- US employment data will hit the markets on Friday at 13:30 GMT

- Another solid jobs report expected, supported by early indicators

- If so, dollar could receive a boost as investors unwind rate cut bets

Dollar shines in early 2024

It’s been a phenomenal start to 2024 for the US dollar, which has already risen more than 2% against a basket of major currencies as a streak of encouraging economic data reinstilled confidence in the US economy, forcing traders to dial back bets of immediate Fed rate cuts.

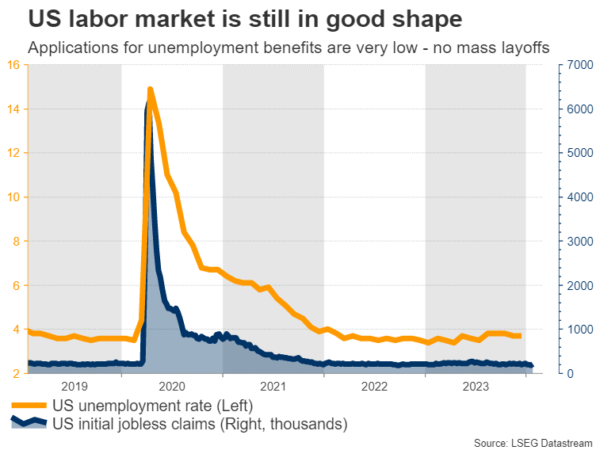

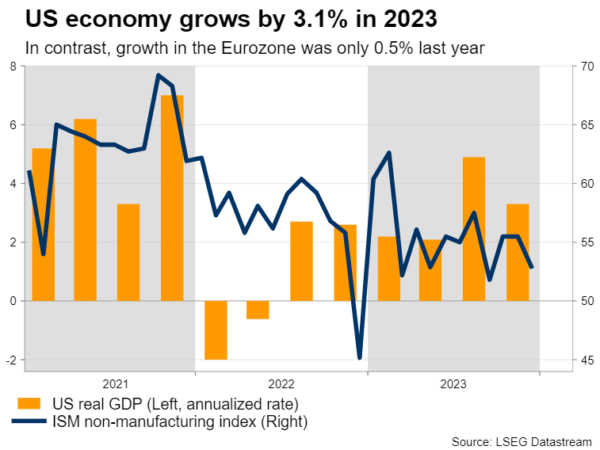

Economic growth has been faster than expected, empowered by strong consumption trends and heavy government spending. With the labor market also in good shape, it is becoming clearer that there’s no urgency to slash interest rates. Inflation has been cooling off, but is still far too high for the Fed to declare victory.

In this light, market participants have started to scale back bets around how quickly and how deeply the Fed will cut rates this year. The prospect of a rate cut in March is now priced as a 50-50 coin toss, which puts even more emphasis on incoming data to decide whether the Fed will pull the trigger or not.

Labor market still tight

Turning to the upcoming data releases, the ball will get rolling on Wednesday with the private ADP employment report for January alongside the employment cost index for Q4, which measures wage growth.

On the same day, Fed officials will deliver their interest rate decision. A full preview of this event can be found here. Expectations of any policy changes are low, so investors will focus mostly on the commentary by Chairman Powell about whether rate cuts are on the horizon. The ISM manufacturing survey for January will follow on Thursday.

Then on Friday, the spotlight will fall on the latest employment report. Nonfarm payrolls are projected to have risen by 180k in January, slightly less than the 216k recorded in the previous month but still a solid number overall. The unemployment rate is forecast to have ticked up to 3.8%, while wage growth as measured by average hourly earnings is seen holding steady at 4.1% in yearly terms.

As for any surprises, early indicators point to another decent jobs report. Applications for unemployment benefits fell sharply in January, so there were no signs of mass layoffs in the US economy. Similarly, the number of advance layoffs filed under the WARN Act, which forces big businesses to notify workers about mass firings in the next two months, remained very low.

In the markets, an employment report that tops estimates could lead to a further unwinding of Fed rate-cut bets, which would likely benefit the dollar. Looking at the euro/dollar chart, such an outcome might push the pair lower, perhaps towards the 1.0720 support region.

On the other hand, a dataset that misses expectations could fuel the opposite reaction and propel euro/dollar higher, with the first barrier on the upside likely to be the congested 1.0870 zone.

Dollar remains attractive overall

In the bigger picture, the outlook for the dollar still appears positive. In terms of growth, the US economy is much stronger than other major regions like the Eurozone, which barely avoided falling into a technical recession last year.

Markets are currently pricing an equal amount of rate cuts in the US and Eurozone this year. However, with growth differentials clearly in favor of the US, there’s a strong possibility the Fed will cut rates at a slower pace than the European Central Bank, boosting the dollar through the interest rate channel.

One element that has prevented the dollar from appreciating significantly in this environment has been the explosive rally in stock markets, which has dampened demand for safe haven assets. That said, this dynamic cuts both ways. If the equity market loses steam or suffers a correction, it might become easier for the dollar to advance, as risk appetite deteriorates.