Summary

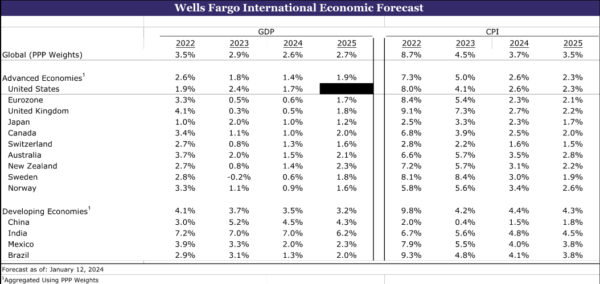

The continued resilience in U.S. activity has prompted a significant shift in our outlook for the U.S. economy. Our U.S. economics colleagues now believe the U.S. economy will avoid recession, achieve a “soft landing”, and experience continued expansion through 2025. This more resilient outlook for U.S. growth has implications for our global economic outlook. Stronger U.S. growth should allow the Eurozone and United Kingdom to recover more quickly from recession conditions, and given extensive trade linkages, should also offer support to activity in Canada and Mexico. Overall, we now see a more mild slowdown in global GDP growth from 2.9% in 2023 to 2.6% in 2024. Amid a firmer global growth backdrop, we also believe select central banks will adopt a more gradual approach to lowering interest rates. For the European Central Bank, Bank of England, Bank of Canada and Bank of Mexico, we expect rate cuts to now proceed at a more measured pace, with policy interest rates not leveling out until the second half of 2025.

U.S. Resilience to Cushion the Global Economic Slowdown

The continued resilience in U.S. activity has prompted a significant shift in our outlook for the U.S. economy. Even amid an aggressive monetary tightening campaign that saw the Fed’s policy rate increase by a cumulative 525 bps over the past couple of years, ongoing employment gains and a sharp deceleration in inflation have seen real household disposable income growth return to positive territory. Expectations of Fed monetary easing and a relaxation of financial conditions are also exerting less restraint on activity and the U.S. economy. As a result, while still acknowledging that risk of a downturn exists, we now believe the most likely outcome is for the U.S. economy to continue growing through the end of 2025 and achieve the hoped for “soft landing.” We now forecast U.S. GDP growth of 1.7% for calendar 2024 (previously 0.9%) and 1.7% for calendar 2025 (previously 1.5%).

This more-resilient outlook for U.S. growth has implications for our global economic outlook. To be sure, Europe’s economic environment will likely remain challenging for the time being. For key economies such as the Eurozone and United Kingdom, the previous spike in inflation and subsequent central bank monetary policy tightening means we still believe those economies experienced mild technical recessions during the second half of 2023. Still, with U.S. activity helping underpin global demand, we believe the Eurozone and United Kingdom economies can recover more quickly in 2024. While still far from robust, we have revised our 2024 GDP growth forecasts modestly higher to 0.6% for the Eurozone and 0.5% for the United Kingdom. For Canada and Mexico, both economies have very significant trade linkages with the United States. The U.S. represents the end destination for 70% or more of overall merchandise exports from both countries. As a result, a firmer outlook for the U.S. should also mean better growth prospects in Canada and Mexico, prompting us to lift our 2024 GDP growth forecasts for Canada and Mexico to 1.0% and 2.0% respectively. However, not all countries will necessarily benefit from more resilient U.S. economic trends. In China, for example, we believe structural headwinds such as a declining working age population and a highly leveraged property sector will continue to restrain overall economic growth. Despite a U.S. soft landing, we have maintained our China GDP growth forecast for 2024 at 4.5%.

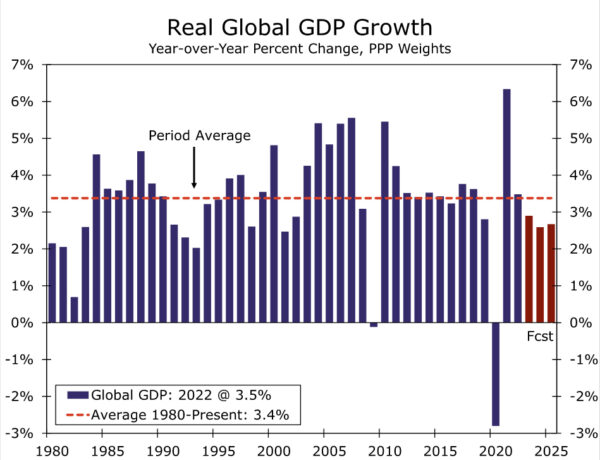

Altogether, a U.S. soft landing should moderate the extent of the global economic slowdown this year. We now forecast a milder global economic slowdown and believe the global economy can experience growth of 2.6% in 2024 relative to our previous forecast of 2.4% (Figure 1).

More Gradual Monetary Policy Easing From Major Central Banks

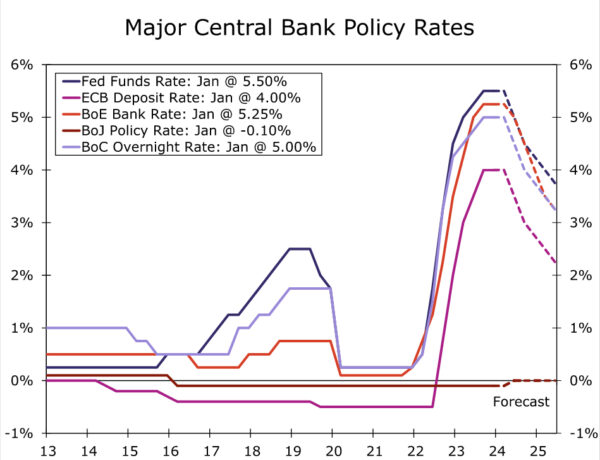

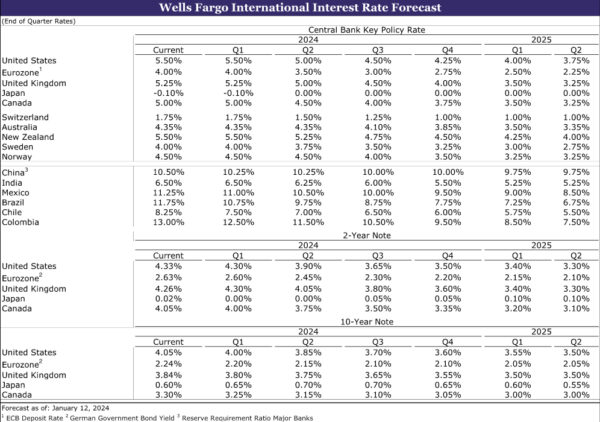

Amid a backdrop of firmer growth prospects, we also believe key central banks will adopt a more gradual approach to lowering interest rates. In the case of the Federal Reserve, we forecast the FOMC will cut rates by 125 bps by the end of 2024, commencing with a 25 bps reduction at the May meeting. That cumulative rate decline in 2024 is less than we forecast last month. A gradual and steady approach from the Federal Reserve means monetary easing will likely continue through much of the following year as well. Altogether, we look for a total of 225 bps of Fed rate cuts, which would put the target for the fed funds rate at 3.00%-3.25% by the end of 2025 (Figure 2).

For the European Central Bank (ECB), we still expect soft growth and an improving inflation outlook will see the ECB deliver an initial rate cut in April, initially proceeding at a 25 bps per meeting clip. As Eurozone growth recovers, we expect the ECB to downshift to 25 bps per quarter from Q4-2024, and not reach a terminal policy rate of 2.00% until the second half of 2025. For the United Kingdom, with inflation still elevated, we forecast Bank of England (BoE) rate cuts to begin slightly later than the ECB, at the BoE’s June meeting. Given a moderately stronger U.K. growth outlook, we no longer see an accelerated pace of BoE rate cuts, but rather anticipate rate cuts continuing at a steady 25 bps per meeting clip until well into 2025. Given this backdrop, we do not see the Bank of England’s policy rate reaching 3.00% until the second half of next year. Turning to Canada, given the progress to date in reducing inflation, we forecast the Bank of Canada (BoC) to deliver an initial rate cut in April and proceed at a 25 bps per meeting pace. However, with steadier Canadian growth, we see the Bank of Canada slowing to 25 bps per quarter from Q4-2024 and not reaching a terminal policy rate of 3.00% until the second half of 2025. Finally, we still forecast an initial Bank of Mexico rate cut in March, but expect Mexico’s central bank to proceed only in 25 bps rate cut increments thereafter. To that point, Banxico policymakers will not reach a policy rate of 8.25% until the second half of next year.

A U.S soft landing also has implications for our 2024 U.S. dollar outlook. As of now, we still anticipate depreciation in the U.S. dollar in 2024 as the Federal Reserve lowers interest rates. In addition, we believe a relatively more optimistic global growth outlook can potentially lead to a loss of “safe-haven” support for the greenback. Lower interest rates and lesser demand for the “safe-haven” characteristics of the U.S. dollar can lead to broad-based greenback depreciation against both G10 and EM currencies this year. However, given a firmer outlook for U.S. economic growth and a slower pace of Fed easing than previously envisaged, the magnitude of U.S. dollar depreciation could be less than we previously expected. We will provide a full set of FX forecasts in our January International Economic Outlook, but given our revised view on the U.S. and global growth outlook, as well as evolving views on monetary policy in key economies, the dollar could also experience a “soft landing” of its own.

Global Forecast Tables