U.S. Highlights

- The Federal Reserve held the policy rate steady at 5.25-5.5% at its final interest rate announcement of the year.

- However, a markdown in the FOMC’s interest rate projections and little pushback from Chair Powell in the press conference on the recent pull-forward in rate cut timing pressured yields across the curve significantly lower.

- However, with inflationary pressures accelerating in November and retail sales holding up much better than expected through the first month of the holiday shopping season, markets may be getting a bit ahead of themselves expecting rate cuts so soon.

Canadian Highlights

- Shifting central bank tone has given investors an early Christmas present, setting off a Santa Claus rally in both equity and bond markets.

- The real estate market continues to lead Canada’s economic slowdown. Housing sales, prices, and starts all declined, as mortgage rates remain at elevated levels.

- Next week we get a fresh release of Canadian inflation, which is expected to show another deceleration on the back of falling gasoline prices.

U.S. – December FOMC Announcement Comes With ‘Dovish Undertones’

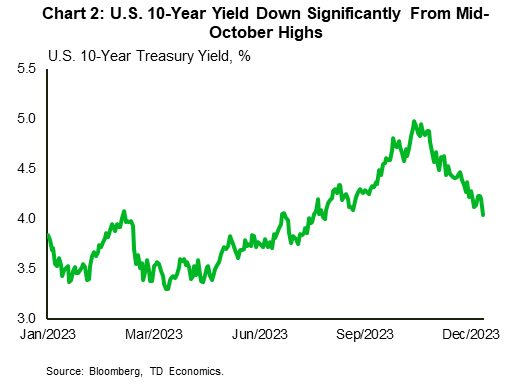

Volatility in the U.S. Treasury market has been a key theme over the past year. This has largely been driven by market participants repeatedly pulling-forward rate cut expectations, only to be reined in by a more cautious Fed concerned of the asymmetric risks of stopping short. That dance is again underway, with markets pulling forward their bets on the timing of the first rate cut to Q1-2024 and pricing for five 25 basis-point (bp) cuts over the course of next year. The only difference this time is policymakers seem less perturbed by the change in view.

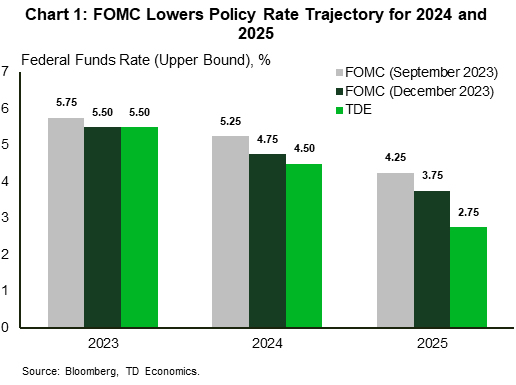

At its final interest rate announcement of the year, the Federal Reserve held the policy rate steady at a range of 5.25%-5.5%. However, both the accompanying statement and the refreshed economic projections had ‘dovish’ undertones. Tweaks to the Fed’s statement suggested that while further tightening remains possible, it’s becoming less probable. This point was reaffirmed in the updated economic projections, which showed 75 bps of rate cuts in 2024 (previously 50 bps), followed by another 100 bps of easing in 2025 (Chart 1). The additional cuts were supported by a more benign inflation outlook, with the FOMC lowering its 2023 and 2024 core PCE forecast to 3.2% (previously 3.7%) and 2.4% (previously 2.6%), respectively. Meanwhile, the 2024 projections for GDP (1.4%) and the unemployment rate (4.1%) were little changed.

During the press conference, Fed Chair Powell had multiple opportunities to push back on the recent re-pricing in market expectations, but instead opted to play it down the middle. Up until this week, the FOMC had remained emphatic that talks of rate cuts were ‘premature’. However, during the press conference, Powell noted that Committee members were now in the “early stages of that loosening discussion”. Investors used the messaging as reaffirmation of its view of earlier rate cuts, which fueled a rally in equities and put further downward pressure on Treasury yields. At the time of writing, the 10-year yield is down 30 bps for the week and at 3.93%, is now over 100 bps below its cyclical high of 5% reached back in mid-October (Chart 2).

We remain of the view that market pricing has gotten a bit ahead of itself. Data out this week showed that the consumer is still holding up reasonably well, while further progress on the inflation front is likely to come more slowly. Indeed, the November reading of CPI showed an acceleration in core inflation, as continued declines in goods prices were more than offset by stronger service-side price pressures.

While we did see considerable breadth in the number of goods categories showing price declines, further downward pressure seems limited. Retail sales data for November showed demand holding up better than expected through the busy holiday shopping season. Moreover, with spending still tracking a healthy 2.5% for the fourth quarter, retailers will hardly feel pressed to extend recent discounts. This means a further loosening in the labor market will be required to cool demand and maintain further downward pressure on inflation. From that perspective, Fed officials are unlikely to get the confirmation they need to begin easing the policy rate until mid-2024.

Canada – Cuts! The Herald Angels Sing

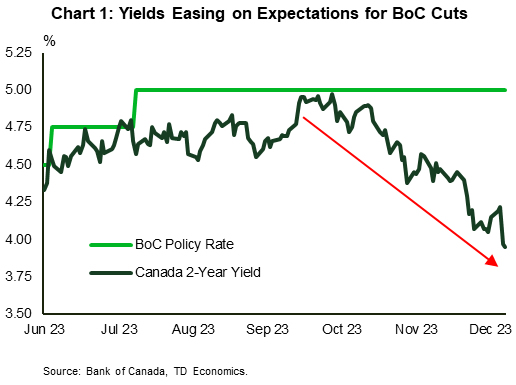

Central banks have given investors an early Christmas present. With economic momentum fading and inflation decelerating more decisively, central banks’ tone has shifted dramatically. The higher for longer narrative is being dampened, with expectations for policy rate cuts coming into greater focus (Chart 1). This has set off a Santa Claus rally in both equity and bond markets.

Evidence of Canada’s slowing economy keeps coming in. Real estate has been front and center, leading the decline ever since the Bank of Canada (BoC) hiked rates in June and July. Existing home sales data this week showed another drop in sales and prices, leaving resale activity down by 17% from the spring 2023 peak and causing a near 7% correction in house prices. This likely spurred November’s big 22% drop in new housing starts data released Friday. The outlook over the next few months doesn’t look favourable either. Mortgage rates have come off their highs, but they are still at elevated levels. And it won’t be until the BoC starts to cut rates before we are likely to see a meaningful upturn in housing activity.

The economic slowdown is also coming through in consumer spending. As we highlighted in our note last week, mortgage holders are paring back spending as more borrowers renew/reset at higher interest rates. Household financial data out this week showed that consumers are now allocating a record amount of their income to pay their debts. This is a key reason why consumer spending per capita has been on the decline for most of 2023. Don’t expect things to get much better. We find that mortgage holders who are set to renew in 2024 have yet to adjust their spending significantly. If borrowing rates don’t come down quickly, expect further weakness in consumer spending.

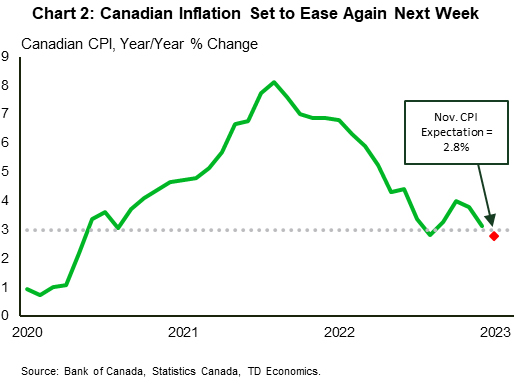

Softer consumer demand has started to force greater discounting amongst retailers. Prices have been cut significantly for goods tied to real estate (furniture and appliances), and now we are seeing discounting for flights and hotels. At the same time, consumers have got some relief from lower gasoline prices. We will get another reading on inflation with the release of Canadian CPI for November next week. We are expecting headline inflation to decelerate again, reaching 2.8% year-on-year (y/y) in November (Chart 2). Importantly, this would bring inflation back into the BoC’s 1% to 3% target range.

Easing headline inflation will certainly encourage the BoC, but it will need to see follow through on core inflation. The average of the BoC’s core measures is running at 3.6% y/y, which is being driven by services inflation. Employee wage gains are still rolling at close to 5% y/y, so it is no surprise that services inflation has been running at effectively that same rate (4.6% y/y). The Bank will want to see further weakening in the labour market, which should slow the pace of wage gains and raise confidence that core inflation rates will decelerate more decisively going forward. We expect this to occur in early 2024, which would allow the BoC to execute on rate cuts by the spring.