Canadian jobs numbers for January will be centre stage next Friday as policymakers and market watchers look for signs of deterioration in the labour market. The data for the first month of 2024 will tell a similar story to the one we have observed over 2023—employment is rising but not quickly enough to prevent an increase in the unemployment rate.

We expect Canada’s unemployment rate likely hit 5.9% in January—up almost a full percentage point from 5% a year earlier. That’s the highest rate since the pandemic—January 2022. We expect to see another 10,000 jobs added from December, but that’s not fast enough to keep up with the country’s record pace of population growth.

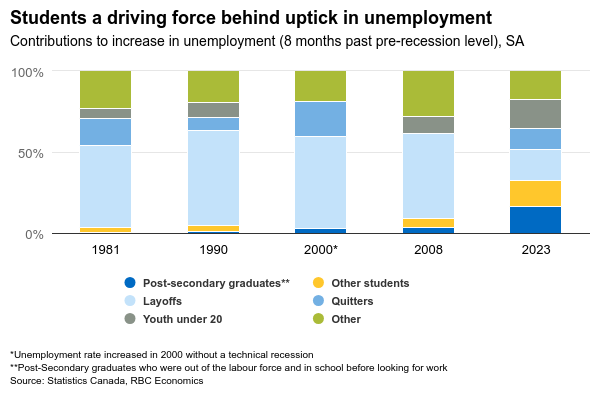

There are also signs hiring demand is continuing to slow. Job postings from Indeed.com were down more than 6% in January from December. Fewer job postings mean fewer opportunities for new people to enter the labour market. In recent months, students and new graduates searching for work accounted for half of the increase in the unemployment rate. While employment counts continued to rise in Q4, actual hours worked outright declined.

The Bank of Canada will be closely watching wage growth for further evidence that labour markets are softening. To date, growth in average hourly earnings has remained firm, and there is still room for growth particularly as unionized worker contracts continue to catch up to inflation. That will keep a floor under wage increases in the near term. But business surveys also widely suggest that wage growth will begin to slow as hiring demand cools.

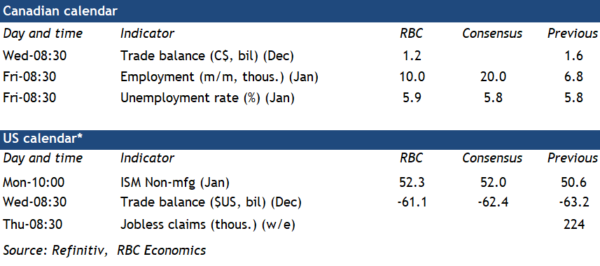

Week ahead data watch

Canada’s trade surplus in December likely shrank to $1.2 billion from November. Exports likely fell (we expect -2.2%) on lower motor vehicle shipments and oil prices. The former is consistent with industry data pointing to a pullback in motor vehicle production in December.

We expect the overall U.S. trade balance for December to come in at $-61.1 billion with the deficit narrowing from $-63.2 billion in November. According to advanced economic indicators, the U.S. goods sector deficit was down by $900 million from November, led by higher goods exports (+2.5%). Goods imports also rose by 1.3%.