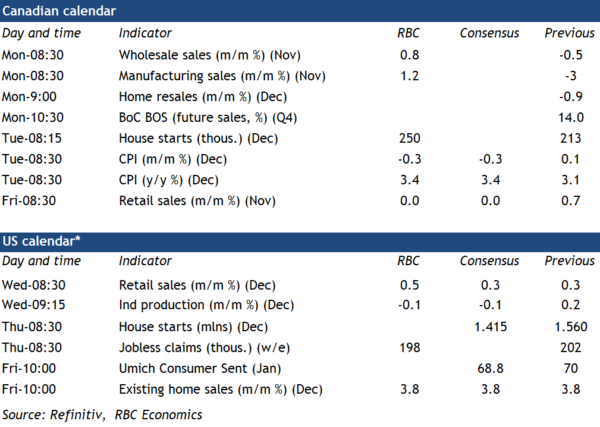

December inflation numbers and the Bank of Canada’s own business and consumer surveys will headline a slew of Canadian indicators ahead of the central bank’s next interest rate decision later this month. Canadian headline CPI growth is expected to tick slightly higher (+3.4% year-over-year) from November’s 3.1% increase, but with the gain largely coming from energy price ‘base-effects’ as a large drop in gasoline prices a year ago falls out of the year-over-year growth calculation.

Food price growth likely slowed again and broader measures of inflation pressures have eased in recent months with the bulk of remaining upward price growth coming from surging mortgage interest costs due to higher interest rates. Year-over-year growth in the BoC’s preferred median and trim ‘core’ CPI measures should be little changed in December, and the more recent three-month annualized growth rate that the central bank has been watching is more likely to tick a touch higher (from 2.3% and 2.6%, respectively, growth rates in November.) Still, the breadth and magnitude of inflation have continued to edge lower on balance. Growth in mortgage interest costs is accounting for roughly a third of total price growth excluding food and energy products. The BoC will continue to look through price growth from that component because the increase is a direct result of earlier interest rate hikes, and price increases excluding that component have been running within the 1% to 3% inflation target range.

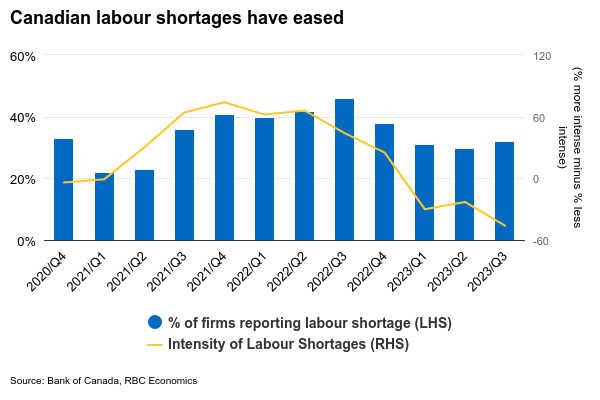

The BoC will also be watching their own Business Outlook Survey and accompanying consumer expectations survey for signs that the slowing in inflation numbers will persist in the future. Canadian business optimism about the future outlook may have ticked higher with growing expectations that the BoC is set to start easing off the monetary policy brakes later in 2024. But the policymakers will be watching for further signs that businesses are reverting back towards pre-pandemic pricing behaviour (smaller and less frequent planned price changes) and that easing in labour shortages is cooling expected wage growth.

Week ahead data watch

Statcan’s preliminary estimate for November manufacturing sales was up 1.2% on higher chemical, transportation equipment, and primary metal sales.

The advance estimate of Canadian retail sales in November was flat after a 0.7% uptick in October. Our own RBC cardholder data suggests purchases of physical merchandise (excluding motor vehicles) are tracking higher in Q4 as a whole, but December marked a slowdown in both discretionary goods and services spending.

Housing starts are expected to come in slightly stronger in December at 250K relative to November’s 213K, but still below the 3-month rolling average level of permit issuance (at 268K).

U.S. retail sales likely ticked higher in December (+0.5% month-over-month), with slightly stronger growth than November (+0.3%) thanks to strong unit auto sales and higher gasoline prices.

U.S. industrial production likely fell 0.1% in December, as manufacturing hours worked slid lower (-0.2%). Utilities output was 1.4% lower on warmer-than-usual winter weather, lowering heating demand and driving energy consumption down slightly.