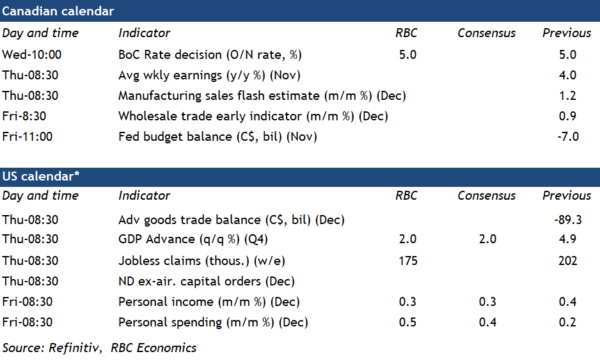

The Bank of Canada is widely expected to hold the overnight rate steady at 5% in the first policy decision of 2024 – extending a pause that started following the last hike in July. The statement and press conference that follows will be watched closely for hints about how much longer the central bank expects to hold interest rates at these levels, although we expect the BoC to push back against the idea that a shift to interest rate cuts is coming soon. There is some potential that the central bank could hint at an earlier-than-expected end to quantitative tightening policy but would likely take pains to communicate the primary objective of that change would be to ensure adequate liquidity in funding markets rather than flagging a shift to easier monetary policy and imminent rate cuts.

In terms of the actual setting of monetary policy, economic developments have been soft enough to reinforce that further interest rate hikes won’t be needed, but inflation (and wage growth) have also been too sticky to push the BoC to consider starting an easing cycle yet. Consumer prices rose 3.2% year-over-year in Q4, slightly below the 3.3% increase that was last projected by the central bank in October. But the details in the December inflation report – including a reacceleration in the closely-watched 3-month average increase in the BoC’s preferred core measures to the 3.5% to 4% range – was a reminder that inflation is not yet fully back under control.

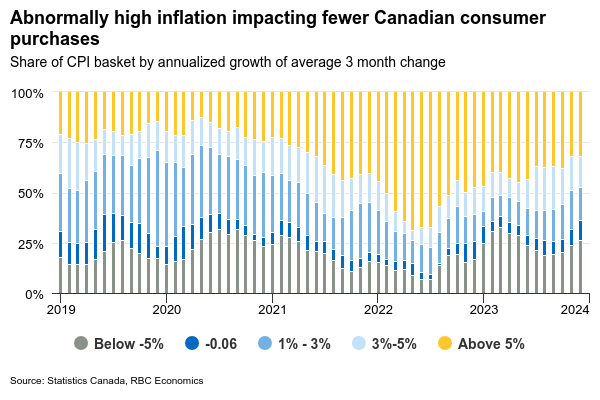

The most likely trajectory for inflation going forward is still lower. Although the BoC’s preferred core measures looked worse in December, the share of the consumer price basket seeing unusually high inflation over the last three months continued to shrink. And a disproportionate share of price growth overall is coming from a surge in mortgage interest costs that is a direct result of earlier interest rate increases. An increasingly soft economic backdrop underpinned by slowing consumer demand, declining per-capita GDP, and higher unemployment offers good reasons to expect the broader downtrend in inflation readings to persist. Total hours worked contracted in Q4 for the first time since Q2 2020, flagging downside risk to the BoC’s prior forecast for a 0.8% Q4 GDP gain. But the BoC will be cautious about declaring victory over inflation too soon. We expect the first decrease in the overnight rate to come around the middle of this year, and for that to be followed by 75 bps more later in the year to lower the overnight rate to 4% by the end of 2024.

Week ahead data watch

U.S. consumer spending (nominal) likely edged up 0.5% in December, given stronger retail sales increase during that month. Wage growth bounced back by 0.4% in December, and we expect the personal income (+0.3%) to go up as well.

We are currently tracking 2% annualized increase for U.S. GDP in Q4 2023, supported by a robust gain in consumer spending. Residential investment likely continued to grow on higher housing starts, albeit at a slower rate than in the prior quarter.

November SEPH report will be watched closely for further softening in the labour demand in Canada -we expect the level of job openings to continue to decline.