U.S. Highlights

- The Federal Reserve opted to hold rates steady in their first decision of the year in order to give themselves more time to assess the sustainability of current disinflation trends.

- Employment gains in January nearly doubled expectations as strong upward revisions to December carried forward into 2024.

- U.S. Treasury markets experienced volatility this week as a decline in yields prompted by a dovish interpretation of Wednesday’s Federal Reserve decision was reversed by stronger than expected employment data on Friday.

Canadian Highlights

- Canadian GDP growth appears to have ended 2023 on a stronger footing than previously expected, according to Statistics Canada’s preliminary monthly GDP estimates.

- The Bank of Canada (BoC) will keep an eye on growth trends while managing sticky underlying inflation pressures. A rate cut by June is not off the table, but recent developments risk pushing the cut further down the line.

- Updated jobs data for January will be the key release next week. We expect a modest employment gain to be met with a larger gain in labour supply.

U.S. – Resilient Labor Demand and A Patient Fed

January ended with a big week for economic data, including the first Federal Reserve decision of the year and the first employment data reading. While the Fed’s statement dropped any tightening bias, Chair Powell’s press conference curtailed market hopes for a near-term pivot to less restrictive monetary policy. This saw Treasury yields fall steeply after the meeting. However, this descent was ultimately short-lived, as much stronger than expected employment data on Friday sent yields higher. At time of writing, the ten-year Treasury yield was 12 basis-points lower on the week.

Overall, the messaging from the Federal Reserve on Wednesday was positive. Chair Powell stated that the committee was pleased by the progress made thus far on returning inflation to their 2% target, but noted that they would require more time to assess the sustainability of current disinflation trends (Chart 1). With economic growth accelerating last year on the back of strong consumption growth, the labor market remaining solid, and geopolitical tensions posing challenges to supply chains (and hence inflation), caution is likely wise. Chair Powell also stated that he viewed it as unlikely that the FOMC would possess the confidence to reduce interest rates by the March meeting in six week’s time.

Powell’s caution was further validated when we received the January employment data on Friday. Not only did we see a very strong 353k jobs added in the first month of the year, but last year’s total job gains were also revised up to 3.1 million, well above the prior reading for 2.7 million, with much of the revised strength coming through the second half of the year (Chart 2). Furthermore, wage growth appears to be accelerating, with the three-month annualized change in average hourly wages rising to a twenty-month high in January. Although near-term strength in the labor market is expected to recede over the coming months, sustained imbalances in the labor market is a risk that the Fed is acutely aware of.

Elsewhere this week, the ISM Manufacturing Purchasing Managers’ Index (PMI) showed that industrial activity continued to contract in January, but by less than expected. Elevated interest rates continue to weigh on the sector, but demand has begun to show signs of improvement, which has stabilized aggregate production output. Forward pricing in financial markets for the eventual decline in interest rates expected this year will likely provide relief to the manufacturing sector moving forward as the demand for goods improves.

The lingering question, however, is when will the Federal Reserve begin to drawdown interest rates? Markets have broadly abandoned their hopes for a March cut after this week, with May now being the expected timeline with about 80% probability as of the time of writing. Upcoming data will likely provide greater clarity on the timing of the introduction of less restrictive monetary policy, including a 60 Minutes interview with Chair Powell on Sunday and the Federal Reserve Senior Loan Officer Opinion Survey on Monday.

Canada – Welcome Back Growth

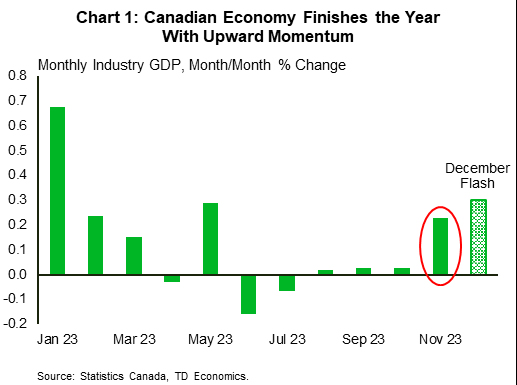

Canadian markets likely took their cue from events south of the border this week, with a light domestic data calendar. The 2-Year Canada yield finished the week flat while the 10-Year yield slipped around 10 bps. The Loonie’s early-week gains were erased on Friday, finishing the week flat at 0.7420. On the data front, the lone GDP update for November printed at 0.2% month-on-month (m/m), exceeding Statistics Canada’s initial guidance and market expectations. What’s more, the flash estimate for December GDP growth was a sturdy 0.3% m/m, which would mark the hottest growth reading since May.

It has been several months since Canada’s economy has recorded any meaningful growth. In fact, between Jun.–Oct. 2023, real GDP flatlined (Chart 1). Not a bad outcome given the current interest rate environment, but still evidence that output was hitting a wall. This week’s update poured cold water on the idea that the economy is completely out of steam. We are hesitant to call this a newly emerging growth trend, but it would be remiss to ignore it.

There is clearly some degree of underlying strength in Canada’s economy despite the turbulent second and third quarter this year. Strength in this sense is relative. GDP for Q4-2023 is tracking above expectations, around 1.2% quarter-on-quarter (q/q) annualized, but still below trend-growth. A range of indicators however, namely housing sales, retail spending and manufacturing, have showed a pulse in recent months. These fresh GDP readings also introduce upside risk to the BoC’s growth projection in last week’s Monetary Policy Report (MPR), which now pegs fourth quarter growth at 0%, down from their 0.8% projection in October.

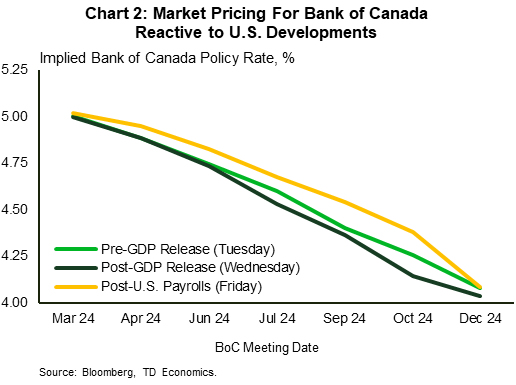

The BoC is now forced to divert some attention back to growth while trying to manage underlying inflation pressures. The ultimate focus for the BoC is to get inflation back to their 2% target, and they have reiterated that they believe trends in growth–and inflation– are headed in the right direction. The GDP release alone didn’t move the needle on the market’s expectations for a first Bank of Canada rate cut, but it appears hawkish data stateside did (Chart 2). At the time of writing, markets are pricing a 30% chance of a rate cut in April and an 80% probability assigned to June. Prior to U.S. payrolls, market expectations for a June cut were fully priced in.

Next week’s main focus is job market updates for January. Encouragingly, the labour market is cooling and looks positioned to avoid a worst-case scenario. The pace of monthly job gains, notably in the private sector, has retreated in recent months while the unemployment rate grinds higher. Expect a modest gain in January employment to be met with stronger labour force growth, a theme that has been playing out for several months.