U.S. Highlights

- Lower borrowing costs are showing up in the housing market with existing home sales rising modestly in November for the first time in five months. Housing starts also jumped to a nineteen-month high on the month.

- Personal spending remained solid in November, bolstered by stable income growth, while inflation continued to moderate.

- The Federal Reserve’s preferred inflation metric, core PCE, decelerated in November to 3.2% year-on-year, while Fed officials continued to push back against easing financial conditions that has occurred since last week’s meeting.

Canadian Highlights

- November’s inflation report was a mixed blessing, showing no progress in headline inflation. However, shorter-term core inflation metrics brought more holiday cheer.

- Retail sales data showed that consumers were in a cheerful mood in October, although weakness elsewhere held GDP flat during the month. Preliminary estimates suggest that the economy grew modestly in November.

- Data this week reinforces the notion that the Bank of Canada will be on hold for some time yet.

U.S. – A Healthy Dose of Holiday Cheer’

Even though this was the darkest week of the year, with yesterday marking the winter solstice, we received several positive reports on the economy showing signs of a thawing housing market, slowing inflation, and resilient consumers. Financial markets picked up where they left off last week, with yields falling and equities rising. At time of writing, the S&P 500 is up 1.0% on the week while the two-year Treasury declined by 14 basis-points (bps) to 4.32%.

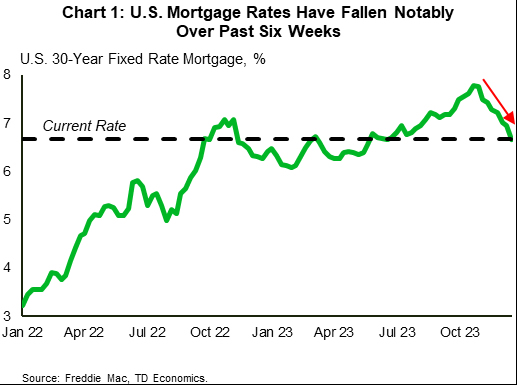

As in many countries around the world, 2023 was a somber year for the U.S. housing market as elevated interest rates restricted supply and demand, pushing sales down to a thirteen year low. November sales data released this week showed the first uptick in five months, however, the level remained low as most of the contracts were signed prior to the decline in rates over the past few months. With mortgages rates back below 7% (Chart 1), it seems likely that sales and listings will trend upward over the coming months. Supply is also likely to receive a boost from the rebound in housing starts seen in November, which hit its highest level since June 2022.

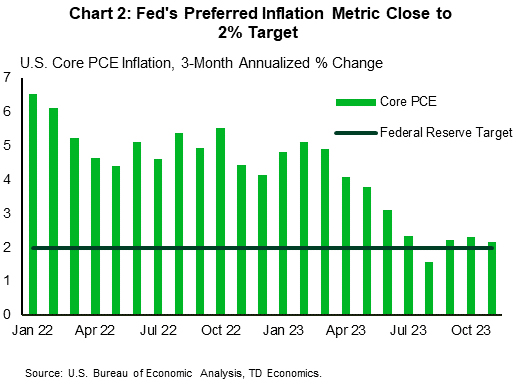

On the spending side, real personal consumption rebounded moderately in November as Americans took advantage of Black Friday deals and worked through their holiday shopping lists. Consumers have also seen a rebound in real income growth over the past two months which has helped to offset inflation headwinds. For its part, PCE inflation continued to decelerate in November, with the Fed’s preferred inflation metric, core PCE, falling to 3.2% year-on-year. On a three-month annualized basis, core PCE has remained moderately above the Fed’s 2% target for the past few months (Chart 2), which has permitted the cessation of further rate hikes, but restricted the Fed from opening the door to rate cuts lest the progress on disinflation thus far become undone.

This is a pertinent concern for the Fed as a concerning divergence between the Federal Reserve and financial markets has grown over the past week. Markets are now pricing in twice as many rate cuts in 2024 as the Federal Reserve dot plot suggests, and this has drawn strong pushback from Fed officials apprehensive of a premature easing in financial conditions. Chicago Fed President Goolsbee noted this week that markets had “got a little ahead of themselves”, while Cleveland Fed President Mester added “they jumped to the end part, which is ‘We’re going to normalise quickly’, and I don’t see that”. Atlanta Fed President Bostic also added that he doesn’t expect an urgency to cut rates in early 2024. We err closer to the Fed’s outlook on interest rates, but still expect rates to be a percentage point lower by the end of 2024, versus the median FOMC member expectation for 75bps.

With the housing market thawing, consumption remaining solid on the back of real income gains, and interest rates falling notably, the Federal Reserve will remain vigilant of upside risks to inflation moving into 2024. The first week of January will include a pulse check on employment trends and whether continued labor market tightness will remain on the long list of Fed concerns moving into the new year.

Canada – A Data Feast Before a Long Winter’s Nap

‘Twas the week before Christmas, when around computer screens, economists gathered, parsing stats with their teams.

The inflation report was first on the docket, and messaging was mixed. On the one hand, headline inflation came in at 3.1% year-on-year in November, showing no downward progress compared to the prior month. Service prices continued to play the proverbial Grinch, rising a plump 4.6% year-on-year amid strong wage growth and a very weak productivity performance. Inflation in travel services was specifically called out by Statcan, thanks to “events held in destination cities in the U.S.” (think Formula 1 racing in Vegas. For those interested, Taylor Swift appears to have been touring elsewhere for much of November).

Shelter price inflation has been top-of-mind for policymakers (given the split between it at the rest of the CPI), and it eased a touch. However, data this week revealed a 3.2% year-on-year surge in Canada’s population in Q4 – the fastest such pace since the post-war baby boom. The pressure this trend will place on rents makes it difficult to envision a rapid slowdown for this component of the CPI. Notably, populations are swelling across Canada, and this will remain a theme for provinces in 2024. Please see for our latest provincial forecast, released this week.

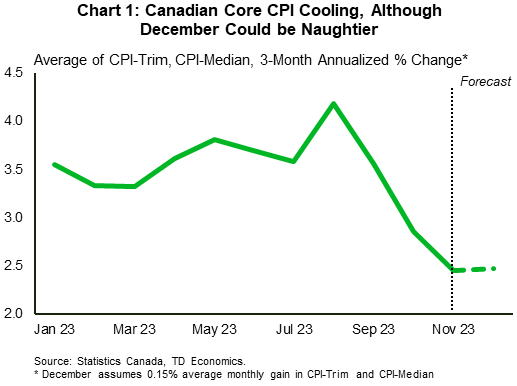

Core inflation’s slow sleigh ride down to the Bank of Canada’s 2% target seemingly hit a bump last month, as CPI-trim and CPI-median remained unchanged in year-on-year terms. However, joyful and triumphant spirits were regained when we looked at shorter-term metrics. In 3-month annualized terms, the Bank’s core measures averaged 2.4% – the chilliest pace since early 2021 and likely offering some comfort to central bank policymakers. Caution is warranted, however, as it wouldn’t take much of a monthly gain to see this measure push higher in December (Chart 1).

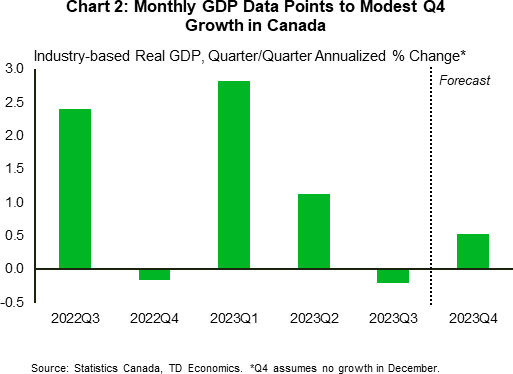

Like inflation, indicators of economic activity were mixed this week. It’s generally been a tough year for retailers, so October’s 0.7% month-on-month gain (which was even better in volume terms) must have felt like a blessing. It also sets up for a solid Q4 print for goods spending overall. However, stealing some sunshine from the report was Statcan’s advance estimate, which pointed to no growth in spending during November. This suggests that sales volumes dropped during the month, given a rise in goods prices.

Ending out the week, October’s GDP report showed that growth was flat during the month. The details were arguably even more lacking, as the print was weaker than Statcan’s preliminary estimate heading into the report, and growth was propped up by gains in public sector industries. The advance estimate for November flagged a 0.1% monthly gain in GDP, suggesting that growth will be modest in the fourth quarter (Chart 2), in line with our latest Canadian forecast. All told, the mixed reading on inflation coupled with some degree of resilience in this week’s economic data should give the Bank leeway to ho, ho, hold the line on rates for some time yet.