- Will Fed officials be the first to cut rates or will the ECB beat them to it?

- Falling inflation everywhere means a bearish US dollar is not a given

- Yen stands to gain from rate cuts as BoJ may hike

- Is sterling set for another bumpy year?

- Aussie and kiwi pin hopes on China recovery, loonie looks to oil boost

Will the dollar bears finally get their way in 2024?

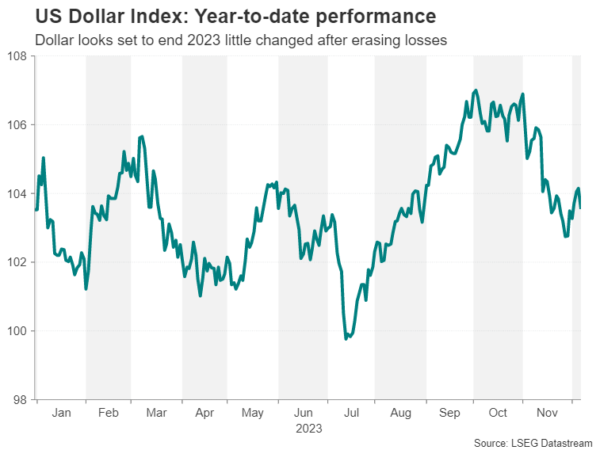

After two consecutive years of gains, a correction in the mighty US dollar was well overdue in 2023. The greenback started the year being taunted by the persistent expectations of a dovish pivot by the Federal Reserve. But those bearish forecasts have not fully materialized as the dollar is on track to finish the year virtually unchanged. Even now, when there is a high probability that a Fed rate cut is just months away, plotting a downwards path may not be very straightforward for the bears.

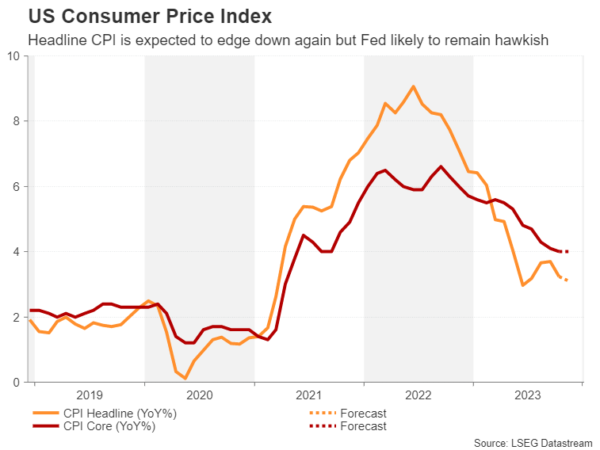

Looking back on 2023, the big story was of course inflation. The good news is that the high inflation problem will probably start to feel like a thing of the past over the next few months. The bad news is that what replaces it might be a recession.

But first, let’s focus on how much progress the Fed has made as inflation in the United States is likely entering the final leg of its journey to 2%. But we’re not there yet and the Fed isn’t ready to take its finger off the hike button as there are still some upside risks to inflation, mainly from strong consumption and the tight labour market.

The question is, will concerns about a slowing economy spur consumers to make drastic cuts to their expenditure? Aside from high borrowing costs starting to bite for households, there are the added dangers of Congress cutting back on spending in 2024 or businesses downsizing staff. The labour market has cooled notably in recent months, with jobs growth slowing and the unemployment rate edging up slightly.

There is nothing on the near-term horizon to suggest that big job cuts are on the way or that consumer confidence is falling off a cliff, so the base case scenario is that the economy is headed for a soft landing. However, there is some disconnect between the soft landing expectations and the market pricing for hefty rate cuts.

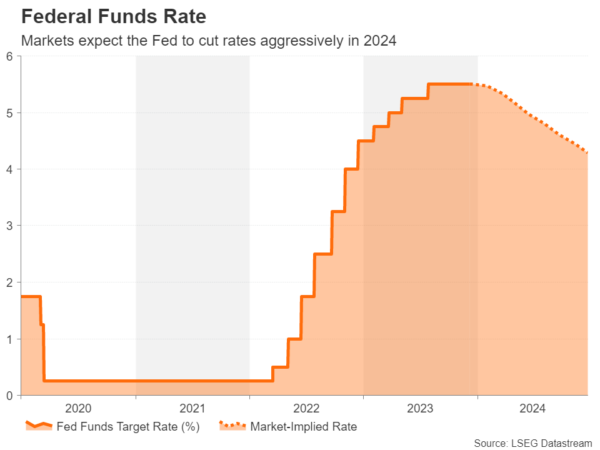

Investors are ending 2023 in jubilant form, betting that the Fed will slash rates by at least 100 basis points by December 2024. But those bets appear to be built on the expectation that inflation will continue to fall sharply rather than the economy stumbling.

But if a recession is avoided and there isn’t a substantial rise in unemployment, how far will the Fed be able to cut interest rates without rekindling inflationary pressures? This might explain why the greenback’s longer-term slide came to a halt during the summer.

That’s not to say, though, that the dollar downtrend has run its course. After all, the Fed has yet to formally signal a dovish pivot. When that happens, possibly in early spring, the dollar will likely come under renewed selling pressure.

The trouble for the bearish view here is that other central banks such as the European Central Bank may also start cutting rates roundabout the same time. The US presidential election in November 2024 is another consideration as the dollar tends to rally post the election and this would especially be true if former President Donald Trump were to get re-elected.

In the more negative scenario, we should not ignore the possibility that the Fed may have already overtightened and a recession cannot be averted.

Summing up, the dollar’s descent may accelerate in the first half of 2024 if the inflation and jobs data keep favouring looser monetary policy. However, the outlook is less certain in the second half, as there’s the risk that either the Fed disappoints those expecting larger rate cuts or the economy takes a turn for the worse, prompting a much bigger dovish tilt.

Another tough year expected for the euro

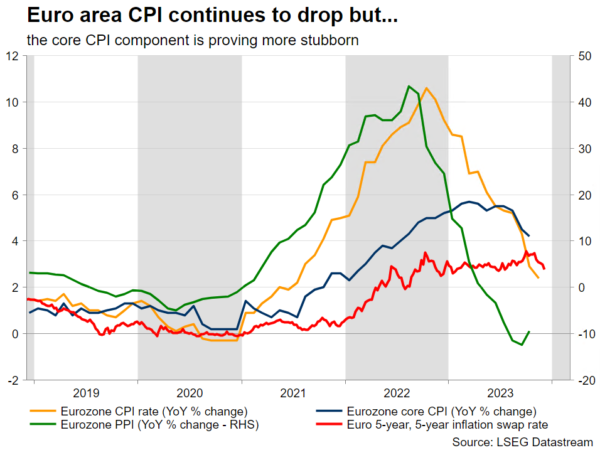

Despite strong inflationary pressures, weak growth momentum and continuously negative news flow, the euro managed to marginally outperform the US dollar in 2023. This euro outperformance has been the theme in most crosses apart from a few exceptions, most notably euro-pound.

Heading into 2024, European Central Bank policy will remain in the spotlight. The market is expecting almost 140bps of rate cuts with the first 25bps move comfortably fully priced in by April 2024. For this scenario to materialize, there must be a high probability for a recession while the ECB’s own 2024 inflation forecasts should be revised lower as well.

Interestingly, investors are pricing a similar policy outlook for the Fed despite the obviously much stronger US economy. Therefore, a much more aggressive easing strategy by the ECB would most likely weigh on the euro with parity possibly being touted by certain market participants as a viable target. In this context, risk reversals remain somewhat bearish on euro-US dollar for 2024.

The main risk for 2024 lies with a much stronger euro area economy. This looks difficult to foresee at this juncture considering the weak forward-looking growth indicators and the relative tightening of lending standards. However, such an outcome would allow the ECB to keep its policy rates on hold for a longer period than currently envisaged, eventually forcing the market to push out its rate-cut expectations.

To a certain extent, the euro area’s growth outlook depends heavily on China’s efforts to significantly restart its economy. In addition, there are various wildcards for 2024 that could unsettle the global economy and the market. For example, an escalation in the Ukraine and the Middle East conflicts that could affect commodity prices and overall economic sentiment, pushing central banks globally to return to a more accommodative policy stance.

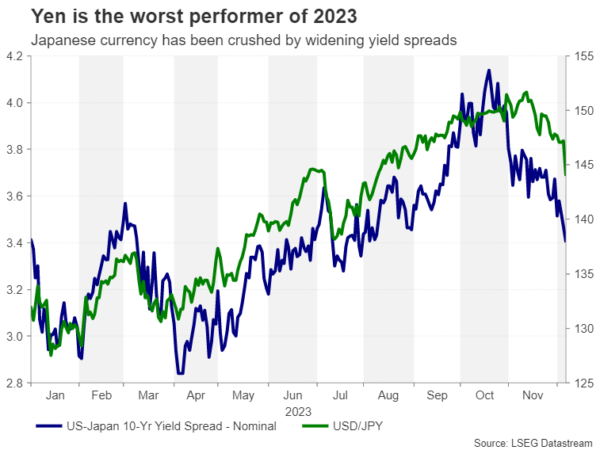

Yen might have a better time in 2024

The Japanese yen looks set to end 2023 as the worst performing major currency. In a year when all the other big central banks kept raising interest rates, the Bank of Japan patiently searched in vain for clues that wage growth is picking up.

But after a short-lived bounce, pay increases sputtered again. There is hope that the next round of the spring wage negotiations will lead to a more sustained acceleration in earnings. The BoJ even upped its inflation forecasts for the next three fiscal years, setting the stage for a possible exit from negative interest rates.

Markets think a BoJ liftoff will come not long after the spring wage negotiations and have priced in a 10-bps increase in the policy rate by April 2024. The inflation data alone has been encouraging, with both headline and core CPI holding above the BoJ’s 2% target.

Yet, the yen has remained extremely pressured, hitting multi-year lows. A couple of tweaks by the BoJ to its yield curve control policy have brought little relief to the Japanese currency. Widening the yield target band would normally be a game-changer for the yen. But when yields have rallied much more in America and Europe, the BoJ’s modest tightening hasn’t had the desired effect.

The question for the yen in 2024 is whether the BoJ will allow the 10-year yield to rise above the current target of 1.0%. If policymakers maintain a tight grip on the yield curve, a surprise early rate hike might provide only a limited boost for the yen.

However, even then, the yen could enjoy a change in its fortunes by the middle of 2024 if not sooner when the Fed, ECB and others begin to cut rates just as the BoJ is unwinding its stimulus policies.

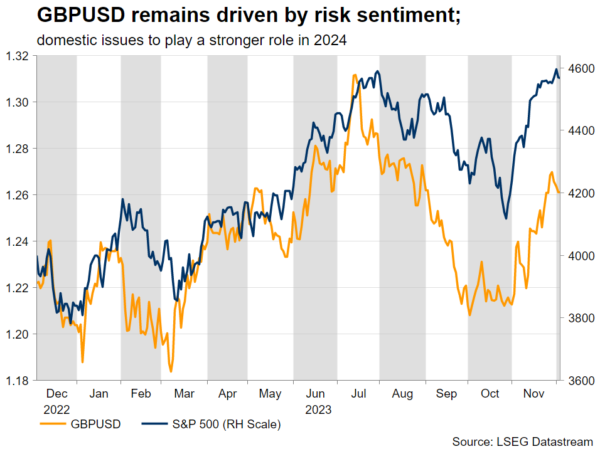

Volatile year on the cards for sterling

Twenty twenty-three has been an odd year for the British pound as, despite the laggard Bank of England and sky-high inflation hampering growth, it managed to outperform its main trading partners.

Next year could be a crucial one for the UK economy as a general election will take place, potentially after the summer break. Elections tend to create nervousness, particularly as the market has developed a love-hate relationship with the opposition Labour party, which is currently ahead in the polls. This increases the possibility for a pound-negative reaction as we get closer to the actual election date.

Additionally, the situation on the ground remains difficult as inflation remains elevated and other sectors like housing that traditionally support UK household wealth are under strong downside pressure. However, the market is more relaxed about the Bank of England’s actions, expecting only 80bps of rate cuts in 2024, with the first 25-bps rate move seen in August.

Should data releases take a turn for the worse, the market could quickly price in an even more aggressive easing path for the BoE. Under this scenario, and with elections lingering in market participants’ minds, we could see the pound underperforming significantly during the latter part of 2024.

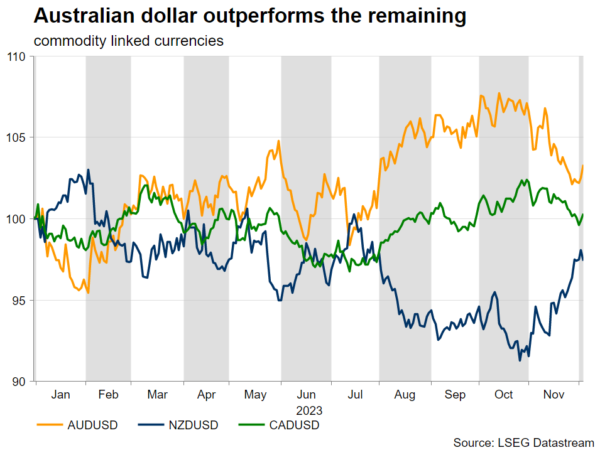

Aussie, kiwi, loonie: China and commodity prices will determine their fate

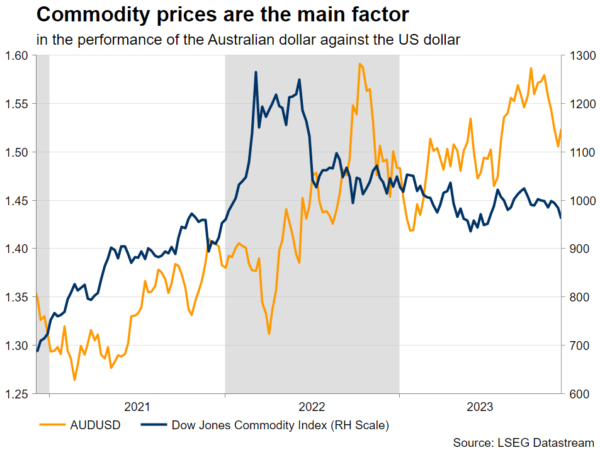

It has been a difficult year for the commodity-linked dollars due to the lower commodity prices, the constant hawkish drive by their respective central banks and the continued weak growth patch experienced by China. In this environment, the Australian dollar managed to outperform the US dollar, overshadowing the weak performance of the New Zealand dollar.

Twenty twenty-four could prove equally tough for the commodity-linked dollars as they are predominantly pro-risk currencies.

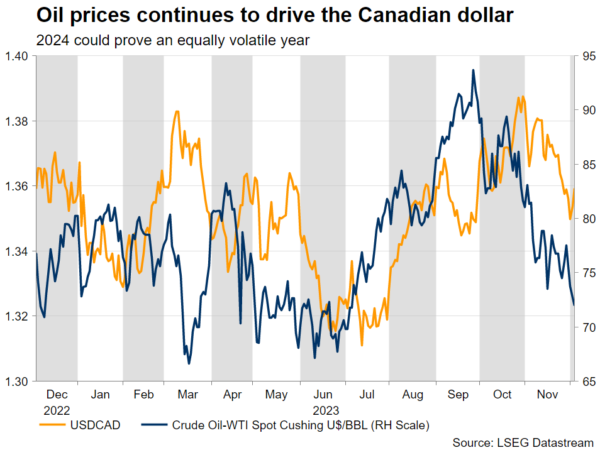

Starting with the Canadian dollar, the Bank of Canada was among the first central banks to pause their tightening cycle. The BoC has remained on the sidelines since July, removing one of the key tailwinds for the loonie, which subsequently has been very volatile.

With the Canadian economy closely linked to both the US economy and oil prices, 2024 is expected to be tough. The BoC has inflation finishing 2024 close to 3%, thus keeping the door open for further rate hikes. But the market is convinced that the first 25bps rate cut will be announced by April with more than 100bps easing pencilled in for 2024.

With OPEC+ trying to keep oil prices from falling further, there is a possibility of another crude oil rally. Such an outcome would cause a new inflation surge globally, boosting the loonie and potentially delaying any rate cuts by the BoC.

Moving down under and the 2024 performance of both the aussie and kiwi mostly depends on China. The various support measures announced by the Chinese administration are welcomed by the market but there is pessimism about their success. If these measures prove effective, then the entire region will enjoy the benefits, starting with commodity-rich Australia.

The Reserve Bank of Australia was the last one to announce a rate hike in November and has maintained its hawkish stance. The market has taken notice of this shift, and it is currently pricing in only 30bps of rate cuts in 2024.

The sluggish domestic economy remains a concern. But should consumer sentiment improve on the back of solid wage increases and China surprises with its growth record, the RBA could stay hawkish, potentially being the last one to cut rates. In this scenario, the aussie stands to benefit, especially against the US dollar.

Similar to the RBA, the Reserve Bank of New Zealand is expected to cut rates by only 40bps during 2024. This is explained by the hawkishness shown by the RBNZ during 2023, due to strong inflationary pressures domestically. Its latest OCR projections point to another rate hike in 2024 with inflation dropping eventually a tad below the 3% threshold.

However, rate hike expectations could intensify further if China’s recovery gathers steam and/or the US achieves a soft landing. In this case, the RBNZ could be the first one to pull the trigger with another rate hike and thus offer strong support to the kiwi.