- Preliminary CPI inflation to slow down in January

- Investors to stick to their rate cut projections as GDP stagnates

- FOMC policy announcement might have a bigger impact on EURUSD

Eurozone economy avoids recession but not Germany

It’s not a secret that the Eurozone has been lagging the US economy for more than a decade, but the gap widened significantly in 2023 when the former started to move in the wrong direction in the face of post-pandemic inflation pressures, high interest rates and heightened geopolitical tensions in Ukraine and the Middle East. On the other hand, the US economic engine managed to finish the year on a positive note despite elevated interest rates and persistent inflation, marking a 3.3% growth in the last quarter of the year.

On Tuesday, Eurozone’s preliminary Q4 GDP growth figures showed zero quarterly expansion after a -0.1% contraction in Q3 and a slight annual pickup of 0.1%. While the whole bloc managed to escape a mild technical recession again, with Spain and Portugal marking the highest growth among member states, Germany, which is the industrial powerhouse, continued to shrink for the fourth consecutive quarter, ending 2023 weaker by -0.3% q/q.

The biggest Eurozone economy has been in the doldrums as its export-oriented and energy-sensitive business model has been suffering from slowing exports to China, stricter climate rules, high energy costs, and tighter financial conditions. Besides, while the switch from Russian gas to American LNGs was the fastest solution to protect the Eurozone’s business activities, its energy security is still out of its control and depends on external factors miles away.

Flash CPI inflation next in the agenda

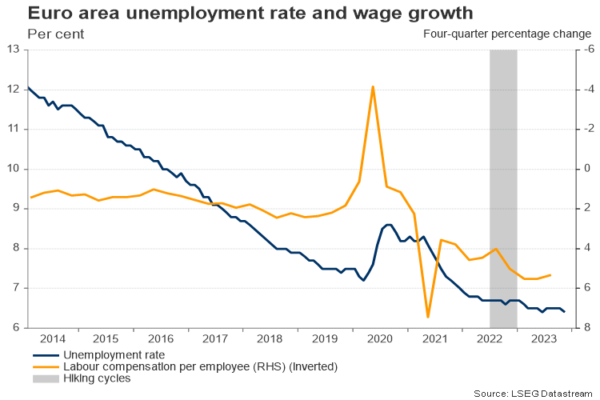

Nevertheless, the euro gained some positive traction against its major peers and especially against the British pound following the GDP release. But for a continuation higher, flash CPI inflation figures due on Thursday will have to reduce the odds for a rate cut in April. Theoretically cheaper borrowing costs would boost economic activity, though according to the labor statistics, the unemployment rate is still at historic lows, suggesting that money keeps circulating through consumers. Hence, cutting interest rates could provide more bargaining power to households, consequently reheating inflation pressures.

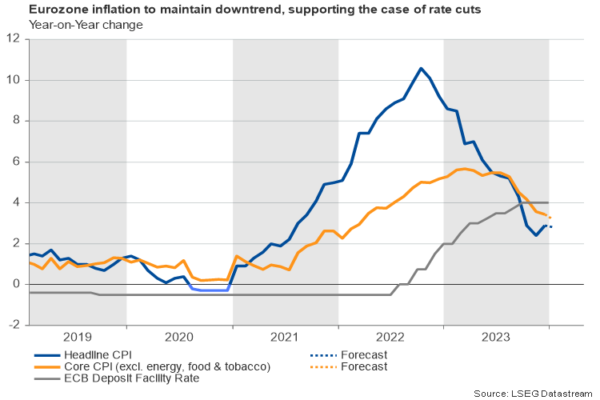

Economic growth is not a priority for the European Central Bank, but inflation is. Wednesday’s flash CPI inflation figures are expected to show a slightly softer increase of 2.8% y/y in January versus 2.9% in December. The core measure, which excludes energy, food, alcohol and tobacco, could ease to 3.2% y/y from 3.4% previously, suggesting that some patience might be needed before policymakers become confident that inflation is sustainably moving towards the 2.0% target.

Upside risks to inflation

The ECB held interest rates unchanged in its first meeting of the year and chief Christine Lagarde tried to play down expectations for a rate cut as soon as in March last week, saying that such an action would be premature given the conflicts in the Red Sea and the implications on shipping costs and deliveries.

The impact of labor shortages and wages on inflation seems to be another puzzle for the central bank. Negotiations for higher payrolls could still force businesses to transfer increased labor costs to consumers. Yet, ECB members may not get new wage data before April’s gathering, and hence June’s meeting could be the right time to decide whether rate cuts are necessary. Of course, if inflation starts to fall more aggressively than expected and financial conditions deteriorate, the central bank will not wait that long to slash borrowing costs.

How will EUR/USD react?

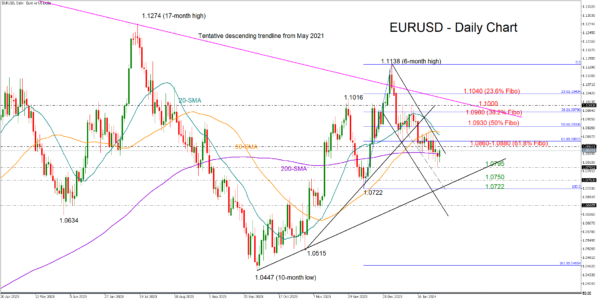

In any case, investors have not locked their rate projections for March and April yet, and any data surprises could still affect their outlook, even though the ECB showed a preference for a summer rate cut. Softer-than-expected inflation prints could press EUR/USD towards the 1.0795 support zone. Significant downside pressures could emerge a day earlier on Wednesday if the Fed delays rate cut signals. In this case, the price could sink towards December’s support zone of 1.0722-1.0750.

For the bulls to regain power, the pair will have to accelerate above the bearish channel at 1.0860 and beyond the 1.0880 resistance territory. The 20- and 50-day simple moving averages (SMAs) and the previous high of 1.0930 might be tested on the way up to 1.0980, especially if the Fed provides more details about when the first rate cut will take place.