U.S. Highlights

- A second reading on U.S. GDP showed that the economy expanded by an even more impressive 5.2% (annualized) last quarter, a 0.3 percentage point upgrade from the initial reading. Government spending and business investment were revised up, but consumer spending was revised down slightly.

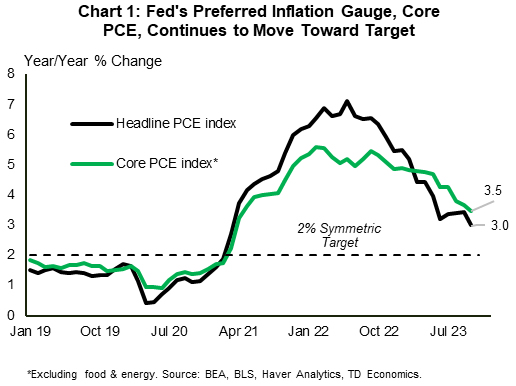

- October’s real consumer spending data showed that growth eased at the start of the fourth quarter. Core PCE inflation, the Fed’s preferred measure, also cooled to 3.5% year-on-year from 3.7% in September.

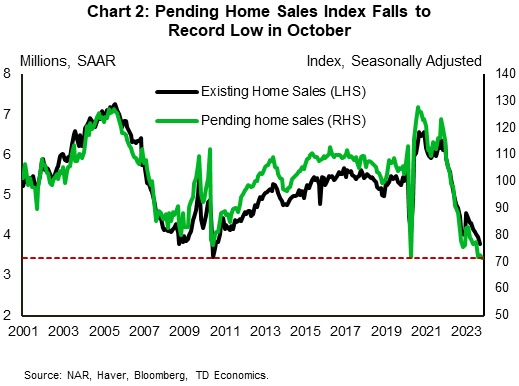

- The National Association of Realtors pending home sales index fell to a record low in October.

Canadian Highlights

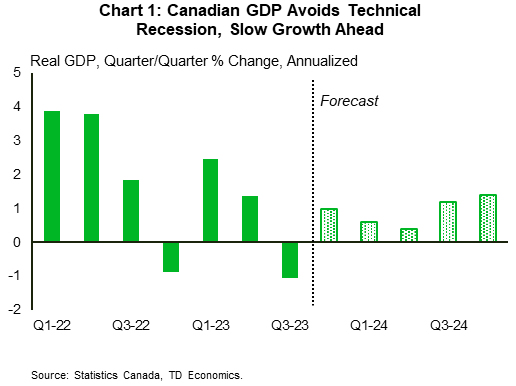

- Canada has avoided a technical recession. The contraction in Q3 GDP growth was offset by large upward revisions to the quarter prior that brought output back into positive territory.

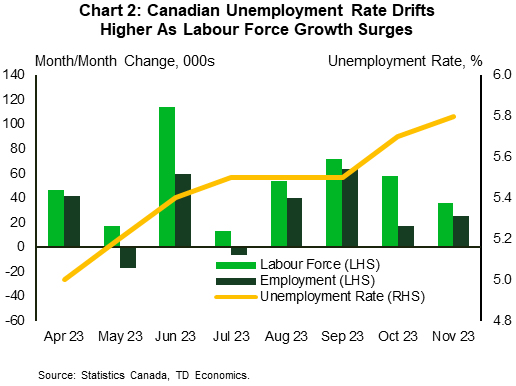

- Canada’s labour market continued to add jobs in November, but robust labour force growth lifted the unemployment rate higher.

- It is still too early for the Bank of Canada (BoC) to hint at interest rate cuts at its rate decision next week, but it’s becoming increasingly evident that further rate hikes are not necessary.

U.S. – Moving Toward Target

The U.S. economy grew at an even better pace than initially reported in the third quarter. But, a moderation in consumer spending in October coupled with some progress on the inflation front, reinforced market expectations that the Fed has likely reached the end of its tightening cycle. That said, Fed speak out this week was somewhat mixed, with some suggesting that today’s policy rate is sufficiently restrictive while others still feel it’s too early to call it quits. In his speech on Friday, Chair Powell called talk of cutting rates ‘premature’.

The second reading on U.S. GDP showed that the economy grew by 5.2% (annualized) last quarter, an upgrade of 0.3 percentage points from the initial reading. The upward revision reflects improvements in government spending and fixed investment. One major category going against the grain was consumer spending, which was revised slightly lower to 3.6% from 4% previously. Stepping into the fourth quarter, the personal income and outlays report, added another layer of moderation for the consumer. Nominal spending rose 0.2% month-over-month (m/m) in October, a deceleration from 0.7% in September. The spending slowdown was less pronounced on an inflation-adjusted basis, with growth easing to 0.2% from 0.3% in the month prior.

Given a reduction in credit availability and the drawdown of pandemic era ‘excess savings’, the American consumer will have to rely more closely on income growth to fund its spending. As such, any softness on the labor market should filter through to weaker spending. Peeking into the labor market, continuing jobless claims rose to 1.93 million in mid-November. This is the highest level since late 2021 and an added sign that the labor market is gradually cooling. Overall, we expect consumer spending to remain buoyant over the holiday period, but the momentum is likely to fade, with consumption growth likely to slow to around 2% this quarter.

The monthly personal income and outlays report also carried some good news on the inflation front. The highlight was a continued deceleration in core PCE – the Fed’s preferred inflation gauge – which slowed to 3.5% year-on-year in October from 3.7% in the month prior (Chart 1). Interest rates have eased alongside this continued progress toward the Fed’s 2% target, and so have mortgage rates. The 30-year mortgage rate is currently hovering near 7.2% – some 80 basis points lower than the 8% peak in mid-October. This pullback appears to be providing some relief on housing, with mortgage purchase applications ticking higher for the fourth week in a row last week. But, the impact of interest rates tends to be felt with a lag, so this will take some time to be manifested in sales activity. To that end, pending home sales fell to an all-time low in October, indicating that things are likely to get worse before they get better (Chart 2).

All in all, higher interest rates are working as intended with inflation gradually easing toward target, but the Fed can’t let its guard down prematurely and is likely to maintain a hawkish tone until it is convinced that the inflation is decisively moving back towards 2%.

Canada – Revisions, Surprises, and a Sprinkle of Jobs

The banner news for the week is that Canada isn’t in a recession. The potential for such a scenario was a growing narrative before updated real GDP figures extinguished that possibility. GDP for the third quarter did in fact surprise to the downside, contracting by an annualized 1.1%. But, strong upward revisions to the second quarter brought output back into positive territory keeping Canada out of a technical recession.

Although Canada isn’t in a recession, it is showing weakness, and the risk to growth cannot be dismissed heading into next year. The decline in real GDP growth for the third quarter was primarily driven by external factors, as net exports and slow inventory accumulation accounted for most of the drag. Final domestic demand, a better measure of domestic economic health, continued to grow at a robust pace.

Monthly industry-based GDP provided a first reading on how the fourth quarter is shaping up. Guidance for October points to output advancing at a moderate pace, piggybacking off September’s slight, but above-consensus gain. This puts early Q4 growth tracking positive, but still in below-trend territory. The next few months will hopefully provide cleaner readings of GDP now that the host of one-off shocks that created choppiness over the last six-months dissipates. For now, chatter around Canada already being in a recession should quiet, but we expect GDP growth to hum along at below trend-pace for the better part of 2024 (Chart 1).

The Canadian labour market is also slowing, but hasn’t fully ceded its strength. Canada added another 25k jobs in November, pulling the three-month trend in job gains slightly downward. The unemployment rate, however, has moved up eight-tenths since April, as labour force gains continue outpace employment. The labour market is holding up relatively well at this point in the cycle, but the Bank of Canada (BoC) likely wants to see the market move further into balance. Notably, wage gains are still robust, potentially fanning future inflation fears and vacancies, while declining, remain at elevated levels.

Developments this week support our forecast that the Bank of Canada (BoC) is done with rate hikes. However, it is too early for the BoC to lean too dovish at next week’s meeting and say anything about rate cuts or their timing. The Bank will likely need to see inflation, especially core measures, move durably lower before they move off their bias towards rate hikes. Markets have priced the possibility of a first rate cut to occur around April–in line with our own view. Rest assured, the BoC’s most aggressive rate hike campaign in over 40 years is working. Consumers are reeling in their spending, labour markets are returning to balance, and growth is evolving in a manner consistent with inflation inching closer to the BoC’s 2% target. Whether it’s a hard, soft, or bumpy landing is still yet to be seen, but the Air-Canad(ian economy) plane is getting closer to the runway.