While dwelling and rents may still be of concern, the increase in household services prices was less than expected while many household goods are not measured in November, the month for the increasingly significant Black Friday/Cyber Monday sales.

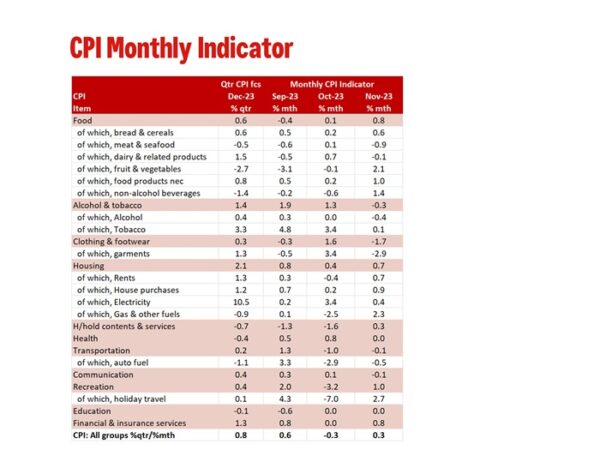

The Monthly CPI Indicator rose 4.3% in the year to November, down from 4.9%yr in October and a recent peak of 8.4%yr in December 2022. The November print was a touch softer than Westpac’s forecast and the market’s median forecast of 4.4%yr. At face value the November Monthly CPI Indicator suggests that if there are any risks to our current December quarter CPI forecast of 0.8%qtr it is very slightly to the downside.

As noted in our preview, the second month of the quarter provides us with an update for most of the quarterly surveys of household services. In this regard the overall tone for household services inflation was softer than expected outside the sizable jump in insurance premiums.

But the mid-month does not include many household goods which are surveyed in the first month of the quarter, so the November survey would have missed some of the price declines associated with the Black Friday/Cyber Monday sales.

To give you a feel for the impact of Black Friday sales, in 2022 garment prices rose 2.2% in October, fell 4.1% in November to then lifted 2.1% in December. So far this year garment prices rose 3.4% in October then fell 2.9% in November.

In the month, the Monthly CPI was up 0.3% compared to our forecast for 0.5% increase. The most significant surprises were.

- A 0.3% fall in alcohol & tobacco compared to a +0.1% forecast.

- A 1.7% fall in clothing & footwear led by a 2.9% fall in garments. The fall in garment prices would have been associated with the Black Friday sales. All other components of this group are surveyed in the first month of the quarter so their data misses the Black Friday sales. Had they been surveyed in November, the reported fall in clothing & footwear would have been larger.

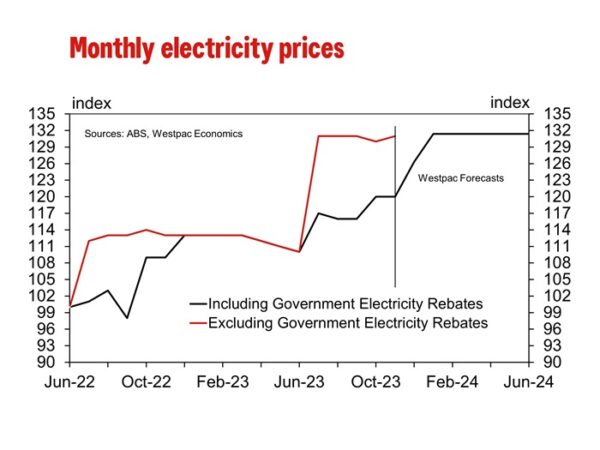

- Total housing costs rose close to expectations at 0.7%. However, the mix was a surprise. Rents rose as expected at 0.7% but dwelling prices were stronger than expected lifting 0.9% in the month, the strongest monthly increase in almost a year. Offsetting this, electricity prices rose just 0.4% (we expected a larger number due to the unwinding of government energy rebates as we did not account for the application further rebates). Gas & other fuels did jump 2.3% but this followed a 2.5% decline in October.

- Household contents & services were softer than anticipated lifting just 0.3% in the month. Outside of non-durable goods no household goods were survey this month missing the Black Friday sales. However, while hairdressing did lift 1.7% other household services prices rose just 0.5% holding back the increase in household services to just 0.7%.

- Recreation was also softer than expected at 1.0% in the month due to holiday travel, up 2.7% vs 5.1% forecast with a domestic travel lifting just 1.8% in the month following a 1.9% decline in October. In addition, other recreation, sport & culture fell 0.1% in the month with the quarterly surveys for equipment for sport & camping plus games, toys & hobbies picking up the Black Friday sales effect.

- Also, it is worth noting the 3.8% rise in insurance premiums. Insurance premiums are up 16.3% in the year. The ABS notes that higher reinsurance and natural disaster costs contributed to higher premiums for house, home contents and motor vehicle insurance.

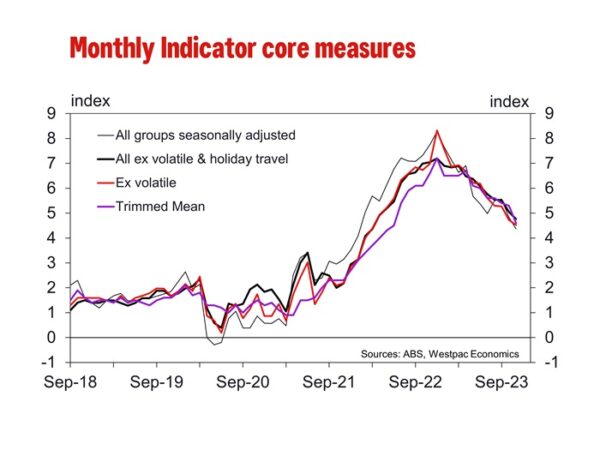

The Monthly Indicator Trimmed Mean printed 4.6%yr, down from 5.3%yr in October and well down from the recent peak of 7.2% in December 2022. The quarterly Trimmed Mean printed 5.2%yr in September and our current forecast for the December quarter is 4.4%yr. As you can see in the chart below all the monthly core annual inflation measures continued to soften in November.

We are reviewing the full data set for the Monthly CPI Indicator to see if there any implications for our December quarter CPI forecast for both headline and core inflation.