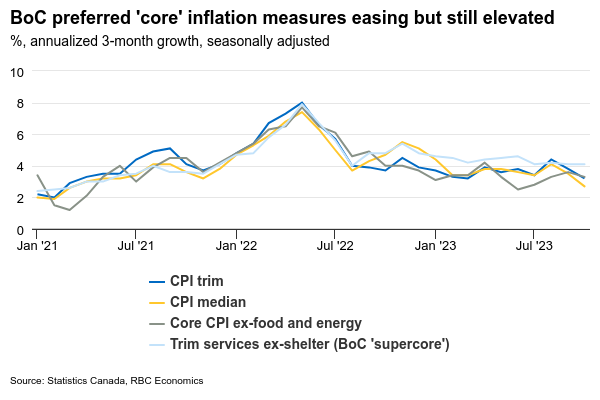

We expect Canadian inflation pressures to have moderated more in November. Headline inflation is expected to have dropped to 2.9% from 3.1% in October reflecting a pullback in retail gasoline prices and further easing in food price growth. That would mark the second time since March 2021 that the reading dips back within Bank of Canada’s 1%-3% target range for inflation after what has been a drawn-out fight between the central bank and very sticky domestic price pressures. We expect price growth excluding food and energy products stayed at 3.4% year-over-year in November, driven by higher shelter costs – more than a third of the rise in ex-food & energy prices in Canada as of October came from mortgage interest costs as higher interest rates continue to flow through to household debt payments with a lag. Both BoC’s preferred core measures – CPI trim and CPI median are also expected to have eased again in November, extending improvements seen in the prior month.

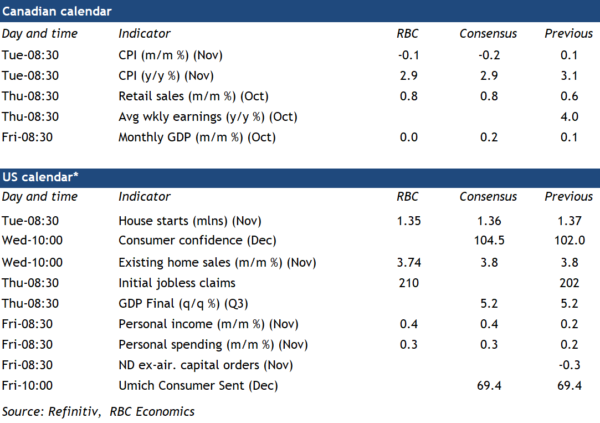

Slowing inflation is following a string of soft economic growth data that we expect also extended into Q4. Canadian GDP has already declined for 5 consecutive quarters on a per-capita basis with Q4 likely to stretch that run to 6. Statistics Canada’s preliminary estimate was that October GDP rose 0.2% month-over-month, but we expect data released since then to point to a softer flat reading. October retail sales appear to have increased, and our own tracking of data of early holiday spending also looked firm in November. But manufacturing and wholesale sale volumes both pulled back (-2.2% and -0.7%, respectively) and total hours worked in October were unchanged before dropping 0.7% in November. We continue to track a small contraction in total GDP in Q4 that will again suggest a bigger decline on a per-capita basis once controlling for still-rapid population growth.

Further softening in the economic backdrop and slower price growth should reinforce that the BoC is done hiking interest rates for this cycle. We don’t expect a pivot to rate cuts right away – central banks will be cautious about declaring victory over inflation too early. We see the BoC to start the easing cycle around the middle of 2024.

Week ahead data watch

November U.S. personal spending likely edged up 0.3% from the prior month, matching retail sales growth in that month. Excluding motor vehicles, sales edged up 0.2%. We look for the U.S. personal income to grow at a faster 0.4% pace in November given a firm round of November labour market data.

StatsCan’s advance estimate showed October retail sales went up by 0.8%, auto sales increased by 1.2% for that month, but that growth was partially offset by a price-related sales decline at gas stations.

Next week’s October SEPH data will be closely watched for more easing in the labour market conditions. We expect job openings will continue to edge lower as separately released LFS showed that the unemployment rate persistently edged higher.