- Today’s ECB policy meeting saw no changes to the policy rates, as unanimously expected across analysts and market pricing, hence the deposit rate was maintained at 4%.

- The ECB already surprised with an announcement today of its schedule for PEPP reinvestments for next year. ECB decided to end full PEPP reinvestments from H2 24 by EUR7.5bn / month on average and no reinvestments beyond the end of 2024.

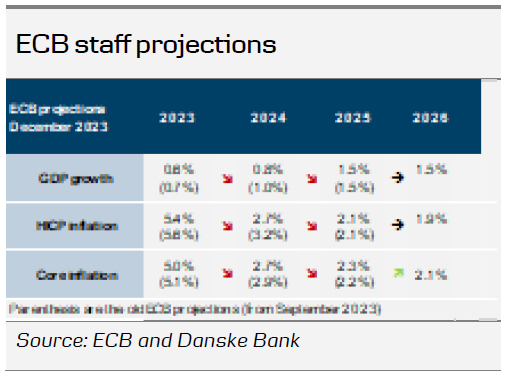

- The staff projections saw a downward revision for 2023 and 2024 in GDP, inflation and underlying inflation. Euro area growth is projected to be around potential from 2025. Lagarde highlighted that the cut-off date of the factors using market pricing was 23 November, which predates the significant bond yield decline, and hence all things being equal would point to higher growth and inflation.

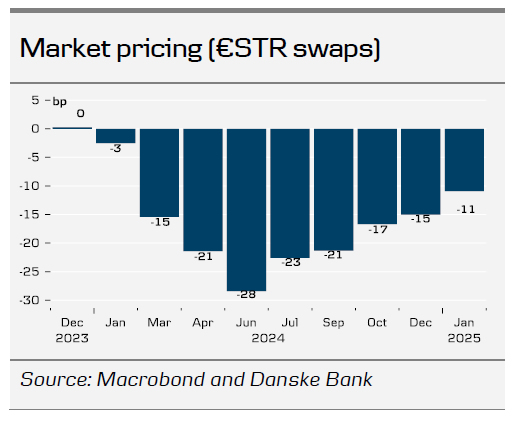

- Lagarde didn’t take the opportunity to clearly push back on the current financial conditions, although if data comes in according to their expectation no rate cut should be imminent. We still expect the first rate cut in June 24 as our baseline.

Delinking the PEPP reinvestments scheme and the policy rate path

The ECB decided today to announce the PEPP reinvestment schedule for 2024. While that was earlier than our expectation – which was for the next meeting in January – the calibration of full reinvestments in H1 24 and only EUR7.5bn/m on average is a dovish surprise. Currently, the PEPP redemptions amount to EUR18bn/m on average, which means that in the second half of next year, the ECB will still reinvest more than EUR10bn on average per month. This was also observed with the Italian-German yield spread compression on the back of the announcement. BTPs-Bund spreads are now trading around 167bp.

We judge that the moderate sell-off in rates markets following the ECB decision and through the press conference should be seen as markets getting confirmation of Lagarde not being more dovish than Powell, rather than Lagarde being hawkish as such. According to their expectations, there will not be an immediate cut delivered, but the data dependency weighs higher than the time dependency. Focus will turn to the incoming labour market data. Should data follow according to the staff projections, which saw an upward revision of wage growth for 2024, markets should reprice accordingly.

With the decision to delink the PEPP reinvestments and the policy rate path, the ECB has essentially given markets a green light to trade the narrative they want. Markets have recently repriced policy rate expectations strongly, and Lagarde only gave a conditional push-back in the sense that should data come in according to the ECB’s expectations, they also expect markets to reprice accordingly. We continue to like our call for the first rate cut of 25bp coming in June, albeit should data come in weaker than anticipated, particularly wage growth in the early part of next year, the risk is for a rate cut earlier than that.

Weak economic activity lowers staff projections of growth and inflation

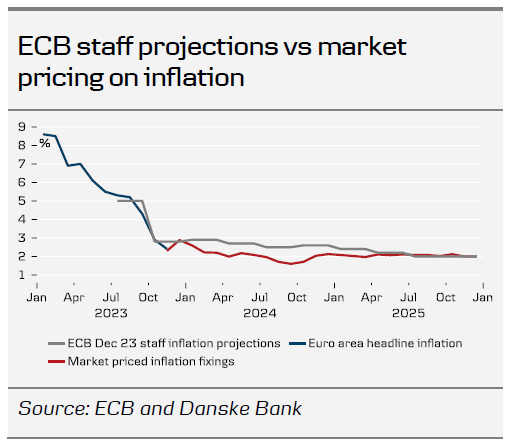

Lagarde characterised the current economic environment as a period with weak and slightly negative growth, particularly due to the manufacturing sector. Service sector activity is set to soften due to the lagged effects of monetary tightening, but rising real incomes should underpin growth next year. The labour market is still resilient, although vacancies have fallen in recent months. Base effects and fading fiscal energy support measures imply that inflation will decline more gradually next year compared with this year.

On the back of the economic assessment, new staff projections lowered the inflation forecasts for 2023 and especially 2024, while 2025 was unchanged. Headline inflation is now expected at 5.4% in 2023 (vs 5.6% in September), 2.7% in 2024 (vs 3.2% in September), 2.1% in 2025 (vs 2.1% in September), and 1.9% in 2026. The significant downward revision for 2024 compared with the September projection reflects a lower path for energy prices, the recent downside surprises in inflation, and less underlying price pressure.

The ECB acknowledged that the underlying inflationary pressure has eased recently, albeit it remains high primarily owing to strong growth in labour costs. Wage growth is expected at 4.6% in 2024, up from 4.3% in the September projections. The ECB expects wage growth at 3.8% and 3.3% in 2025 and 2026, respectively. Lagarde stressed that wage growth is the key upside risk for inflation and that the ECB needs to see more data of lower wage growth and that company profit margins can absorb the wage increases before it can start lowering interest rates. The ECB revised down projections for core inflation by 0.1pp for 2023 to 5.0% and by 0.2pp for 2024 to 2.7% due to lower activity, while projections for 2025 increased to 2.3% from 2.2%. In 2026, the ECB expects core inflation at 2.1% as it sees growth at 1.5% in both 2025 and 2026, which is around or just above its estimates of potential growth.

The near-term growth projections were revised down as past interest rate hikes continue to be transmitted forcefully onto the economy. The growth forecast for 2023 was revised down to 0.6% in 2023 (from 0.7% in September) and to 0.8% in 2024 (from 1.0% in September). Tighter financial conditions are damping demand, but the economy is still expected to recover due to rising real incomes and improving foreign demand. Risks to the economic outlook are tilted to the downside due to stronger monetary policy transmission and weak external demand. These two factors pose downward risks to the inflation outlook, while upside risks to inflation include higher than expected energy prices, wage increases and profits.

EUR/USD continues its move higher

EUR/USD moved higher following today’s ECB monetary policy announcement, currently trading just below the 1.10 mark and thus close to highs seen at the end of November. Today’s move is a continuation of yesterday’s sharp uptick higher in response to the dovish FOMC meeting, which included a surprising dovish adjustment in the Fed dot plot. We anticipate USD weakness continuing in the near term due to the recent substantial easing of financial conditions, which should lend support to a general risk-on sentiment in markets. Combined with bearish USD year-end seasonality, this could provide some support to EUR/USD in the next months. Further out, we expect USD to regain strength and see EUR/USD falling towards 1.04 on a 12M horizon. We also remain short EUR/USD via a 6M put spread as part of our FX Top Trades 2024.