Next week’s Bank of Canada interest rate decision itself is unlikely to be a surprise. The BoC is widely expected to hold the overnight rate steady at 5% for the third meeting in a row. But the statement will be watched closely for signs that a slowing economy and easing inflation pressures are shifting future interest rate cuts into focus.

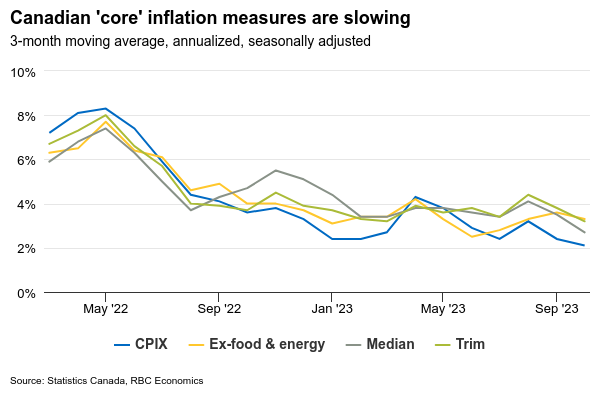

The BoC will remain mindful of inflationary risks and retain the option to move interest rate higher. But we don’t see that as likely to be necessary. Canadian inflation data has looked decidedly better . Headline CPI growth at 3.1% (year-over-year) in October was just a touch above the top end of BoC’s 1%-3% inflation target range. The Bank’s current preferred “core” inflation measures have also showed improvements – the ‘old’ CPIX core measure (which excludes mortgage interest costs along with 7 other volatile price components) has slowed to 2.8% year-over-year and an annualized 2.1% over the last three months. Moving forward, sluggish economic data should reinforce that slowing price pressures will persist. That includes a sizable downside surprise in Q3 GDP growth (-1.1% q/q annualized relative to -0.5% expected by RBC and +0.8% expected by the BoC) and softening labour market conditions with the unemployment rate rising to 5.8% in November from 5% earlier in spring.

With evidence building that the economy is softening, focus has shifted from whether additional interest rate hikes will be needed to how long before the first cuts. While we’re expecting a dovish lean from the BoC relative to past interest rate decisions, and Governor Macklem himself has said that past rate hikes may have been enough to slow inflation to target, we don’t see the BoC rushing to cutting rates. Lower inflation prints over the late fall were welcome but followed a string of “sticky” core inflation readings. We expect the BoC will stay on hold through the first half of 2024 before moving to rate cuts in Q3 next year.

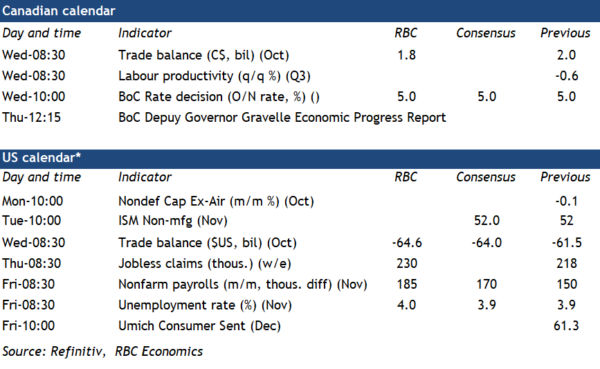

Week ahead data watch

November’s U.S. employment report likely revealed more softness in the labour market. We expect the unemployment rate to tick up again (+0.1%) in November to reach 4%. Employment likely grew by 185K, slightly higher than the 150K in the prior month but with return of workers from the UAW strike accounting for 30K workers of that gain. Broadly speaking, we expect labour demand will continue to slow, and for that to ease wage pressures further.

The Canadian trade surplus likely narrowed in October, given oil prices (-4.3%) were lower during that month, resulting a negative trade balance in the energy sector. September saw a large pullback in exports of metal and non-metallic mineral products, reversing part of the strength in that component in August.

Advance indicators showed the U.S. goods deficit likely widened by $3B in October, led by lower exports of consumer (-9.1%) and auto goods (-7.3%). Imports went up for capital goods (2.5%) during that month.