- RBNZ remains hawkish despite slowing inflation and weaker growth

- Investors price in 90bps rate cuts by the end of 2024

- Focus turns to jobs data for Q4 on Tuesday at 21:45

Despite hawkish RBNZ, data drive investors to price in rate cuts

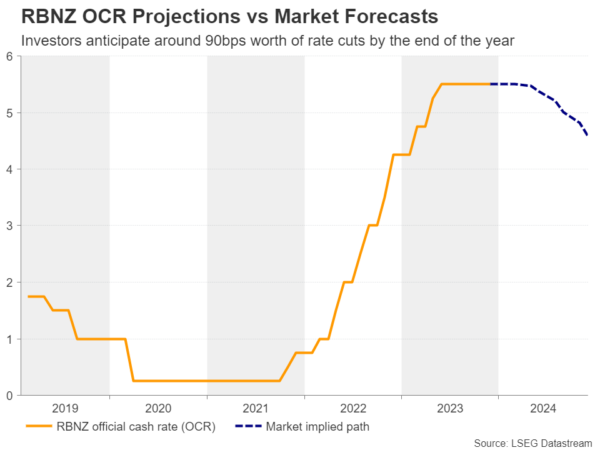

At its November gathering, the RBNZ held its official cash rate (OCR) steady at 5.5% and noted that inflation remains too high and that if price pressures were to become stronger than anticipated, interest rates would likely need to rise further. Officials also lifted their OCR projections to signal a decent chance for another 25bps hike before this tightening crusade ends.

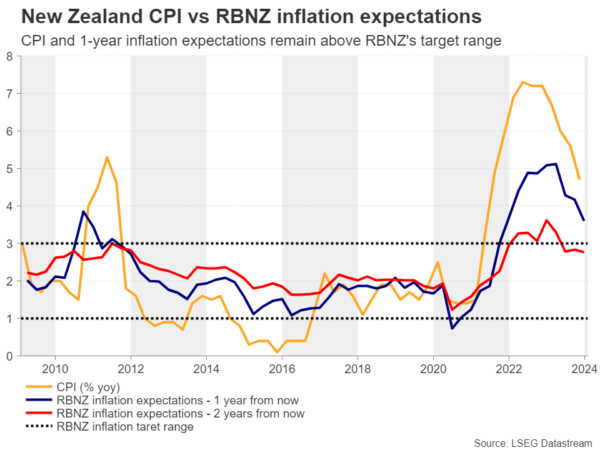

Data since then revealed that New Zealand’s economy unexpectedly contracted by 0.3% q/q in Q3, while the growth rate for Q2 was revised notably down to 0.5% from 0.9%. On top of that, headline inflation slowed to 4.7% y/y in Q4 from 5.6%, with the core standardized rate also sliding to 4.7% y/y from 5.0%. One-year inflation expectations have also been coming down at a relatively fast pace.

Taking that into account, investors don’t believe that higher rates are on the table anymore. On the contrary, they are anticipating around 90bps worth of rate reductions by the end of the year, with a quarter-point cut more-than-fully priced in for July.

Governor Orr says jobs data to impact next decision

Nearly three weeks after the GDP data were out, RBNZ Governor Andrian Orr told parliament that surprisingly weak Q3 economic data was a “complex situation,” adding that although interest rates continue to constrain spending, the Bank remains wary of inflationary surprises. He noted that the Bank was analyzing the data but other key data points before the February meeting, including employment, would also impact the decision.

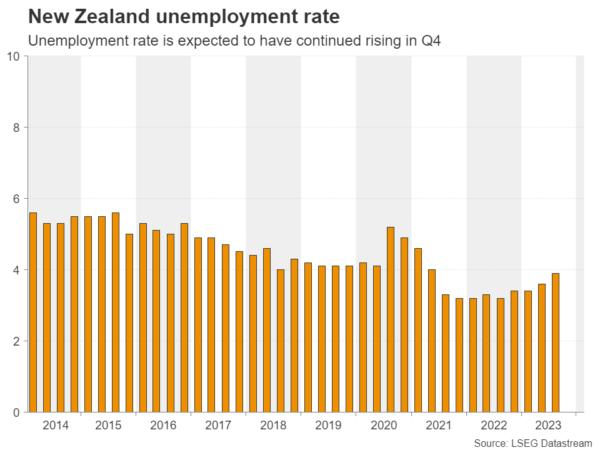

This likely adds an extra degree of importance to next week’s jobs report for Q4 due out late on Tuesday, during the early Asian session Wednesday. The unemployment rate is forecast to have continued rising to 4.3% from 3.9%, while the labor cost index is seen slowing to 3.7% y/y from 4.1%, which could raise speculation that inflation may continue cooling.

Such numbers may confirm the market’s view that the RBNZ will be forced to lower borrowing costs at some point this year, although shifting from a hiking bias to immediately signaling rate reductions may not be the case at the February gathering.

China also a big variable in the kiwi equation

What’s more, apart from domestic data, the kiwi seems to be sensitive to developments surrounding China, as the world’s second-largest economy is New Zealand’s main trading partner. On Friday, China’s Shanghai Composite fell further, logging its worst week in five years as concerns about the property sector after Evergrande was ordered to be liquidated overshadowed earlier optimism sparked by the nation’s announcement of measures to stabilize the market. Thus, those concerns could continue weighing on the kiwi.

Are kiwi bears waiting behind the bushes?

Kiwi/dollar has staged a decent recovery lately, after hitting support at 0.6060 on January 23 and now looks to be headed towards the 0.6170 resistance zone. That said, the pair remains below the prior uptrend line drawn from the low of October 26, which means that the bears may still be willing to jump into the action.

If they do so from near the 0.6170 barrier, they may feel confident to drive the action back down to the 0.6060 zone, the break of which would confirm a lower low and perhaps carry extensions towards the round number of 0.6000, which offered support on November 22 and resistance on November 6. For the outlook to turn positive, the pair may need to climb all the way above the 0.6275 zone, which acted as resistance between January 3 and 12.