 even though the Reserve Bank of Australia is expected to be one of the last to cut rates this year. China’s economic woes and the resurgent US dollar have offset the RBA’s relatively more hawkish stance.

An improvement in the labour market might lessen the aussie’s pain. Employment fell in December, taking markets by surprise. But Thursday’s jobs numbers are expected to provide some relief as the Australian economy likely added 30k jobs in January. This could pull the aussie away from multi-month lows versus the greenback as investors would pare back their bets of how many times the RBA would cut rates this year.

Chinese markets will be shut for the entire week for the Lunar New Year celebrations so the aussie could be more sensitive than usual to domestic data.

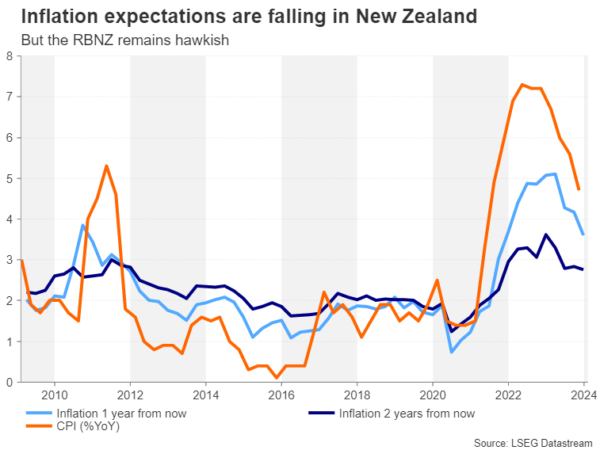

Across the Tasman Sea, the New Zealand dollar will be keeping an eye on the latest inflation expectations survey on Tuesday that the Reserve Bank of New Zealand publishes quarterly.

In the last report, one-year inflation expectations had fallen to 3.6% and two-year ones to 2.8%. Should expectations about future inflation maintain their downward path, this could undermine any fresh hawkish rhetoric from RBNZ Governor Adrian Orr when he speaks on Thursday.

Nevertheless, any downside reaction in the kiwi would likely be short lived as the RBNZ would need to see more evidence of abating inflation before turning dovish.