- Oil prices remain under pressure despite Middle East crisis

- Risk of another supply war between US and OPEC is rising

- Outlook for oil seems negative as supply outpaces demand

Oil unable to capitalize on geopolitical tensions

Oil prices have taken a beating in recent months, falling by around 23% since late September despite a series of production cuts from the OPEC+ cartel that were meant to reduce supply and stabilize prices. Concerns that the Israel-Hamas war could spiral into a regional conflict that impacts supply have also done little to support prices.

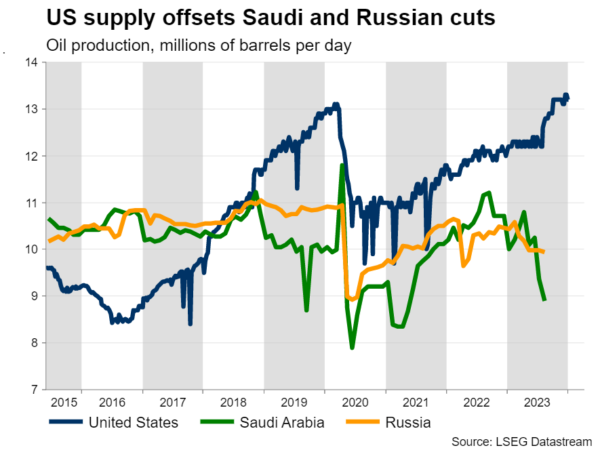

That’s mostly because oil supply has not fallen on a global level. While OPEC+ has taken repeated steps to decrease its production, foreign producers like the United States have raised their own output, countering those efforts.

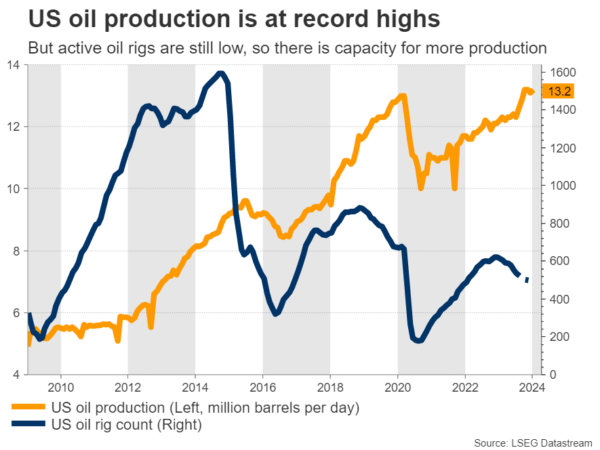

Crude production in the US is currently at a record high of 13.2 million barrels a day and has the capacity to rise much further, as the number of active drilling rigs remains fairly low. Hence, OPEC may have taken some barrels out of the market, but the US has put them back in, which explains why investors have paid no attention.

Similarly, the crisis in Gaza has only sparked fears about oil supply being lost – it hasn’t actually affected physical markets. Some missile attacks against ships in the Red Sea have raised the cost of transportation, but have not taken any crude supply offline yet.

Meanwhile, the demand outlook is deteriorating. The world’s largest oil importer – China – reported an annual decline in its crude imports in November, as the economy grapples with a painful slowdown in its manufacturing and construction sectors. Reflecting this shift, the US Energy Information Administration has warned that it expects slower oil demand growth in 2024 and 2025.

Is another supply war brewing?

With US oil production at record highs and likely to keep rising, there is a clear risk of another supply war taking place, as OPEC+ attempts to defend its market share. Previous episodes of rising US production were met with aggressive increases in OPEC+ supply, which flooded the market with oil and pushed prices down so that American producers became unprofitable, forcing them to exit.

This happened twice over the past decade, in 2014 and early 2020. Both instances were characterized by a dramatic increase in global supply and a collapse in oil prices. The situation today appears eerily similar. Saudi Arabia just announced it will cut the price at which it sells crude, which is essentially a strategy to undercut foreign producers and defend its market share.

Naturally, market participants are concerned that the next step might be to raise production, abandoning the disciplined approach that OPEC has pursued in recent years. That could lead to a period of oversupply that is devastating for prices, especially if a weaker macroeconomic environment suppresses demand.

Picture is gloomy overall

All told, the outlook for oil prices seems gloomy in the coming months. The mismatch between abundant supply and lackluster demand could keep oil prices under pressure for some time, or at least stand in the way of any massive rallies.

Of course, there are some upside risks. An escalation in the Middle East that includes nations such as Lebanon or Iran joining the conflict would be bullish for oil prices. Similarly, a strong economic recovery in China could help lift demand. However, neither of these scenarios appears likely. There is little political appetite for a wider conflict in the Middle East, while China has not rolled out sufficient stimulus measures to kickstart its economy.

As such, the downside risks dominate, especially when accounting for the possibility of a ceasefire in Ukraine. Some recent reports suggest the Russians have quietly signaled they are open to such an outcome. Considering that the war has been frozen for months now and that military support for Ukraine is slowly fading, a ceasefire later this year is very plausible, with negative consequences for oil prices.

Looking at the charts, WTI crude oil has been in a steady decline over the last three months. If the drop persists, the most important region to watch on the downside is around $67.00 per barrel, an area that halted multiple selloffs last year. On the upside, buyers would need a decisive move above $76.20 to regain confidence about a potential reversal.