Forward Guidance will be on vacation next week, with the next edition to come January 5th, 2024. Happy Holidays!

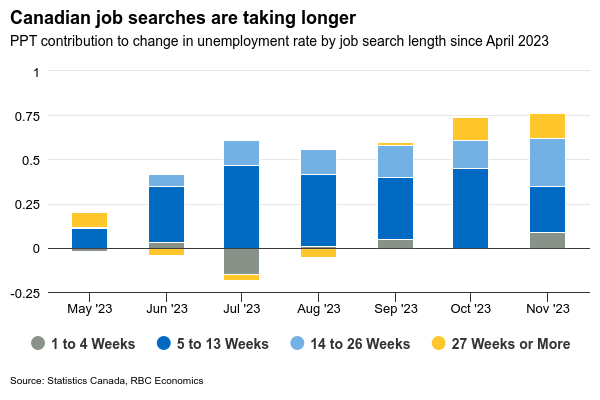

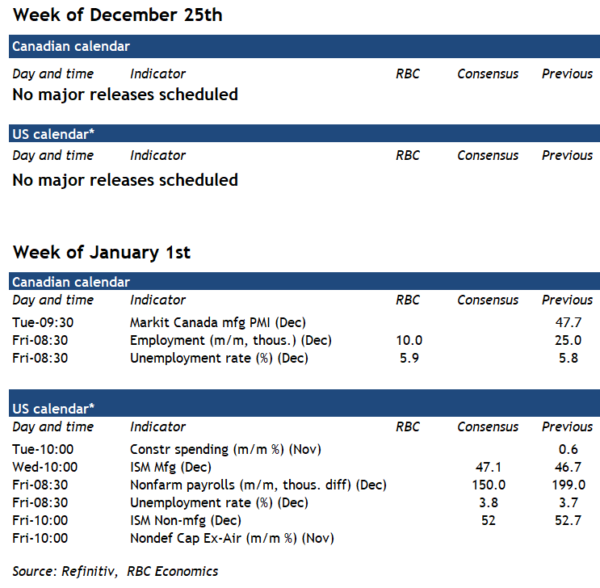

The holiday week ahead is empty of major economic data releases, but the new year will kick off with a fresh set of high profile Canadian and U.S. labour market data. We expect Canadian employment to edge higher again in December (+10k) to add to the 25k November increase. But that gain would (again) not be enough to offset surging growth in the labour force and we look for the unemployment rate to tick up another tenth of a percent to 4.9%. For now, higher unemployment has come from longer job search times rather than a rise in the number of layoffs. The 0.8 ppt rise the unemployment rate since the spring has come mostly from those taking longer to find work. Since April employment is up by 182k, but the labour force has expanded twice that pace (364K.)

Still, employment has been outright declining for some smaller groups within the labour force. Employment has fallen by 50K for those under the age of 25. Most of those declines have come from retail, construction, and finance sectors. New arrivals to Canada appear to have still been finding work relatively quickly compared to ‘normal.’ The unemployment rate for immigrants who landed in Canada less than 5 years ago is still higher than for other groups but was little-changed from the spring by our count. But unemployment has increased more significantly among those who have been in Canada for at least 5 years.

The December jobs report will be the last labour market update before the Bank of Canada’s January 24th announcement. The central bank is highly likely to remain on hold at that meeting, leaving the overnight unchanged. The BoC will remain cautious about declaring victory over inflation, but we expect further softening in the economic backdrop alongside a narrowing breadth of inflation mean the first cut will come by mid-year.

Week ahead data watch

U.S. payrolls will also be released on January 5th. We expect the December data will show a slight uptick of 186K jobs, with the unemployment rate ticking higher to 3.8% from 3.7% in November. November employment data was firmer than expected but against a backdrop of slower job growth. A continued moderation in inflation pressures alongside easing labour market tightness are expected to keep the Fed on the sidelines on January 31st.