- BoC meets on Wednesday; decision to be announced at 14.45 GMT

- Market wants a dovish show, but BoC might not be ready for such a shift

- Loonie could find its footing again against the US dollar

Bank of Canada meets on Wednesday

The week will be dominated by central bank meetings with the first BoC gathering for 2024 coming on Wednesday. The market does not expect any significant announcements but would clearly enjoy a dovish meeting that could open the door to rate cuts down the line. The BoC is seen cutting by around four times in 2024 with the first 25bps rate move fully priced in by June 5, 2024. It is worth noting that the BoC has amended its communication procedures with the decision being published 15 minutes earlier than usual i.e. at 14.45 GMT and a press conference held, 45 minutes after the decision, at every meeting.

What has changed since early December 2023?

The December 6, 2023 gathering was a touch more dovish compared to the October 2023 meeting but far less than anticipated by certain market analysts. No press conference was hosted but both the Governor Macklem and the BoC member Gravelle were quite explicit in their post-meeting appearances that (1) the BoC wants to see a number of months of sustained downward momentum in core inflation, (2) it is too early to consider cutting rates and (3) the housing sector remains a big hurdle and plays a key role in the recently elevated inflation rates.

By examining the data flow since December, it is evident that no significant progress has been made on any front. Inflation for the month of December edged higher to a yearly increase of 3.4% with the prices subcomponent of the December Ivey PMI survey remaining north of 60. However, producer and raw material price indices continue to record negative yearly changes, thus setting the scene for possibly weaker price pressure down the line.

The housing sector remains a grave issue

On an equal footing, the housing sector remains a key input in the BoC’s deliberations. BoC member Gravelle devoted an entire speech in mid-December on the housing sector with the end-product being that the low supply of new homes is keeping shelter price inflation high and thus feeding through to national CPI.

Having said that, a central bank cannot directly affect the supply of new homes, but it could slow down the economy and reduce the demand for borrowing by keeping rates at current high levels for a considerable amount of time. That would probably be the outcome of Wednesday’s meeting i.e. no rate change and anticipation until inflation makes the BoC-desirable dip, barring a major surprise.

Quarterly projections matter

A small surprise could come at the quarterly Monetary Policy Report (MPR) and more specifically at the 2025 inflation projection. The October MPR had headline inflation dropping to 2.1% by the fourth quarter of 2025. Therefore, a downward revision to this figure would be the strongest signal yet that rate cuts are coming at some stage in 2024.

In addition, any BoC comments on the developments in the Middle East with its oil prices implication, could upset the market. A price war would be particularly bad for the oil-rich Canada but to a certain extent it might not displease the BoC, as lower growth would cool inflation, provided of course that such an event proves short-lived.

Could the loonie reverse its underperformance against the US dollar?

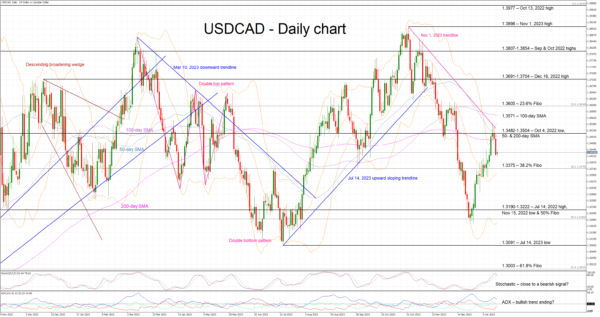

The aggressive correction recorded during the November-December 2023 period is a distant memory as in the past 20 days the US dollar has managed to rally around 2.5% against the loonie. It is currently trading below a busy area which is populated by the 50- and 200-day simple moving averages (SMAs).

A hawkish show on Wednesday could allow the loonie bulls to regain the market reins and aim for the next key support area at the 38.2% Fibonacci retracement of the April 5, 2022 – October 13, 2022 uptrend at 1.3375. On the flip side, should the BoC decide to make a dovish turn, then the US dollar-loonie pair could finally manage to overcome the busy 1.3482-1.3504 area.