- The Fed maintained its monetary policy unchanged as widely anticipated.

- Lower rate and inflation projections together with more dovish wording in the statement and from Powell sparked a post-meeting rally in the markets. The Fed did not attempt to guide the market against the easing in financial conditions.

- We see this as a strong signal that the Fed is now preparing the market for rate cuts when warranted by the data. We stick to our long-held call for a first cut in March, which is now also the clear base case for the markets.

The title of our last week’s Fed preview was ‘low-key optimism’, as we anticipated that the 2024 dots could be revised down by a modest 25bp and that Powell would not guide strongly against the market pricing in rate cuts for next year.

However, Powell & co. appeared even more confident about slowing inflation than we (or the markets) expected prior to the meeting. The 2024 dots were revised down by 50bp (now signalling a total of 3x25bp cuts), 2024 median forecast for Core PCE was revised down to just 2.4% (from 2.6%) and the wording on the statement more explicitly noted slowing growth and cooling inflation. In other words, the Fed made no effort to guide the markets towards pricing in ‘higher for longer’ rates anymore.

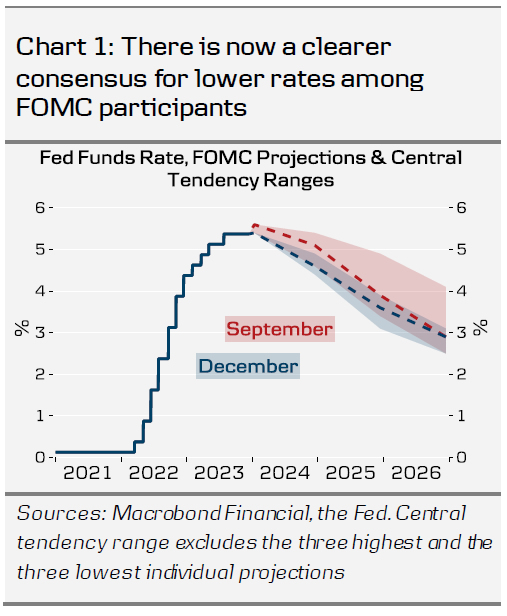

Notably, there is now a stronger consensus on the need for lower rates among FOMC participants. The central tendency range of individual rate projections narrowed, and even the upper limit now pencils in 150bp worth of rate cuts by the end of 2025 (100bp more than in September, Chart 1).

While unemployment rate remains low, both recovering labour supply and cooling demand have helped with balancing the labour market this year. Nominal wage growth is set to continue moderating, and Powell noted that there has now been ‘reasonable progress in non-housing services inflation’ as well. We discussed the outlook for underlying inflation earlier this week in our new flagship publication, Reading the Markets USD, 12 December.

The restrictive level of real rates has already affected credit growth and investments, but we agree with Powell’s assessment that the full impact of past tightening has not yet been felt. We see risks tilted towards weaker private consumption and labour markets going forward, and while the Fed adjusted the 2024 GDP forecast lower (1.4%; from 1.5%), we still remain slightly more pessimistic in our latest Nordic Outlook, 5 December.

Powell did not touch upon the recent spike in SOFR in his remarks, but simply reiterated that the Fed is not discussing altering the pace of QT for now, and that QT could continue well past the first rate cut, which has been our expectation as well.

Bottom line: we see no reason to change our call for the first rate cut in March, followed by quarterly 25bp reductions through 2024-2025. Markets are pricing in a modest 15% probability for a cut already in January, but as Powell did not suggest that the rate cut talks are already imminent, and as we see no signals of the economy falling off a cliff, we still think that the Fed is likely to remain on hold in the January meeting.

Markets: Dovish reaction leaves market sensitive to disappointments in data

The dovish dot plot signal of three rate cuts next year provided the spark to a significant rally in bond markets tonight. 2Y UST yields dropped 10bp following the release of the projections, while the rally extended through the press conference with an additional decline of 10bp. Fed Funds Futures are now pricing in close to 140bp worth of cuts next year with 20bp for the March meeting. 10Y UST yields are down 15bp to 4.02%, now well below our 12M target of 4.20%. In our opinion, the aggressive pricing following today’s meeting leaves the market very sensitive to the incoming data flow from here.

EUR/USD rose by a full figure after the meeting. We anticipate USD weakness to continue in the near-term due to the recent substantial easing of financial conditions, which should lend support to a general risk-on market mood. In the longer horizon, we expect USD to regain strength and see EUR/USD falling towards 1.04 in the 12M horizon. We also remain short EUR/USD via a 6M put spread as part of our FX Top Trades 2024.