- BoE highlights “higher for longer” message in December

- Yet, investors are penciling in aggressive rate reductions

- CPI inflation data for December could well impact that view

- The numbers are scheduled for Wednesday at 07:00 GMT

Investors don’t pay attention to BoE’s signals

At its December policy gathering, the Bank of England kept interest rates unchanged via a 6-3 vote, with the three dissenters preferring to increase the Bank rate by another 25bps to 5.5%. In the accompanying statement it was noted that policy “will need to be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term,” with Governor Bailey highlighting that view at the press conference following the decision.

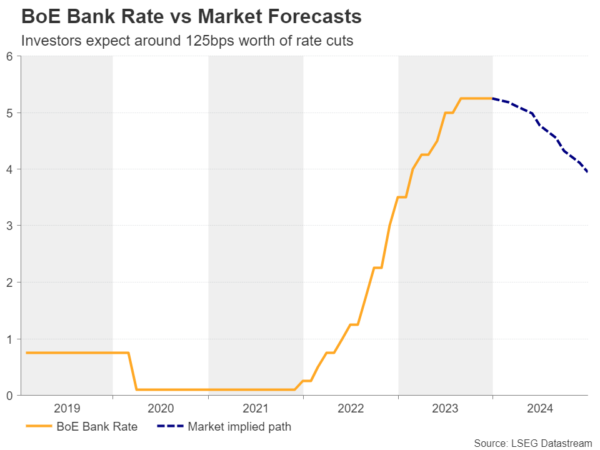

Yet, investors are penciling in around 125bps worth of rate reductions for this year, assigning an 80% probability for the first quarter-point reduction to be delivered in May. Perhaps they were concerned about the state of the UK economy after the quarterly GDP rate for Q3 was revised down to -0.1% and the October monthly print revealed a contraction of -0.3%, thereby ringing the recession alarm bells.

That said, even with the November data pointing to a 0.3% m/m rebound and the NIESR tracker forecasting GDP to remain flat in the fourth quarter, in other words avoiding a recession, investors stubbornly are maintaining their rate cut bets. Perhaps they believe that the BoE may be forced to agree with them after the Oxford Economics consultancy and analysts at Investec and Deutsche Bank forecasted that UK inflation will fall below 2% by April. The BoE’s November projections suggested that CPI inflation will return to the target by the end of 2025.

Upside risks surround December CPI data

With all that in mind, pound traders may now lock their gaze on next week’s CPI numbers for December, due out on Wednesday. The employment report for November, due out the previous day, may also attract attention as average weekly earnings could provide a glimpse of where inflation may be headed in the months to come. The UK retail sales are scheduled to be released on Friday.

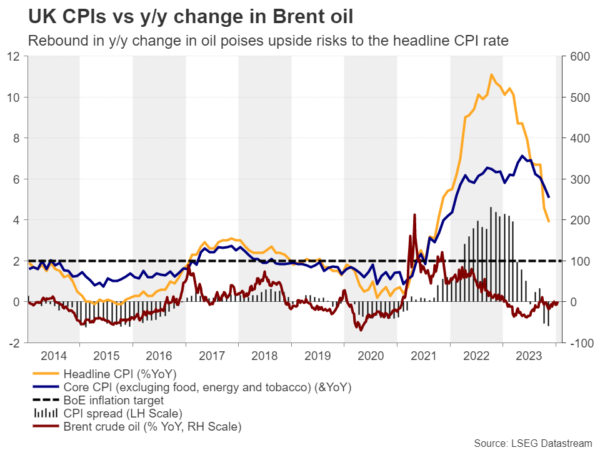

Although the manufacturing PMI showed that selling prices rose only slightly in December, the services survey revealed that input cost inflation accelerated to a three-month high, contributing to the fastest rise in prices charged since July. With the service sector accounting for around 80% of the total UK economic output, there are risks of a reacceleration in Wednesday’s data. And if the core CPI rate rebounds, the headline rate may rise by more as the 2022 downtrend in oil prices is dropped out of the y/y calculation, pushing the yearly change of oil from negative close to zero.

Will the pound extend its prevailing uptrend?

Combined with signs that the UK economy may have once again dodged a recession, accelerating inflation may eventually convince market participants to push back their BoE rate cut bets, thereby allowing the pound to extend its latest recovery and perhaps its prevailing near-term uptrend.

From a technical standpoint, pound/dollar has been in a recovery mode since January 3, with the pair remaining above the uptrend line drawn from the low of November 1, as well as above both the 50- and 200-day exponential moving averages.

Accelerating UK inflation may push the pair higher, with a clear close above the key resistance zone of 1.2800 signaling the resumption of the prevailing uptrend. Such a break may encourage the bulls to climb all the way up to the peak of July 27 at 1.2995.

Now, in case the CPI figures miss their estimates, the pair may slide and even fall below the aforementioned uptrend line, but for a near-term reversal to start being discussed, a fall below 1.2600 may be needed.