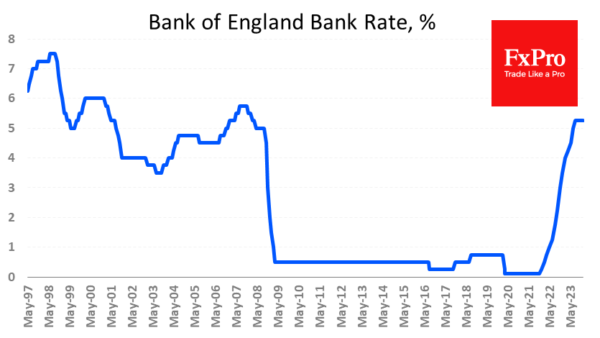

The Fed’s dovish attitude, for now, hasn’t extended too far into Europe. The Bank of England kept its key rate unchanged at 5.25%, with three of the nine members voting in favour of a quarter-point hike.

In a commentary on the decision, the Bank of England emphasised that it is not yet certain that inflation will return to normal through strong wage growth in the economy and higher prices for services.

The Fed is almost invariably at the forefront of the monetary policy cycle. Hence, the dollar tends to rise against its peers at the start of policy tightening and fall at the first hints of an easing reversal. GBPUSD’s reaction to the Fed and Bank of England meetings is a colourful illustration of this rule.

The willingness to ease the Fed’s policy soon weakens the USD, while the willingness to increase further strengthens the GBP. Both factors worked in the same direction within 16 hours, and as a result, GBPUSD rallied 1.7%, exceeding 1.27 – a sharp return to the highs seen a fortnight ago. The pair has now found itself in the territory of meaningful resistance since August. In addition, the latest rally looks somewhat stretched, and the currency market may go into consolidation or correction mode until the end of the year.