U.S. Highlights

- An upside inflation surprise didn’t do much to move markets, as the details of the report fell in line with expectations.

- The focus remains firmly on the services sector, where housing costs continue to prop up price growth.

- Looking forward, the Fed will need to see more consistent evidence of disinflation – likely delaying any policy changes to mid-year.

Canadian Highlights

- The week’s limited economic calendar was centered around merchandise trade, where the surplus extended into the fourth consecutive quarter. We expect trade to be a positive contribution to real GDP in Q4.

- Likewise, consumer spending is tracking stronger than previously expected, with recent readings of TD spend data showing a notable contribution from both goods and services. We expect this uptick in spending to be short-lived.

- Next week we’ll get critical insights from consumer and business surveys, CPI, housing markets and retail sales. These updates will help the BoC fine tune its communication strategy ahead of delivering its first rate cut in the spring of 2024.

U.S. – The Long and Bumpy Road

Taming inflation is never easy, and usually proceeds in fits and starts. So, given the experience of the past year, this week’s hotter-than-expected print to consumer price index (CPI) inflation doesn’t come as all that much of a surprise. Indeed, the details of the report left room for optimism and meant that markets brushed off the surprise – leaving ten-year U.S. treasury yields virtually unchanged on the news. The positive developments under the hood (so to speak) fell in line with consensus expectations and meant that the focus could be kept firmly on the timing of possible Fed cuts.

Headline CPI inflation rose 0.3% month-on-month (m/m), taking the annual reading for December to 3.4%. While the print did exceed market expectations, it was the more closely watched core measure that drove the muted market response. The price index excluding food and energy matched the headline gain at +0.3% m/m – a pace it has logged in four of the past five months. This is the interesting bit, on a three-month annualized basis core CPI inflation is running at 3.3%, roughly unchanged since October and still clear of the Fed’s target.

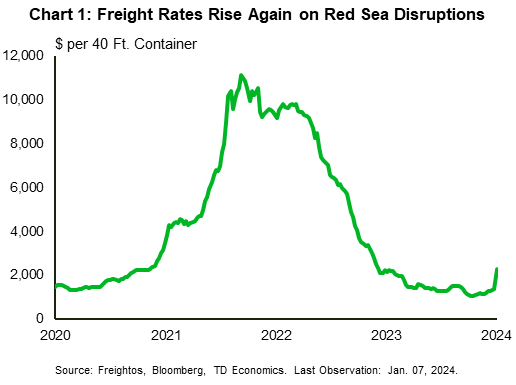

The stickiness in the core measure is slightly concerning, particularly as core goods prices remained flat, snapping a six-month run of price declines. Moreover, there is some near-term upside risk to goods prices as attacks on ships in the Red Sea affecting access to the Suez Canal have lead to a jump in freight costs (Chart 1). Despite this, what the pause in goods price deflation laid bare was the ongoing strength in services price gains.

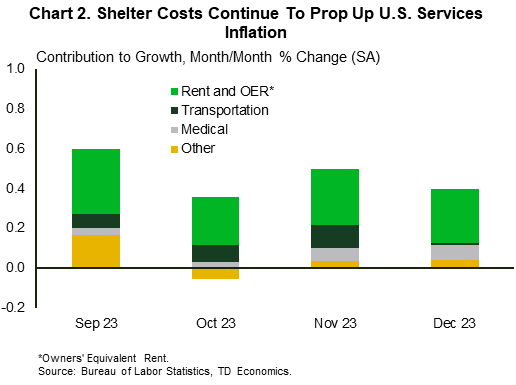

Core services prices were up 0.4% m/m in December. Moreover, the strong price gains have been persistent, with the three-month and six-month (annualized) rates of core services inflation at 5.1% and 5.2%, respectively. Yet, while these figures are significantly higher than the Fed would feel comfortable with, there are reasons to believe conditions are improving. Currently, the largest contributing factor to services inflation is the shelter component (Chart 2). On this front relief is expected as increases in observed rents (which tend to lead the measure in the CPI report) have moderated sharply in recent months – a dynamic that is still gradually working through to the shelter component of CPI. Moreover, the slowdown in home price appreciation through early-2023 also continues to gradually work its way into the CPI.

The return to two percent inflation continues to be bumpy, but progress has been tangible and signs suggest that the Fed continues to be on course. After a few months of solid progress, optimism had begun to emerge that cuts might come sooner rather than later. However, price pressures remain sticky, and the economy continues to outperform. December job growth was above trend, and the Atlanta Fed Nowcast is expecting GDP growth of over 2% (annualized) in the fourth quarter or 2023.

A packed slate of Fed speakers is on tap for next week, and should hopefully give some additional insight into how they view the recent data. However, given this week’s developments, it will likely be mid-year before officials have sufficient evidence that they can begin loosening their policy stance.

Canada – A Week of Economic Stillness

As January progresses, the Canadian economy sails through a period of relative stillness. In the world of finance, markets took cues from oil price movements and economic developments south of the border. Equity markets exhibited slight volatility, closing the week with modest gains, while bond markets were fairly steady, with the 5-year yield hovering around 3.3%.

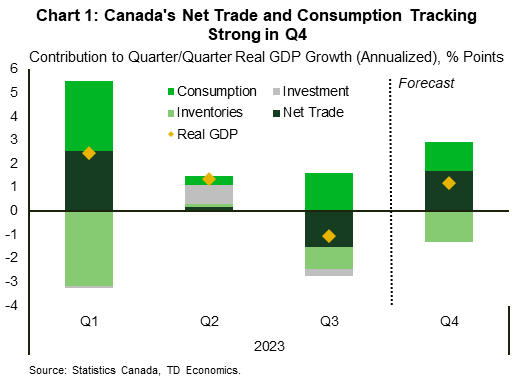

The week’s limited economic calendar was centered around merchandise trade, where the surplus extended into the fourth consecutive quarter, narrowing from $3.2 billion in October to $1.6 billion in November. The decline in exports, stemming from short-term factors in aircraft and other transportation equipment exports, highlights the volatile nature of international trade. On the import front, a robust increase points to remnants of domestic demand, particularly notable in the energy sector. With two months of data under the belt, our tracking points to trade’s positive contribution to real GDP in Q4 (Chart 1).

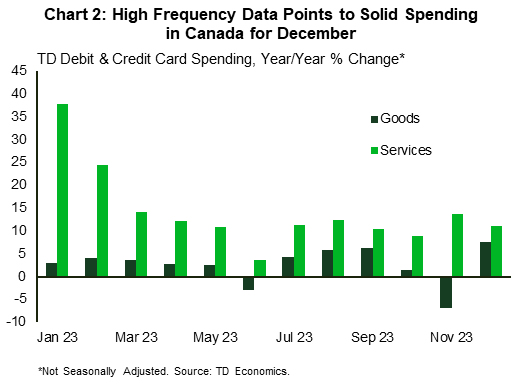

Some evidence of domestic demand presented itself in our TD’s most recent debit and credit card data. December data indicates that consumer spending was up 6.2% year-on-year and largely driven by spending on services (Chart 2). Last month’s notable uptick in goods spending was largely concentrated in clothing and general merchandise stores. This could reflect a strategic shift by consumers towards last-minute holiday shopping, possibly in search of attractive deals. All in all, high-frequency data points to a stronger than previously expected contribution from consumer spending in the last quarter of 2023 (Chart 1). This uptick is likely to be short-lived, however, as consumers will return to more cautious spending behaviour in the first half of 2024 (see forecast).

Consumers’ quest for value may pose a challenge for the Bank of Canada (see report). As the central bank contemplates the path of rate cuts in the forthcoming year, it finds itself in a delicate dance, navigating the dual pressures of an economy not yet at its inflation target and the potential for rate cuts to rekindle inflationary forces. This is particularly pertinent in the housing sector, where lower rates could breathe new life into home prices. In Canada, households are more prone to anchoring their inflation expectations to home prices, so a premature easing in financial conditions that fuels shelter price pressures could amplify household inflation expectations, impeding the Bank’s efforts to restore its credibility.

Incidentally, next week we’ll get updates on Q4 Canadian Survey of Consumer Expectations together with a parallel Business Outlook Survey and the inflation data (CPI) for December. These releases will provide critical insights to help the BoC attune its communication strategy to help strike the right balance between exerting too much pressure on the economy and stoking inflationary pressures. In addition, December data on housing will shed light on recent changes in home prices, while retail sales will give a sense of consumer spending in November.