U.S. Highlights

- The U.S. economy continued to add jobs in November, while the unemployment rate dipped, and wage growth held steady.

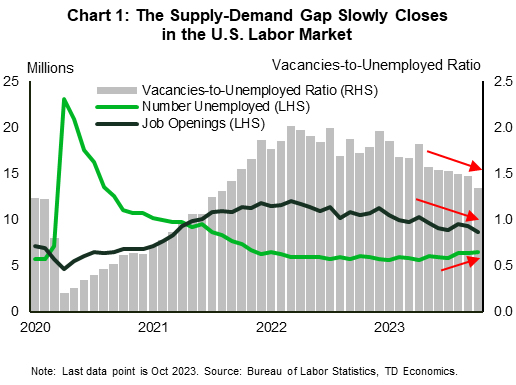

- The JOLTS data also showed a narrowing gap between labor demand and supply, which suggests that activity in the labor market continues to normalize and come into better balance.

- The ISM services index showed that the services sector managed to maintain a modest expansion in November. Nonetheless, the trend continues to show that services sector growth is slowing.

Canadian Highlights

- As expected, the Bank of Canada kept its policy rate at 5%, communicating a wait and see policy stance. Bond markets remained calm, with the 5-year yield moving slightly lower.

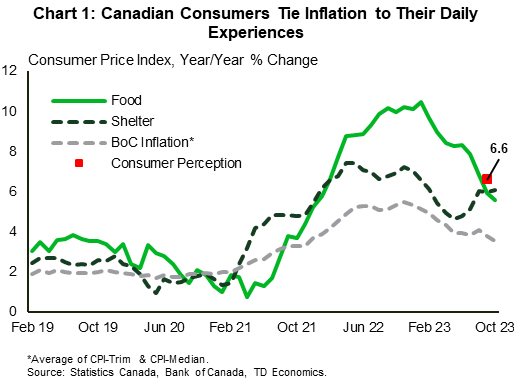

- The market has priced in rate cuts for next year, but the Bank looks for signs of broad deceleration across several inflation components before it starts cutting rates. Taming inflation will also help re-anchor consumers’ perception about inflation.

- This week’s trade data pointed to moderating domestic demand as imports fell. Meanwhile. exports edged higher, resulting in a trade surplus in October.

U.S. – The (Re)balancing Act Continues

The major focus on the U.S. economic data calendar this week was the labor market, with the two main reports showing labor demand and supply are gradually coming back into better balance. The service sector also continued to expand while U.S Treasury yields continued to push further below their mid-October highs.

First up, the more backward-looking JOLTS data showed that the number of job openings in October fell by more than expected and slipped to the lowest level since March 2021. Although still higher than before the pandemic, at 8.7 million, openings are down notably from a record high of 12 million in March 2022. To be sure, there were still plenty of jobs available relative to the more than 6.5 million unemployed job seekers in October. However, the gap has narrowed with the vacancies-to-unemployed ratio falling to 1.34 from 1.47 in September — its lowest reading since August 2021. Other elements of the report also supported a softening labor market narrative – lay-offs held steady at 1.6 million and the quit rate remained unchanged at 2.3% for the fourth consecutive month (in-line with where it was immediately prior to the pandemic). Further evidence of labor demand cooling has been seen in continuing jobless claims, which have ticked higher over the past month, suggesting workers are finding it a bit harder to find a new job.

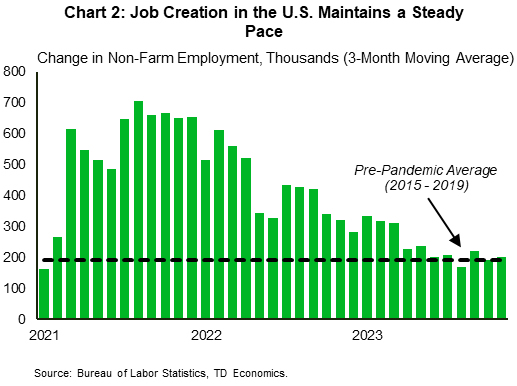

The signal from the more recent November payrolls report was generally in line with the JOLTS data. The economy added 199k jobs in November, largely in line with its pre-pandemic average and up from 150k the previous month (Chart 2). The unemployment rate dipped to 3.7% as the labor force participation rate edged higher. Annual wage growth held constant at 4.0%, down from the highs seen last year, but still above what’s consistent with 2% inflation.

The recent cooling in the labor market alongside easing inflationary pressures has pushed term yields notably lower as market participants have pulled forward the timing of when the Fed could begin cutting rates. Since their recent peak in October, yields have retreated closer to levels seen in September. Given the resilience of the economy thus far however, a further easing in financial conditions could provide a stimulus to demand that could reignite price pressures and prompt further Fed action contrary to market expectations.

On the production side, the services sector of the economy managed to eke out a continued expansion with the ISM services index rising modestly to 52.7 in November. The lackluster growth suggests that activity in the sector is slowing down, which could help to keep a lid on service sector inflation and help wage inflation continue to cool.

The resilient labor market that supported an unexpectedly strong U.S. economy this year is showing signs of cooling. The latest signs that it is coming back into greater balance will be welcomed at the Fed, which will be meeting next week for their final policy decision of the year. When Fed Chair Powell noted that the central bank can “let the data reveal the appropriate path”, this week’s data points to a steady course. All eyes will be on next week’s CPI release to see if it corroborates that plan of action.

Canada – Steady Hand on the Tiller

The Bank of Canada made it easy for the market this week by keeping its policy rate at 5%. On the communication front, the bank’s comments that “the slowdown in the economy is reducing inflationary pressures” were balanced by concerns about upside risks to the inflation outlook and that they “remain prepared to raise the policy rate further if needed”. There was no major post-announcement reaction in the bond market as the 5-year yield continued easing throughout the week.

Said plainly, the Bank is in wait and see mode. With consumer spending fading and business hiring softening in recent months, policymakers and financial markets are transferring their attention from the direction of the next rate adjustment (rate cuts are priced in next year) to its timing. Before this happens, inflation must come down closer to the target of 2% and so far, the central bank’s preferred measures of inflation remain above 3%. While this is much lower than the 5% peak last year, progress since the middle of 2023 has been more limited, and the Bank is concerned that inflation becomes entrenched above 3%.

The Bank is also likely a bit concerned about inflation expectations becoming anchored at a higher level, as this would hurt its credibility. The evidence from the most recent Canadian Survey of Consumer Expectations suggest that people overestimate inflation as they tie it to experiences that are part of their everyday lives, such as food and shelter. As a result, consumers perceive inflation to be three percentage points higher than official estimates (Chart 1).

Paradoxically, consumers’ responses from the recent survey (conducted when interest rates reached their highest level) suggest that some focus on the fact that monetary policy, contributes to inflation in some ways. This is partly due to the impact of rising interest rates on household mortgage payments. Indeed, our recent report highlights that those who have reset their mortgages in 2023 have reduced their spending the most, while those who haven’t seen the impact of higher rates yet also pulled back on spending over the last year in anticipation of higher costs.

This week’s trade data also pointed to moderating demand. Canada’s merchandise imports fell in October both in nominal and volumes terms. While a portion of the decline is driven by supply constraints (such as strikes of auto workers in the U.S.), most of the slow-down is driven by a pullback in domestic consumer discretionary purchases and slow-down in manufacturing activity. Meanwhile, exports edged up 0.1% driven by large increase in aircraft and other transportation equipment. The resulting surplus sets trade up to boost growth in the final quarter of the year (Chart 2).

All said, the Bank is likely to remain in wait and see mode for some time, as it keeps a close eye on the economic data. Next week we’ll take the temperature of the housing market with the latest readings on housing starts and existing home sales. In addition, we’ll find out whether households’ wealth continued rising through the third quarter of the year.