U.S. Highlights

- Minutes from the December FOMC meeting confirmed that monetary policy was “likely at or near its peak” for this tightening cycle, but showed no meaningful discussion on rate cuts.

- The U.S. economy added a better-than-expected 216k jobs in December, but downward revisions to the prior two months kept a cooling trend intact. The unemployment rate held steady at 3.7%, while wage growth accelerated slightly.

- The ISM surveys overall signaled softness. Manufacturing remained in contractionary territory in December, albeit slightly less negative, while activity in the services sector slowed but remained in expansionary territory.

Canadian Highlights

- As the Canadian economy continues to gear down, the focus turns to when the Bank of Canada (BoC) will cut interest rates. Our view of a 25 basis-point cut at the BoC’s April rate setting date currently aligns with market expectations.

- Getting inflation back to the Bank of Canada’s 2% target remains the key consideration. We expect inflation to durably get below 3% in 2024 with a return to 2% in 2025.

- Canada’s job market is continuing to find its balance as job growth stalled in December. Meanwhile, preliminary housing market data showed surprising strength to end the year.

U.S. – Rate Cut Expectations Ease Slightly at the Start of 2024

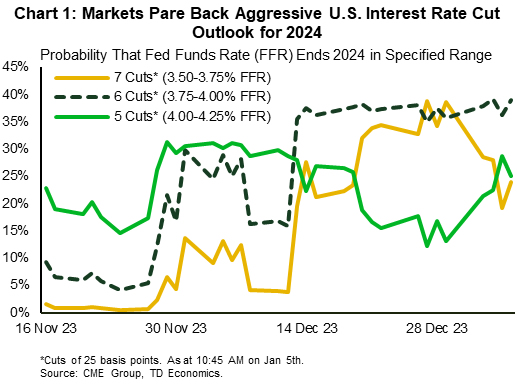

After a festive December where a sharp pullback in long-term yields sent risk assets higher, markets have gotten off to a much more sober start in 2024. Investors have seemingly adjusted their New Year’s resolutions, resulting in more moderate expectations for interest rate cuts this year. Cuts totaling 150 basis points by the end of 2024 remains the dominant scenario. The probability for more aggressive policy loosening (i.e., 7 cuts) has fallen sharply, while the probability of slightly less aggressive loosening (i.e., 5 cuts) has increased (Chart 1). In line with these developments, the 10-year Treasury yield has recouped some of the lost ground, rising from 3.8% at the end of December to near 4% recently, and equity markets have pared back year-end gains, with the S&P 500 down 1.6% from its recent peak.

The minutes from the December FOMC meeting contributed to the softening in expectations for interest rate cuts this week. After the Fed signaled that the policy rate would head lower in 2024, there was an anticipation that rate cut talk may have featured heavily at the last meeting. Committee participants confirmed that the policy rate was “likely at or near its peak for this tightening cycle”, given the reduction in inflation in 2023 and “growing signs of demand and supply coming into better balance in product and labor markets”. But, meaningful debate on rate cuts was missing. Instead, the discussion was somewhat more balanced, touching on both the risks of maintaining rates in a restrictive position for too long and the risks of prematurely easing policy. Participants noted that their outlooks were associated with an “unusually elevated” degree of uncertainty and stressed the importance of maintaining a data-dependent approach to setting monetary policy.

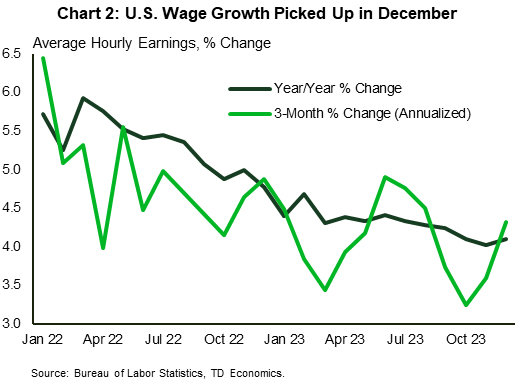

Chart 2 shows U.S. wage growth increased slightly in year-over-year terms in December, with a more meaningful acceleration recorded on a 3-month annualized basis (from 3.6% in November to 4.3% in December).

Speaking of data, this morning’s payrolls report showed that hiring unexpectedly accelerated in December, with the U.S. economy adding 216 thousand jobs. However, a downward revision of 71 thousand jobs to the prior two months limits some of the enthusiasm of this upward surprise. On a three-month moving average basis, hiring is still trending lower, which suggests that restrictive monetary policy continues to work as intended, cooling labor demand. Nonetheless, other aspects of the report still play in favor of showing some caution on easing monetary policy. The unemployment rate held steady at 3.7%. With the labor market still tight, wage growth gained some ground in December (Chart 2). A recent pullback in the job ‘quits’ rate – a leading indicator of labor costs – suggests that wage growth is nonetheless poised to cool ahead.

Other data reports were a mixed bag. Consumers increased vehicle purchases in December (up 3.2% to 15.8 million annualized), although this appears to be partially related to the return of year-end discounts. Meanwhile, the ISM indexes signaled softness. There was a slowdown in the expansion of the services side of the economy, and the manufacturing sector remained in contraction for the 14th month in row in December, albeit slightly less so on the month.

All factors considered, a loosening in monetary policy is coming, but we anticipate the Fed will show a bit more caution, with the first rate cut not likely to come until the second half of the year.

Canada – The Year of the Cut

The new year is less than one week old, but the theme that will govern the next 12 months is firmly in place. After the most aggressive interest rate hiking campaign in over 40 years, the Bank of Canada’s (BoC) focus is now shifting towards rate cuts. The burning questions are when the first cut will occur and how many cuts will be delivered. Markets had ended the year preparing for a loosening in conditions, with equities up over 10% from late-October and both Canadian and U.S. yields sliding almost 100 basis points (bps) from their fourth-quarter peaks.

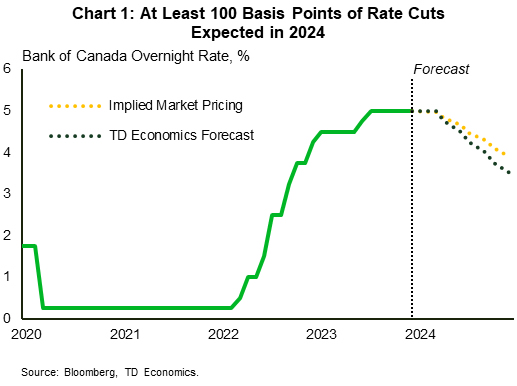

The BoC will meet eight times in 2024 with their first policy decision on January 24th. For the last six months, the Bank has held the overnight policy rate at 5.00% as it continues to assess the incoming data. Markets are pricing the first rate cut to occur at the BoC’s April meeting (Chart 1), in line with our forecast. We expect measured 25 bp cuts to occur over the remaining meetings, bringing the end-point to 3.50%, slightly lower than market expectations of 3.75%. Still, this rate is notably tighter than pre-pandemic levels.

Make no mistake, the effects of the cumulative 475 bps of interest rate hikes are taking hold. Consumers are reeling in their spending, and growth is evolving in a manner consistent with inflation inching closer to the BoC’s 2% target. But the job is not done yet, as inflation remains elevated and wage growth is still running hot. Thus, we sit at a critical crossroads between prematurely cutting rates and potentially reigniting inflation, or keeping conditions too tight, causing more economic pain than necessary.

Recall that Canadian inflation printed on the hotter side in November, with headline and core measures above 3%. The next inflation release, due out on January 17th could see inflation accelerate on the back of base-effects that saw weak inflation a year-ago. However, inflation is trending in the right direction, and we forecast it will durably break below the 3% level in 2024.

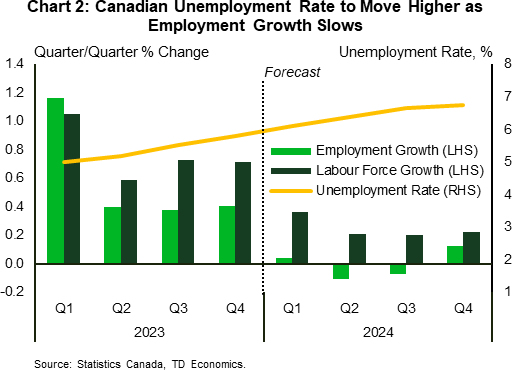

On the data front, Canadian employment was flat in December while the unemployment rate held steady at 5.8%. We are seeing signs that the job market is gradually losing momentum, but further cooling is needed to give the Bank of Canada comfort to pull the trigger on rate cuts. Over the year, we expect labour force growth to continue outpacing employment gains, pulling the unemployment rate higher from current levels (Chart 2). Meanwhile, job vacancies are declining across the country, although it is not occurring evenly across provinces, and wages remain elevated in the in 4-5% range.

Preliminary housing market data for the month of December pointed to strong sales activity and declining listings, tightening conditions in major markets. The greater-than-expected drop in yields, and subsequently mortgage rates, in the fourth quarter partially explains this uptick in activity. The BoC will be watching the housing market as seasonally strong spring homebuying will to fall directly in line with the expected timing of interest rate easing.