- Data and Fed rhetoric prompt investors to increase rate cut bets

- Dollar’s next major test comes in the form of the US jobs report

- The data comes out on Friday at 13:30 GMT

Dollar bleeds as investors ramp up bets of massive rate cuts

The US dollar has been bleeding lately as the market keeps adding to its Fed rate cut bets on every opportunity. Following the disappointing jobs data for October and the larger-than-expected inflation slowdown for the same month, it was Fed Governor Waller’s turn to add fuel to expectations of massive rate cuts next year. Early last week, Waller said that if the decline in inflation continues for several more months, they could start lowering the policy rate, marking the first time a Fed official discussed the possibility of lower rates. The latest hit for the dollar came from Fed Chair Powell, who said that the risks of the Fed slowing the economy more than necessary have become more balanced with the risks of not moving interest rates high enough to control inflation.

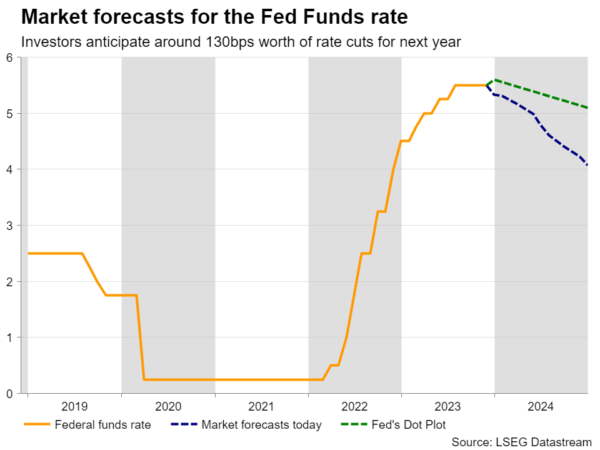

Although he did not shut the door to more increases if deemed necessary and was clearly more hawkish than Waller, the market may have interpreted his comments on balanced risks as validating the end of this tightening crusade and was encouraged to bring forth its rate-cut bets. According to Fed funds futures, a quarter point rate cut is more-than-fully priced in for May, with the probability of it being delivered in March rising to nearly 70%. What’s more, the total number of basis points worth of rate reductions expected by the end of 2024 has gone up to around 130.

Spotlight turns to the US employment numbers for November

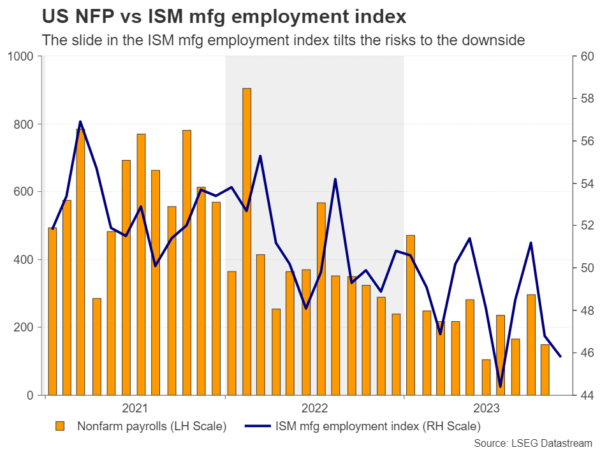

After Powell, investors will turn their attention back to economic data as Fed policymakers have entered the blackout period before next week’s policy decision. Following the ISM manufacturing PMI for November last week, which stayed below the boom-or-bust zone of 50 for the 13th consecutive month, Tuesday’s non-manufacturing index may attract special attention. However, the highlight of the week will most likely be the US employment report for November on Friday.

The unemployment rate is expected to have remained unchanged at 3.9% and nonfarm payrolls to have accelerated to 180k from 150k in October. That said, the ISM manufacturing PMI revealed that factory employment declined further as hiring slowed and layoffs increased. Thus, if the non-manufacturing survey paints a similar picture, then the risks surrounding the NFP print could be tilted to the downside.

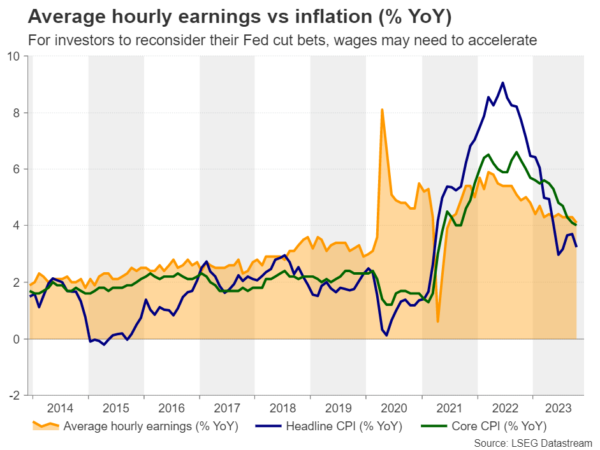

But, even if the forecasts are met, for investors to scale back some rate-cut bets for next year, these numbers may need to be accompanied by a reacceleration in wages. This could spark some fear that inflation could pick up steam in the months to come, thereby prompting the Fed to keep interest rates high for a longer period than currently anticipated. That said, the forecast for average hourly earnings is for a further slowdown to 4.0% y/y from 4.1%, which could solidify investors’ belief and push the dollar lower. After all, lately, market moves suggest that investors are selling the dollar more aggressively when data or headlines corroborate their view, rather than buying it when there are indications supporting the opposing ‘higher for longer’ case.

Aussie and kiwi may continue outperforming the dollar

Expectations of several rate cuts by the Fed do not only translate into dollar weakness and sliding Treasury yields, but also into improving risk appetite and rallying stocks, as lower yields mean higher present values for high-growth firms that are usually valued by discounting expected future cash flows. Ergo, the risk-linked currencies, like the aussie and the kiwi, are getting an extra boost against the US dollar compared to other major currencies.

On top of that, the RBNZ appeared hawkish at its latest gathering, and although the RBA adopted a softer tone this week, investors are still assigning a 20% probability for another hike at the Bank’s February gathering. So, the divergence in policy expectations between those two Banks and the Fed also supports more gains in aussie/dollar and kiwi/dollar.

From a technical standpoint, following last week’s hawkish hold by the RBNZ, kiwi/dollar extended its recovery against its US counterpart, breaking above the key barrier of 0.6130, marked by the high of August 4. Although the pair pulled back after hitting 0.6220, the price structure still consists of higher highs and higher lows above a short-term uptrend line, and thus, should investors continue to believe that the Fed will cut rates sharply next year, the bulls may be tempted to challenge the peak of July 27 at 0.6270 soon. A break higher could carry extensions towards the important area of 0.6385, which acted as a ceiling between February and July.

For the bullish picture to be dismissed, the pair may need to slide all the way back below the crossroads of the 200-day exponential moving average and the very important 0.6060 area. Such a dip may turn the near-term outlook back to neutral.