Continued optimism about U.S tax reform after yesterday’s House passing of a budget plan is helping to keep the U.S dollar well supported.

With the European Central Bank (ECB) out of the way, market expectations regarding the next Fed chair is also giving the greenback a lift with Powell and Taylor – two ‘hawks’ – seen coming to the finish line first, now that Ms. Yellen is apparently not in the picture.

Note: President Trump is expected to reveal his choice to lead the Fed by Nov. 3. The Fed’s next rate decision is on Nov. 1 and expectations are for no rate hike. The market is pricing in a +90% odds for the Fed to increase them at the Dec. meeting

In equities, Euro gains are broad-based this morning as the ECB’s ‘slow’ approach to reducing stimulus is encouraging some equity bulls.

However, the exception is Iberian assets. Spanish stocks continue to underperform as Europe’s worst constitutional crisis for 30-years comes to a head. Federal politicians are expected to pass legislation later today to allow PM Rajoy to seize control of the Catalan administration.

Later this morning, the advance reading on U.S Q3 GDP is due (08:30 pm EDT). The market is expecting growth of +2.6%.

1. Stocks well supported

In Japan, the Nikkei surged +1.2% to a fresh 21-year high overnight, led by financial shares as U.S yields remained elevated and by tech shares after their U.S counterparts posted strong earnings. The broader Topix rose +1%.

Down-under, Australia’s S&P/ASX 200 Index fell -0.2% to solidify its first weekly slide in four, while South Korea’s Kospi index climbed +0.7%.

In Hong Kong, stocks have ended the week on a firmer footing after an encouraging slew of earnings from U.S. tech firms and the ECB’s having extended its stimulus. The Hang Seng index rose +0.8%, while the China Enterprises Index gained +1.7%.

In China, blue chip stocks rallied on President Xi’s vision of a ‘new era.’ Signs of economic resilience have also fuelled the three-week rally. The blue-chip CSI300 index rose +0.4%, bringing its gains to +2.1% this week. The Shanghai Composite Index edged up +0.3% or +1.1% on the week.

In Europe, regional indices trade mostly higher across the board with notable outperforms in the DAX and CAC which trades at all time highs, while the Spanish IBEX trades lower.

U.S stocks are set to open in the ‘black’ (+0.2%).

Indices: Stoxx600 +0.5% at 393.3, FTSE +0.3% at 5504, DAX +0.7% at 13229, CAC-40 +0.9% at 5502, IBEX-35 -0.5% at 10293, FTSE MIB -0.1% at 22782, SMI +0.3% at 9225, S&P 500 Futures +0.2%

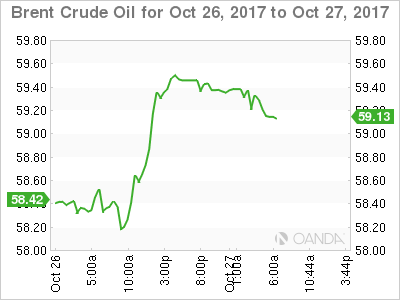

2. Brent crude approaches $60 as markets tighten, gold lower

Oil prices are steady, with benchmark Brent crude trading a tad shy of +$60 a barrel, supported by comments from Saudi Arabia’s crown prince backing the extension of OPEC-led output cuts.

Brent crude is unchanged at +$59.30. The contract is more than +30% above this year’s low print touched in June. U.S light crude is down -4c at +$52.60, but still +25% above its June 2017 low. U.S crude prices have been capped by rising U.S production.

OPEC is expected to discuss extending that agreement of cutting daily production by -1.8m bpd at a meeting in Vienna on Nov. 30.

However, rising U.S crude production continues to remain an issue for OPEC as it strives to clear a global overhang. Data from the EIA this week showed that U.S crude production rose by +1.1m bpd to +9.5m bpd in the week ended Oct. 20.

Gold prices have inched down ahead of the U.S open, to print new low in nearly three weeks, as the dollar finds traction against G7 currency pairs after the ECB extended its bond-buying programme. Spot gold has dropped -0.1% to +$1,265.71 per ounce. It’s heading for a weekly decline of about -1%.

3. Dovish taper tantrum has the Fed as lonesome hawk

With the ECB’s new ‘lower for longer’ QE policy has achieved to put monetary policy divergence back on the agenda.

The ECB’s ‘dovish’ decision yesterday to pare bond purchases is in stark contrast with market speculation that the Fed will be leading the pack when it comes to hiking rates, no matter who comes out on top in the race to lead the Fed from February onwards.

European bond prices have remained better bid as the ECB decided to reduce bond purchases to €30B a month in 2018 and cushion the blow by continuing to reinvest proceeds from maturing securities. In his press conference yesterday, Draghi strengthened his ‘dovishness’ by stressing the need for caution as the ECB moves toward the stimulus exit.

With the ECB taking the ‘lower-for-longer’ route, U.S debt product is facing the prospects that even a Janet Yellen led Fed might pursue a pace of higher rates.

Overnight, the yield on U.S 10-year Treasuries decreased -1 bps to +2.45%. In Germany, 10-year Bund yields fell -1 bps to +0.41%, the lowest in more than a week. In The U.K, the 10-year Gilt yield increased +2 bps to +1.384%.

4. Dollar’s rate divergence rally

Rate divergence remains the incentive to owning particular FX currency pairs.

In the aftermath of the ECB rate decision yesterday and the lack of a signal on any potential first rate hike any time soon by Draghi and company has sent the euro’s ‘single unit’ (€1.1634) to test its three-month low outright.

Elsewhere, USD/CHF ($0.9993) managed to trade above parity for first time in four-months.

Dow-under, AUD/USD (A$0.7647) is a tad softer on political uncertainty after a High Court ruling erased PM Turnball’s one seat majority in Parliament. The Court ruling has disqualified Deputy PM Barnaby Joyce from sitting in parliament on account of his dual citizenship (Australia and New Zealand) at the time of last year’s Federal election. Joyce is expected to re-contest his seat in a special by-election.

5. French consumer confidence continues to fall

Data this morning from statistics agency Insee shows that French consumer confidence continued to decline this month.

Consumer confidence in the eurozone’s second-largest economy fell slightly to 100 from 101 in September. Market expectations were looking for consumer confidence to remain stable in October.

Note: The reading jumped +6 points in June after Emmanuel Macron won the French presidential election and a majority in the national assembly.

However, consumer confidence dropped to 104 in July from 108 in June as households lost confidence in their finances and as Macron’s oen popularity declined.