- UK GDP likely expanded in November, potentially dashing hopes for early rate cut

- But any disappointment would increase the odds of a technical recession

- Data due at 07:00 GMT, Friday, will be key to sustaining pound’s uptrend

Confounding expectations

The British pound was the second best performing major currency of 2023, ending the year with gains of 5.2% against the US dollar. Unfortunately, the pound’s bullish streak had more to do with out-of-control inflation than an exceptionally strong economy, but nevertheless, the Bank of England looks set to be one of the least dovish central banks in 2024.

On the bright side, the UK economy has been able to withstand several major headwinds far better than anyone anticipated. So although growth has been near stagnant for the past two years, it’s steered clear of a recession. But the risk of one is rising and the fourth quarter of 2023 could be when the economy succumbs to the pain of high interest rates and weak global demand and slips into recession.

On the brink of a recession

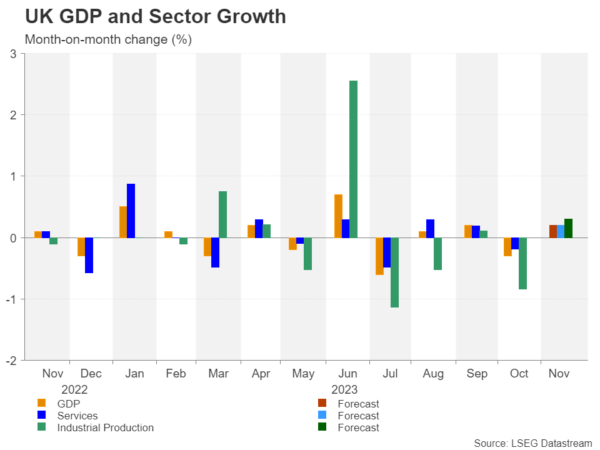

Revised data for the third quarter showed that GDP contracted by 0.1% q/q, while in the first month of the fourth quarter, output declined by 0.3% m/m. However, it appears that the economy started regaining some momentum towards the end of the year, driven primarily by a rebound in the services sector, as indicated by the S&P Global PMI surveys. Thus, the British economy may narrowly avoid a recession if the actual data follows in the PMIs’ footsteps.

Analysts expect GDP to have grown by 0.2% m/m in November. This would put the 3-month average at -0.1% so a positive figure is also needed for December to dodge a negative print for the full quarter. But it seems that the recent sharp drop in inflation combined with the BoE putting the brakes on further rate hikes have lifted optimism among UK businesses, raising hopes that GDP eked out modest growth in the final three months of 2023.

Looking at the breakdown of the GDP components, the services sector is expected to have expanded by 0.2% m/m, and manufacturing by 0.3%, while broader industrial output is forecast to have risen by 0.3%.

Can the pound stay on an uptrend?

If the economy fails to expand in November, or even contracts, there would be little chance of any pickup in December being substantial enough to turn quarterly GDP growth positive. The pound is therefore likely to come under pressure from any disappointing figures.

Having bounced off the ascending trendline only last week, cable could again test this crucial support line in such a scenario, putting strain on the $1.26 handle. A break below the trendline would turn the attention on the 50- and 200-day moving averages, which just achieved a golden cross in the $1.2540 region. A steeper selloff could see cable tumbling all the way to the historically congested $1.2375 zone.

However, if the November GDP estimate exceeds expectations, the timing of any recession is bound to be pushed back again along with that of the first rate cut. The pound could extend its latest upswing towards the December high of $1.2827. A successful break above it would quickly bring the $1.3000 mark into scope, which would then raise the prospect of cable surpassing the July peak of $1.3144.

Politics and inflation path will be key for sterling

Investors have pared back some of their dovish expectations for the Bank of England in January following a similar shift in Fed rate cut bets. Nonetheless, a 25-basis-point cut is nearly fully priced in for May, with further similar-sized reductions seen in almost all the remaining meetings of the year.

This would likely keep GBP bulls in check as cumulative rate cut bets for the Fed aren’t significantly higher, although even if UK CPI does fall in line with market expectations, looser fiscal policy domestically is one factor that could compromise the BoE’s fight against inflation.

With a general election likely to take place sometime in the second half of the year, there is speculation the ruling Conservative party will announce fresh tax cuts in the government’s March 6 budget, in addition to those announced in the Autumn Statement. But a Labour win in the election wouldn’t necessarily mean tighter fiscal policy as any reversal in tax cuts would probably be replaced by higher spending.

So to sum up, although the pound’s uptrend lost some steam at the start of the year, the risks in the medium term remain tilted to the upside.