- We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 14 December, which is in line with current market pricing.

- Overall, we expect the MPC to stick to its previous guidance emphasising the “higher for longer” approach and pushing back on market pricing of rate cuts.

- We expect a muted reaction in EUR/GBP but see risks for EUR/GBP ending the day higher.

We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 14 December. This is in line with current market pricing. We expect the vote split to be 6-3 with Greene, Haskel and Mann once again to vote for a 25bp hike and the rest of the MPC to vote for an unchanged decision. Note, this meeting will not include updated projections nor a press conference following the release of the statement.

Overall, we expect the MPC to stick to its previous guidance and signals from individual members noting that it is too early to start discussing rate cuts and similarly that interest rates must remain in restrictive territory for sufficiently long to bring inflation sustainably back to target.

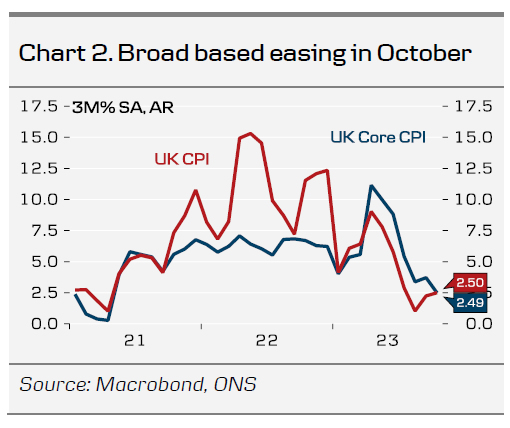

Since the last monetary policy decision in November, data releases have been mixed. As widely expected, large base effects from energy prices led to a markedly drop in headline inflation for October. Similarly, the decline was broad based and larger than expected with core at 0.2% m/m SA and headline at 0.1% m/m SA (chart 2). Service inflation remains elevated but also showed signs of easing. As previously flagged, we do not see inflation developing materially different in the UK compared to elsewhere. PMIs for November came in better than expected edging back above the 50 mark with both service and composite now in expansionary territory. In Q3 the economy flatlined with GDP at 0.0% q/q in line with the BoE’s forecast but only narrowly saved by net imports. The KPMG/REC report on UK jobs delivered comforting news for the BoE with pay pressures receding for both permanent and temporary staff and signalled a broad based reduction in hiring activity. The official report by the ONS is released on Tuesday next week before the meeting but we do not expect this to lead to the majority of the MPC deviating from an “unchanged”-decision.

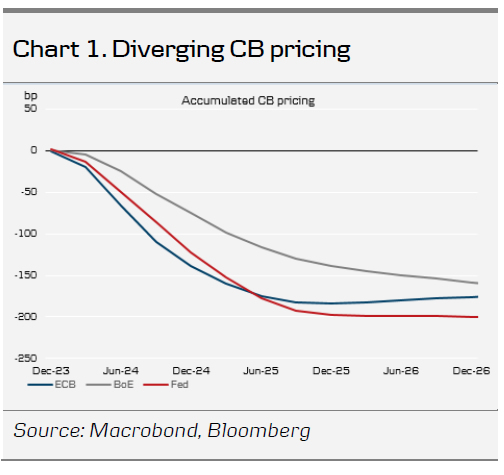

BoE call. We maintain our call that the BoE has delivered its final hike of this hiking cycle, which is in line with current market pricing. We expect the first rate cut of 25bp in June 2024 and subsequently 25bp cuts in the following quarters, totalling of 75bp of cuts for 2024. This is slightly less than current market pricing. We do not see the BoE deviating from the Fed and ECB by the extent currently priced by markets (see chart 1) and expect markets to scale back on expectations from the latter.

FX. In our base case of an unchanged decision, we expect a muted reaction in EUR/GBP. We expect the guidance to provide a hawkish tilt in an attempt to push-back on the pricing of cuts for the next year. However, combined with the expectation of a relatively hawkish ECB later in the afternoon, we expect EUR/GBP to end the day higher. Overall, we see relative rates as a negative for GBP and see the recent rebound as attractive levels to sell GBP. We continue to forecast EUR/GBP to move modestly higher the coming year to 0.89.